What is a Correspondent Bank?

A correspondent bank is a financial institution that provides services on behalf of another financial institution in a different country. It acts as an intermediary between banks in different countries to facilitate international financial transactions.

Correspondent banks play a crucial role in the global banking system by providing various services such as payment processing, foreign exchange transactions, trade finance, and compliance with regulatory requirements. They act as a bridge between banks in different countries, allowing them to conduct business and settle transactions efficiently.

When a bank in one country needs to make a payment or transfer funds to a bank in another country, it can use the services of a correspondent bank. The correspondent bank holds an account on behalf of the foreign bank and facilitates the transfer of funds. This ensures that the payment reaches its intended recipient securely and in a timely manner.

Correspondent banks also assist in foreign exchange transactions. When a bank needs to convert one currency into another, it can rely on the services of a correspondent bank to execute the transaction at competitive exchange rates. This helps banks facilitate international trade and manage currency risk effectively.

Furthermore, correspondent banks provide trade finance services to facilitate international trade. They issue letters of credit, provide financing for import and export transactions, and handle the documentation required for international trade. This enables banks and businesses to engage in cross-border trade with confidence and efficiency.

However, it is important to note that correspondent banking relationships come with risks. Due to the complexity of international transactions and the involvement of multiple parties, there is a risk of money laundering, terrorist financing, and other illicit activities. Therefore, correspondent banks are subject to strict regulatory requirements and must have robust compliance programs in place to mitigate these risks.

Definition and Function

A correspondent bank is a financial institution that provides services on behalf of another financial institution, typically in a different country or region. It acts as an intermediary between banks, facilitating various transactions and services to ensure smooth international banking operations.

The main function of a correspondent bank is to offer banking services to its client banks, which are often smaller or less well-established institutions. These services can include processing payments, facilitating foreign currency exchanges, providing liquidity, and offering access to global financial networks.

Services Provided by Correspondent Banks

Correspondent banks play a crucial role in international banking by providing a range of services to their client banks. These services include:

- Payment Processing: Correspondent banks help facilitate cross-border payments between different banks. They ensure that funds are transferred efficiently and securely, adhering to international banking standards and regulations.

- Foreign Currency Exchange: Correspondent banks assist in converting currencies, allowing banks to conduct transactions in different currencies. They provide competitive exchange rates and help mitigate foreign exchange risks.

- Liquidity Management: Correspondent banks offer liquidity management services to their client banks. They provide access to short-term funding options, such as loans or lines of credit, to help banks meet their liquidity needs.

- Access to Global Financial Networks: Correspondent banks provide their client banks with access to global financial networks, such as SWIFT (Society for Worldwide Interbank Financial Telecommunication). This enables banks to connect with other financial institutions worldwide and conduct international transactions.

Benefits of Correspondent Banks

Correspondent banks bring several benefits to their client banks:

- Global Reach: By partnering with a correspondent bank, smaller banks can expand their reach and offer international banking services to their customers. They can access global markets and conduct cross-border transactions.

- Efficiency: Correspondent banks streamline the banking process by providing efficient payment processing and foreign currency exchange services. This helps banks save time and resources.

- Risk Mitigation: Correspondent banks assist in managing risks associated with cross-border transactions. They ensure compliance with regulatory requirements and help mitigate foreign exchange and settlement risks.

- Expertise: Correspondent banks have extensive knowledge and expertise in international banking. They can provide guidance and advice to client banks on navigating complex international financial systems.

Importance in International Banking

Correspondent banks play a crucial role in facilitating international banking transactions. They act as intermediaries between banks in different countries, providing a range of services that enable cross-border payments and other financial activities.

Facilitating Cross-Border Transactions

One of the primary functions of correspondent banks is to facilitate cross-border transactions. When a bank in one country needs to send money to a bank in another country, they can use the services of a correspondent bank. The correspondent bank holds accounts with banks in different countries, allowing for the smooth transfer of funds across borders.

For example, if a customer in the United States wants to send money to a relative in Japan, their U.S. bank can use a correspondent bank in Japan to complete the transaction. The U.S. bank would send the funds to the correspondent bank, which would then credit the account of the recipient’s bank in Japan. This process ensures that the funds reach the intended recipient in a timely and secure manner.

