Barbell Investing Strategy: Definition

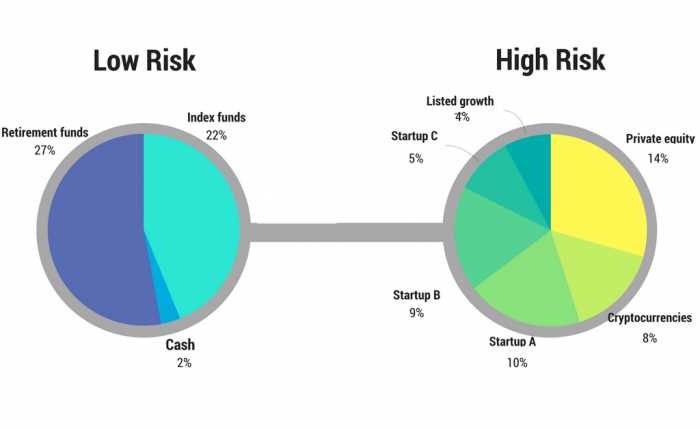

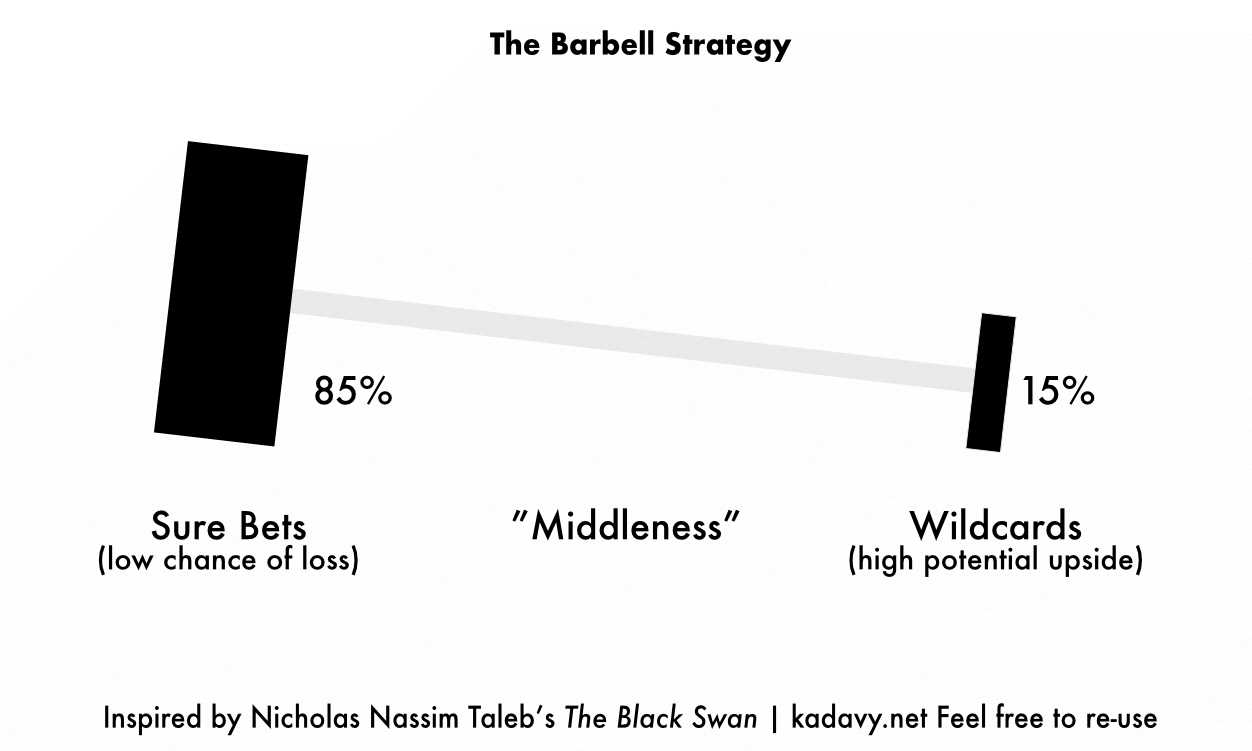

The barbell investing strategy is a financial investment approach that involves dividing an investment portfolio into two distinct parts: one part with low-risk, low-return investments and another part with high-risk, high-return investments. This strategy is based on the concept of balancing the portfolio by combining safe investments with more aggressive ones to achieve a potentially higher overall return while minimizing the risk.

The low-risk, low-return investments typically include fixed-income securities such as government bonds, treasury bills, and high-quality corporate bonds. These investments provide stability and a steady income stream but may have lower returns compared to other investment options.

