Bail-In Definition and Role in a Financial Crisis

In times of financial crisis, governments and regulatory authorities often face the difficult task of stabilizing the financial system and preventing the collapse of major financial institutions. One tool that has gained prominence in recent years is the concept of bail-in.

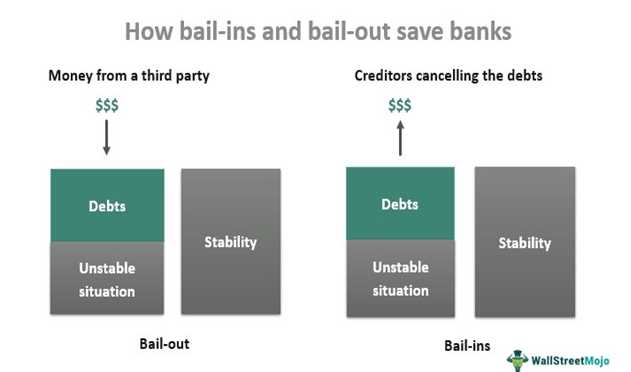

Bail-in refers to a process in which a troubled financial institution’s creditors and shareholders are required to bear some of the losses incurred by the institution, rather than relying solely on taxpayer-funded bailouts. This approach aims to promote financial stability, protect taxpayers, and ensure that the costs of a financial crisis are borne by those responsible.

The role of bail-in in a financial crisis is multifaceted. Firstly, it serves as a mechanism to recapitalize a distressed institution and restore its solvency. By imposing losses on creditors and shareholders, bail-in helps to strengthen the institution’s balance sheet and improve its financial health.

Secondly, bail-in acts as a deterrent for excessive risk-taking by financial institutions. Knowing that they can no longer rely on government bailouts, institutions are incentivized to adopt more prudent risk management practices and maintain sufficient capital buffers to absorb potential losses.

Furthermore, bail-in contributes to the overall stability of the financial system by reducing the likelihood of contagion. By imposing losses on creditors and shareholders, bail-in helps to contain the financial distress within the troubled institution and prevent it from spreading to other institutions in the system.

However, it is important to note that bail-in is not without its challenges. Implementing a bail-in framework requires careful planning and coordination among regulatory authorities, as well as clear rules and procedures to ensure fairness and transparency. There is also a risk of unintended consequences, such as potential disruptions to financial markets and a loss of investor confidence.

Bail-in is a crucial concept in the world of corporate debt, especially in times of financial crisis. It refers to a process where a troubled financial institution’s debt holders are required to bear a portion of the losses and recapitalize the institution, rather than relying solely on taxpayer-funded bailouts. This approach aims to promote financial stability, protect taxpayers, and ensure the accountability of financial institutions.

What is Bail-In?

Bail-in is a regulatory tool that allows authorities to intervene in a distressed financial institution and restructure its liabilities. It involves converting a portion of the institution’s debt into equity or writing down the value of the debt. By doing so, the institution’s capital position is strengthened, and it becomes more resilient to financial shocks.

The concept of bail-in gained prominence after the global financial crisis of 2008, which highlighted the risks associated with the “too big to fail” mentality and the moral hazard created by taxpayer-funded bailouts. Bail-in aims to address these issues by shifting the burden of losses from taxpayers to the institution’s creditors, including bondholders and other debt holders.

The Role of Bail-In in Financial Crisis

During a financial crisis, troubled financial institutions may face insolvency or severe distress, posing risks to the stability of the entire financial system. In such situations, bail-in can play a crucial role in restoring confidence and preventing the contagion of financial instability.

By requiring debt holders to absorb losses, bail-in helps to recapitalize the institution and strengthen its balance sheet. This, in turn, enhances the institution’s ability to absorb future losses, reduces the need for taxpayer-funded bailouts, and promotes market discipline. It also ensures that the costs of financial instability are borne by those who have invested in the institution’s debt, rather than taxpayers.

Implications of Bail-In for Investors and Financial Institutions

Financial institutions, on the other hand, are incentivized to maintain strong capital positions and manage their risks prudently. They need to ensure that their debt holders understand the potential risks involved in holding their debt instruments and price them accordingly. This promotes market discipline and encourages financial institutions to operate in a more sustainable manner.

Regulatory Framework for Bail-In: Ensuring Stability in the Financial System

To ensure the effective implementation of bail-in, regulatory frameworks have been developed in many jurisdictions. These frameworks outline the rules and procedures for conducting bail-in, including the triggers for intervention, the hierarchy of creditor claims, and the conversion or write-down mechanisms.

