Cost Basis Basics: How to Calculate and Examples

Cost basis refers to the original value of an investment, including any fees or commissions paid. It is used to calculate the capital gain or loss when the investment is sold. To calculate the cost basis, you need to consider the purchase price of the investment, any additional costs incurred during the purchase, and any adjustments made over time.

Here is a step-by-step guide on how to calculate the cost basis:

- Determine the purchase price of the investment: This is the amount you paid to acquire the investment initially.

- Add any additional costs: Include any fees or commissions paid to purchase the investment.

- Consider adjustments: If there were any stock splits, dividends reinvested, or capital distributions, you need to adjust the cost basis accordingly.

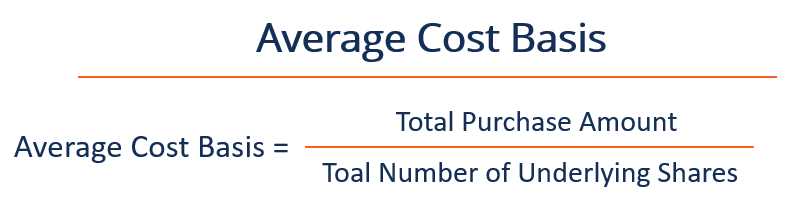

- Calculate the average cost basis: If you made multiple purchases of the same investment at different prices, you can calculate the average cost basis by dividing the total cost by the number of shares.

Let’s look at an example to better understand how to calculate the cost basis:

Suppose you purchased 100 shares of XYZ stock at $50 per share, and you paid a $10 commission fee. Later, you received a dividend of $2 per share and reinvested it by purchasing an additional 10 shares at $60 per share. To calculate the cost basis, you would:

- Initial purchase cost: 100 shares * $50 = $5000

- Additional costs: $10 commission fee

- Average cost basis: ($5000 + $10 + (10 shares * $60)) / (100 shares + 10 shares) = $51.82

By calculating the cost basis, you can determine the capital gain or loss when you sell the investment. If you sell the 100 shares of XYZ stock at $70 per share, your capital gain would be:

Cost basis is a fundamental concept in portfolio management that refers to the original price at which an investment was acquired. It is an essential component in calculating capital gains and losses for tax purposes.

Importance of Cost Basis

- Tax Reporting: Cost basis is used to determine the capital gains or losses when an investment is sold. It helps in accurately reporting taxable income and calculating the tax liability.

- Portfolio Performance: Cost basis is essential for evaluating the performance of a portfolio. By comparing the current value of an investment to its cost basis, investors can assess the profitability of their investments.

- Asset Allocation: Cost basis information is vital for determining the allocation of assets within a portfolio. It helps investors identify which investments have performed well and which ones may need to be adjusted or reallocated.

Calculating Cost Basis

Calculating the cost basis of an investment depends on various factors, including the type of investment and any adjustments made over time. Here are some common methods for calculating cost basis:

- First-In, First-Out (FIFO): This method assumes that the first shares purchased are the first ones sold. The cost basis is calculated based on the price of the oldest shares in the portfolio.

- Last-In, First-Out (LIFO): This method assumes that the most recently purchased shares are the first ones sold. The cost basis is calculated based on the price of the most recent shares in the portfolio.

- Specific Identification: This method allows investors to choose which specific shares they are selling. The cost basis is calculated based on the price of the selected shares.

- Average Cost: This method calculates the cost basis by taking the average price of all shares purchased.

Example of Cost Basis Calculation

Let’s consider an example to illustrate how cost basis is calculated. Suppose an investor purchases 100 shares of a stock at $50 per share. Later, they buy an additional 50 shares at $60 per share. If the investor sells 120 shares at $70 per share, the cost basis can be calculated using the FIFO method.

The cost basis for the first 100 shares would be $50 per share, resulting in a total cost of $5,000. The cost basis for the remaining 20 shares would be $60 per share, resulting in a total cost of $1,200. Therefore, the total cost basis for the 120 shares sold would be $6,200.

Calculating Cost Basis for Investments

Calculating the cost basis for investments is an essential task in portfolio management. The cost basis represents the original purchase price of an investment, including any fees or commissions paid. It is used to determine the capital gains or losses when the investment is sold.

There are several methods for calculating the cost basis, depending on the type of investment and the specific circumstances. Here are some common methods:

1. First-In, First-Out (FIFO) Method

The FIFO method assumes that the first shares purchased are the first shares sold. This method is commonly used for stocks and mutual funds. To calculate the cost basis using FIFO, you need to know the purchase date, purchase price, and the number of shares bought and sold.

2. Specific Identification Method

The specific identification method allows you to choose which shares to sell based on their individual cost basis. This method is commonly used for investments such as stocks, where you can identify the specific shares you want to sell. To calculate the cost basis using the specific identification method, you need to know the purchase date, purchase price, and the number of shares bought and sold for each specific transaction.

3. Average Cost Method

The average cost method calculates the cost basis by taking the average cost per share of all the shares owned. This method is commonly used for mutual funds and ETFs. To calculate the cost basis using the average cost method, you need to know the total cost of all shares owned and the total number of shares.

Examples of Cost Basis Calculation

Calculating the cost basis of an investment is an essential part of portfolio management. It allows investors to determine their profit or loss on an investment and helps with tax reporting. Let’s look at some examples of how to calculate the cost basis for different types of investments.

Example 1: Stocks

Suppose you purchased 100 shares of XYZ Company stock at $50 per share. You also paid a $10 commission fee for the transaction. To calculate the cost basis, you add the purchase price and the commission fee:

| Purchase Price | Commission Fee | Cost Basis |

|---|---|---|

| $5,000 | $10 | $5,010 |

So, the cost basis for your 100 shares of XYZ Company stock is $5,010.

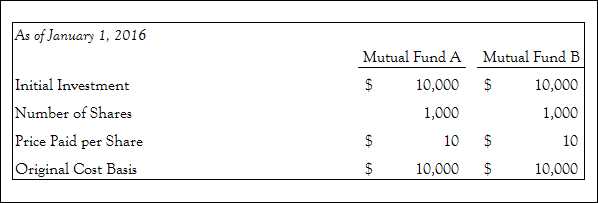

Example 2: Mutual Funds

Let’s say you invested $10,000 in a mutual fund. The fund charges a 2% front-end load fee, which is deducted from your investment. To calculate the cost basis, you subtract the front-end load fee from your initial investment:

| Initial Investment | Front-End Load Fee | Cost Basis |

|---|---|---|

| $10,000 | $200 | $9,800 |

Therefore, the cost basis for your mutual fund investment is $9,800.

Example 3: Real Estate

Suppose you purchased a rental property for $200,000. In addition to the purchase price, you paid $10,000 in closing costs and $5,000 in renovation expenses. To calculate the cost basis, you add all these costs together:

| Purchase Price | Closing Costs | Renovation Expenses | Cost Basis |

|---|---|---|---|

| $200,000 | $10,000 | $5,000 | $215,000 |

Therefore, the cost basis for your rental property is $215,000.

These examples demonstrate how to calculate the cost basis for different types of investments. It is important to accurately calculate the cost basis to ensure accurate reporting of gains or losses and to make informed investment decisions.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.