The high-risk, high-return investments, on the other hand, are typically more volatile and include stocks, real estate, commodities, and other alternative investments. These investments have the potential for higher returns but also come with a higher level of risk.

The barbell investing strategy aims to take advantage of the benefits of both low-risk and high-risk investments. By allocating a significant portion of the portfolio to low-risk investments, investors can protect their capital and generate a steady income. At the same time, allocating a smaller portion to high-risk investments allows investors to potentially benefit from market opportunities and higher returns.

It is important to note that the allocation between low-risk and high-risk investments may vary depending on the investor’s risk tolerance, investment goals, and market conditions. The barbell investing strategy provides flexibility and allows investors to adjust their portfolio allocation based on their individual circumstances.

What is Barbell Investing Strategy?

The Barbell Investing Strategy is an investment approach that aims to balance risk and reward by allocating investments at the two extremes of the risk spectrum. It involves investing in both high-risk, high-reward assets and low-risk, low-reward assets, while avoiding moderate-risk assets.

How It Works

The Barbell Investing Strategy works by diversifying investments across two distinct categories: high-risk assets and low-risk assets. The high-risk assets are typically investments with the potential for high returns but also a higher level of volatility and risk. These may include stocks of small-cap companies, emerging market equities, or high-yield bonds.

On the other hand, the low-risk assets are investments with a lower potential for returns but also lower volatility and risk. These may include government bonds, investment-grade corporate bonds, or cash equivalents. The idea is to have a balanced portfolio that can potentially benefit from both high-risk, high-reward opportunities and the stability of low-risk assets.

The Barbell Investing Strategy also involves avoiding moderate-risk assets, which are investments that fall in between the high-risk and low-risk categories. These assets may have moderate returns and moderate levels of risk, but they do not fit into the extreme ends of the risk spectrum that the strategy aims to capture.

Principles of Barbell Investing Strategy

The Barbell Investing Strategy is based on several key principles:

- Diversification: By investing in both high-risk and low-risk assets, the strategy aims to reduce overall portfolio risk.

- Opportunistic approach: The strategy takes advantage of both high-risk, high-reward opportunities and the stability of low-risk assets.

- Avoiding moderate-risk assets: By avoiding investments that fall in the middle of the risk spectrum, the strategy focuses on capturing the extremes of risk and reward.

- Regular rebalancing: To maintain the desired risk profile, the portfolio needs to be rebalanced periodically to adjust the allocation between high-risk and low-risk assets.

Example

Let’s say an investor follows the Barbell Investing Strategy with a portfolio allocation of 70% high-risk assets and 30% low-risk assets. The high-risk assets may include a mix of small-cap stocks, emerging market equities, and high-yield bonds. The low-risk assets may include government bonds and investment-grade corporate bonds.

If the high-risk assets perform well, the investor can potentially benefit from the high returns. However, if the high-risk assets experience a downturn, the low-risk assets can provide stability and act as a hedge against losses. The goal is to achieve a balance between risk and reward by diversifying across different asset classes.

Real-Life Application of Barbell Investing Strategy

The Barbell Investing Strategy can be applied by individual investors, institutional investors, and fund managers. It is particularly useful for investors who want to balance the potential for high returns with the need for stability and risk management.

For example, a fund manager may allocate a portion of the portfolio to high-risk assets such as small-cap stocks or emerging market equities, while also investing in low-risk assets such as government bonds or cash equivalents. This approach allows the fund manager to capture potential high returns from the high-risk assets while also providing stability through the low-risk assets.

Barbell Investing Strategy: How It Works

The barbell investing strategy is a risk management technique that involves allocating investments to two extremes of the risk spectrum. This strategy aims to balance the potential for high returns with the need for capital preservation.

1. Diversification

One of the key principles of the barbell investing strategy is diversification. By spreading investments across two extremes, investors can reduce the overall risk of their portfolio. This means allocating a portion of the portfolio to high-risk, high-reward investments and another portion to low-risk, stable investments.

2. High-Risk Investments

The high-risk portion of the barbell strategy typically consists of investments with high potential returns but also high volatility. These investments can include stocks of emerging companies, speculative investments, or options and derivatives. The goal is to capture the upside potential of these investments while accepting the higher risk.

3. Low-Risk Investments

The low-risk portion of the barbell strategy involves investing in assets that provide stability and capital preservation. This can include government bonds, high-quality corporate bonds, or other fixed-income securities. These investments may have lower returns but offer a higher level of safety and protection against market downturns.

