What is International Banking Facility (IBF)?

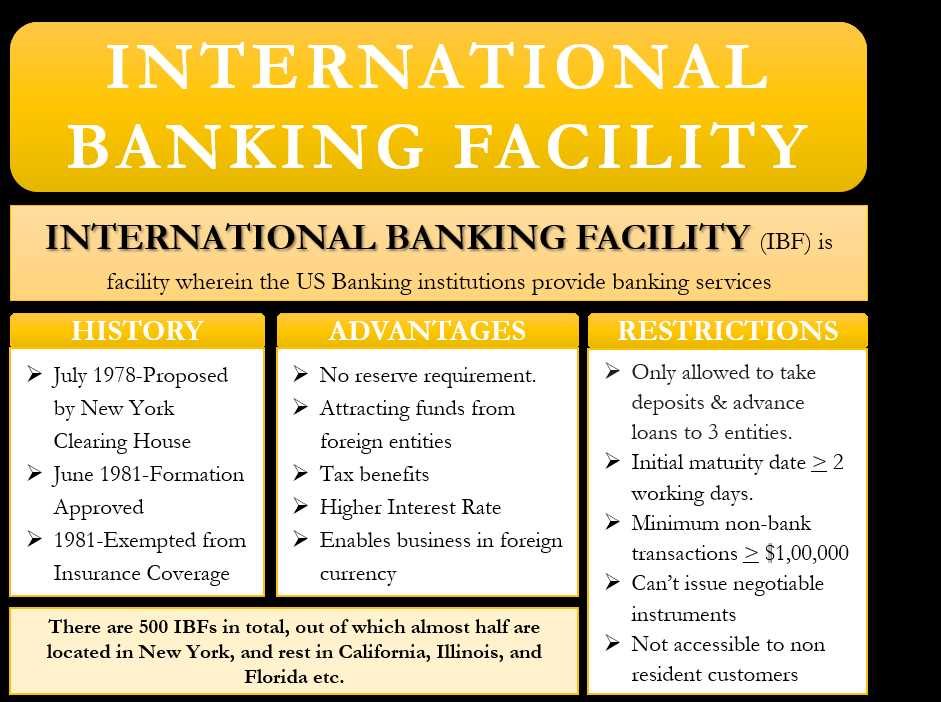

An International Banking Facility (IBF) is a specialized banking unit that operates within a country’s domestic banking system but is exempt from certain regulations and restrictions. It is designed to facilitate international banking transactions and attract foreign investments.

Definition

Purpose

The main purpose of an IBF is to attract foreign investments and promote international trade. By offering a favorable regulatory environment and tax incentives, countries can encourage foreign banks and investors to establish their presence in the country. This can lead to increased capital flows, job creation, and economic growth.

IBFs offer a range of banking services, including foreign currency deposits, international fund transfers, trade finance, and foreign exchange transactions. They also provide access to international markets and financial instruments, such as bonds, equities, and derivatives.

Overall, an IBF plays a crucial role in facilitating global financial transactions and promoting cross-border investments. It serves as a gateway for international businesses to access the domestic market and for domestic businesses to expand their operations globally.

Definition and Purpose

An International Banking Facility (IBF) is a specialized unit within a bank that is established to conduct international banking operations. It is a separate entity from the bank’s domestic operations and is subject to specific regulations and requirements.

The purpose of an IBF is to provide a range of banking services to international clients, including foreign corporations, non-resident individuals, and other financial institutions. These services may include accepting deposits, making loans, issuing letters of credit, and facilitating international trade transactions.

One of the main advantages of an IBF is that it allows clients to conduct their international banking activities in a more efficient and cost-effective manner. By operating in a separate unit, banks can streamline their processes and offer specialized services tailored to the needs of international clients.

Additionally, an IBF can benefit clients by providing access to a wider range of financial products and services. This can include access to foreign currency accounts, offshore investment opportunities, and specialized financing options for international business activities.

Overall, the establishment of an IBF allows banks to expand their global reach and offer enhanced banking services to international clients. It provides a platform for conducting international transactions and facilitates cross-border business activities.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.