Providing Foreign Exchange Services

Correspondent banks also provide foreign exchange services, which are essential for international trade and investment. They enable banks to convert one currency into another, allowing businesses and individuals to engage in cross-border transactions with ease.

For instance, if a company in France wants to import goods from China and needs to pay in Chinese yuan, they can rely on a correspondent bank to convert their euros into yuan. The correspondent bank would handle the currency exchange and ensure that the payment reaches the Chinese exporter in the appropriate currency.

Enhancing Financial Stability

Correspondent banks contribute to the stability of the global financial system by facilitating international transactions and promoting economic growth. They help foster economic cooperation and trade between countries, which can lead to increased investment and job creation.

Furthermore, correspondent banks play a vital role in combating financial crime, such as money laundering and terrorist financing. They adhere to strict regulatory requirements and conduct thorough due diligence on their customers to prevent illicit activities. By doing so, they help maintain the integrity of the international banking system and ensure that funds are not used for illegal purposes.

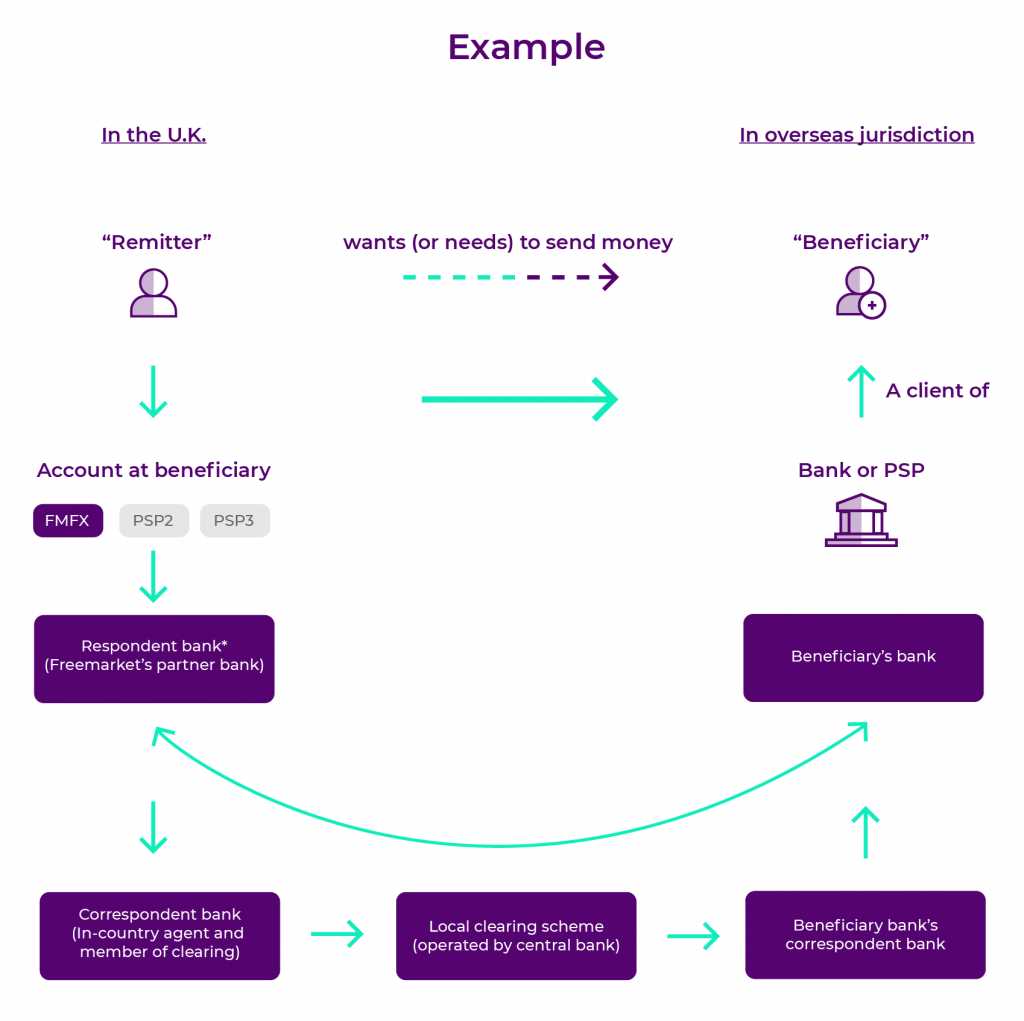

How Correspondent Banks Work

Correspondent banks play a crucial role in facilitating international banking transactions. They act as intermediaries between banks in different countries, allowing them to conduct business and transfer funds across borders.

When a bank in one country needs to make a payment to a bank in another country, they typically use a correspondent bank to facilitate the transaction. The process begins with the initiating bank sending the payment instructions to their correspondent bank. The correspondent bank then verifies the instructions and transfers the funds to the receiving bank.

Correspondent banks often have established relationships with banks in multiple countries, which allows them to efficiently process international payments. They have a network of correspondent accounts in different currencies, which enables them to hold and transfer funds in various currencies.

In addition to facilitating payments, correspondent banks also provide other services to their client banks. These services can include foreign exchange transactions, trade finance, and liquidity management. They act as a bridge between banks in different jurisdictions, helping to overcome regulatory and operational challenges.

However, there are risks associated with correspondent banking. One of the main risks is the potential for money laundering and terrorist financing. Correspondent banks need to have robust anti-money laundering and know-your-customer procedures in place to mitigate these risks.

Another risk is the exposure to the financial stability of the correspondent bank. If the correspondent bank encounters financial difficulties, it could impact the operations of the client banks. Therefore, it is important for banks to carefully select their correspondent banking partners and regularly assess their financial health.