4. Rebalancing

5. Risk Management

The barbell investing strategy is a risk management technique that aims to protect the portfolio from significant losses while still allowing for potential high returns. By diversifying investments across two extremes, investors can mitigate the risk of a concentrated portfolio and reduce the impact of market volatility.

| Advantages | Disadvantages |

|---|---|

| – Potential for high returns | – Requires active management |

| – Capital preservation | – May underperform during certain market conditions |

| – Risk mitigation | – Requires careful selection of investments |

Overall, the barbell investing strategy can be an effective approach for investors looking to balance risk and reward. By diversifying investments across two extremes, investors can potentially achieve high returns while protecting their capital.

Principles of Barbell Investing Strategy

The barbell investing strategy is based on a few key principles that guide investors in their decision-making process. These principles are designed to help investors achieve a balanced and diversified portfolio while minimizing risk.

1. Focus on extremes:

2. Diversification:

Diversification is a fundamental principle of the barbell strategy. By spreading investments across different asset classes, sectors, and geographies, investors can reduce the impact of any single investment on their overall portfolio. This helps to mitigate risk and increase the potential for long-term returns.

3. Active management:

The barbell strategy requires active management and regular monitoring of investments. This allows investors to adjust their portfolio allocation based on market conditions and changing investment opportunities. By staying informed and making informed decisions, investors can optimize their returns and minimize potential losses.

4. Long-term perspective:

The barbell strategy is best suited for investors with a long-term perspective. By focusing on long-term goals and avoiding short-term market fluctuations, investors can ride out market volatility and potentially benefit from the compounding effect of their investments over time.

5. Risk management:

Risk management is a crucial aspect of the barbell strategy. Investors should carefully assess the risk-reward profile of each investment and ensure that their portfolio is adequately diversified to mitigate risk. Additionally, investors should regularly review and rebalance their portfolio to maintain the desired risk exposure.

By following these principles, investors can implement the barbell strategy effectively and potentially achieve their investment objectives.

Barbell Investing Strategy: Example

Let’s take a closer look at an example of how the barbell investing strategy can be implemented. Suppose you have a portfolio of $100,000 and you want to allocate your investments using the barbell strategy.

First, you decide to invest 80% of your portfolio, or $80,000, in safe and low-risk assets such as government bonds or high-quality corporate bonds. These investments provide stability and a steady income stream.

On the other hand, you allocate the remaining 20% of your portfolio, or $20,000, to high-risk and potentially high-reward investments. This portion of your portfolio can include individual stocks, small-cap companies, or emerging market funds. These investments have the potential for significant growth but also come with higher risk.

By following the barbell strategy, you are able to balance the risk and return of your portfolio. The safe and low-risk assets provide stability and income, while the high-risk investments offer the potential for growth and higher returns.

Overall, the barbell investing strategy allows you to diversify your portfolio and take advantage of both low-risk and high-risk investments. It provides a balanced approach to investing and can help you achieve your long-term financial goals.

Real-Life Application of Barbell Investing Strategy

The barbell investing strategy is a popular approach used by investors in various real-life scenarios. Here are some examples of how this strategy can be applied:

- Portfolio Diversification: The barbell strategy can be used to diversify an investment portfolio by allocating funds to both low-risk and high-risk assets. This helps to spread the risk and potentially increase returns.

- Bond Investments: In the fixed income market, the barbell strategy can be applied by investing in both short-term and long-term bonds. This allows investors to benefit from the stability of short-term bonds and the potential higher returns of long-term bonds.

- Equity Investments: For equity investments, the barbell strategy can involve investing in both large-cap and small-cap stocks. Large-cap stocks provide stability and dividends, while small-cap stocks offer growth potential.

- Hedging Risk: The barbell strategy can also be used as a risk management tool. By investing in low-risk assets, such as government bonds, alongside higher-risk assets, investors can hedge against potential losses.

- Market Timing: The barbell strategy can be used to take advantage of market timing opportunities. For example, if an investor believes that interest rates will rise in the future, they may allocate more funds to short-term bonds and less to long-term bonds.

Fixed Income Trading Strategy & Education

1. Types of Fixed Income Securities:

There are various types of fixed income securities, including government bonds, corporate bonds, municipal bonds, and mortgage-backed securities. Each type has its own risk and return profile, and investors should carefully consider their investment goals and risk tolerance before choosing the appropriate securities.

2. Yield and Duration:

There are several trading strategies that investors can use in fixed income trading, including buy and hold, active trading, and barbell investing. Each strategy has its own advantages and disadvantages, and investors should choose the one that aligns with their investment goals and risk tolerance.

4. Risk Management:

Managing risk is crucial in fixed income trading. Diversification, which involves spreading investments across different types of fixed income securities, can help reduce the impact of any single security’s performance on the overall portfolio. Additionally, monitoring and adjusting the portfolio regularly can help investors stay on top of market trends and make informed investment decisions.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.