Benefits and Risks of Correspondent Banks

Correspondent banks play a crucial role in facilitating international transactions and providing various benefits to both sending and receiving banks. However, they also come with certain risks that need to be carefully managed. Let’s take a closer look at the benefits and risks associated with correspondent banks.

Benefits

1. Enhanced global reach: Correspondent banks allow financial institutions to expand their global reach by providing access to markets and customers in different countries. This enables banks to offer a wider range of services to their clients and support international trade and investment.

2. Efficient cross-border transactions: Correspondent banks streamline cross-border transactions by acting as intermediaries between the sending and receiving banks. They facilitate the transfer of funds, process payments, and handle necessary documentation, making international transactions faster and more efficient.

3. Liquidity management: Correspondent banks help financial institutions manage their liquidity by providing access to foreign currency accounts and offering services such as foreign exchange, cash management, and liquidity pooling. This allows banks to optimize their cash flow and mitigate currency risks.

4. Compliance and regulatory support: Correspondent banks assist in ensuring compliance with international regulations and anti-money laundering (AML) measures. They conduct due diligence on their clients, monitor transactions for suspicious activities, and help banks meet regulatory requirements, reducing the risk of financial crimes.

Risks

1. Counterparty risk: Correspondent banks are exposed to counterparty risk, which refers to the risk of the other bank defaulting on its obligations. This risk can arise due to financial instability, regulatory issues, or operational failures of the correspondent bank.

2. Reputation risk: If a correspondent bank is involved in money laundering, terrorist financing, or other illicit activities, it can damage the reputation of the banks it is associated with. Financial institutions need to carefully select their correspondent banks to avoid reputational risks.

3. Compliance risk: Correspondent banks must comply with various regulatory requirements, including anti-money laundering (AML) and know-your-customer (KYC) regulations. Failure to meet these obligations can result in penalties, fines, and damage to the reputation of both the correspondent bank and the banks it serves.

4. Operational risk: Correspondent banking involves complex operational processes, including transaction processing, documentation, and settlement. Any operational failures, such as errors in payment processing or delays in fund transfers, can lead to financial losses and reputational damage.

Overall, while correspondent banks offer numerous benefits in terms of global reach, efficient transactions, liquidity management, and regulatory support, financial institutions need to carefully assess and manage the associated risks to ensure the smooth functioning of their international banking operations.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.