Regulators also work closely with financial institutions to assess their capital adequacy and stress test their resilience to potential financial shocks. This helps to identify any vulnerabilities and take necessary actions to prevent or mitigate the risks of a financial crisis. The regulatory framework for bail-in aims to maintain stability in the financial system, protect investors, and ensure the orderly resolution of distressed financial institutions.

| Key Points |

|---|

| – Bail-in is a process where debt holders of a troubled financial institution bear a portion of the losses and recapitalize the institution. |

| – Bail-in promotes financial stability, protects taxpayers, and ensures the accountability of financial institutions. |

| – It involves converting debt into equity or writing down the value of the debt to strengthen the institution’s capital position. |

| – Bail-in plays a crucial role in restoring confidence and preventing the contagion of financial instability during a crisis. |

| – It has implications for investors, who face higher risks, and financial institutions, which need to maintain strong capital positions. |

| – Regulatory frameworks ensure the effective implementation of bail-in and maintain stability in the financial system. |

The Role of Bail-In in Addressing Financial Crisis

In times of financial crisis, the concept of bail-in plays a crucial role in addressing the challenges faced by financial institutions. Bail-in refers to the process of rescuing a struggling institution by converting its debt into equity, thereby shifting the burden of losses from taxpayers to investors and creditors.

One of the key advantages of bail-in is that it helps to maintain financial stability by preventing the collapse of a systemically important institution. By imposing losses on investors and creditors, bail-in ensures that the institution remains solvent and can continue its operations, thus avoiding the need for a taxpayer-funded bailout.

How does bail-in work?

When a financial institution is on the verge of failure, regulators have the authority to invoke bail-in measures. This involves converting a portion of the institution’s debt into equity, effectively reducing its liabilities. This process is typically carried out in a hierarchical manner, with shareholders being the first to bear losses, followed by bondholders and other creditors.

Bail-in can be implemented through various mechanisms, such as debt write-downs, debt-to-equity swaps, or the creation of a new holding company to absorb the losses. The specific approach depends on the regulatory framework in place and the circumstances of the financial institution in distress.

Benefits and challenges of bail-in

Bail-in has several benefits in addressing financial crises. Firstly, it helps to maintain market discipline by holding investors and creditors accountable for their investment decisions. This encourages responsible risk-taking and reduces moral hazard, as institutions and their stakeholders are aware that they will bear the consequences of their actions.

Secondly, bail-in reduces the burden on taxpayers. By shifting the losses onto investors and creditors, the cost of rescuing a failing institution is borne by those who have benefited from its operations, rather than the general public. This promotes fairness and equity in the financial system.

However, bail-in also presents challenges. One of the main concerns is the potential for contagion and systemic risk. If a large financial institution fails, it can have ripple effects throughout the financial system, impacting other institutions and the broader economy. Regulators need to carefully manage the process to minimize these risks.

The future of bail-in

Bail-in has gained prominence in the aftermath of the global financial crisis of 2008, as regulators sought to find alternative solutions to taxpayer-funded bailouts. Many countries have implemented bail-in frameworks to ensure that failing institutions can be resolved in an orderly manner, without destabilizing the financial system.

Going forward, the effectiveness of bail-in will continue to be evaluated and refined. Regulators will need to strike a balance between maintaining financial stability and protecting investors and creditors. The lessons learned from past crises will inform the development of robust regulatory frameworks that can effectively address future financial challenges.

Implications of Bail-In for Investors and Financial Institutions

The concept of bail-in has significant implications for both investors and financial institutions. It represents a shift in the way financial crises are managed and aims to ensure that the burden of rescuing failing institutions is shared by stakeholders, rather than solely shouldered by taxpayers.

For investors, the introduction of bail-in means that their investments in financial institutions are not without risk. In the event of a crisis, investors may face losses or even the possibility of their investments being completely wiped out. This has important implications for the pricing and risk assessment of financial instruments issued by these institutions. Investors need to carefully evaluate the financial health and risk profile of the institutions they invest in.

Financial institutions, on the other hand, are now required to have sufficient capital and resources to absorb losses in the event of a crisis. This means that they need to maintain higher levels of capital and liquidity, which can impact their profitability and ability to lend. It also puts pressure on their risk management practices and requires them to have robust contingency plans in place.

Furthermore, bail-in introduces a new level of complexity in the resolution process of failing financial institutions. Determining the order in which different classes of creditors are bailed-in can be a challenging task, as it involves weighing the interests of various stakeholders. This can lead to legal and operational complexities, potentially resulting in delays and uncertainties in the resolution process.

Overall, the implications of bail-in for investors and financial institutions are significant. It requires investors to be more cautious in their investment decisions and financial institutions to be more resilient and prepared for crises. While bail-in aims to promote stability in the financial system and reduce the burden on taxpayers, its implementation and impact need to be carefully monitored and evaluated to ensure its effectiveness and fairness.

Regulatory Framework for Bail-In: Ensuring Stability in the Financial System

The regulatory framework for bail-in plays a crucial role in maintaining stability in the financial system during times of crisis. Bail-in refers to the process of converting a portion of a failing financial institution’s debt into equity, thereby recapitalizing the institution and protecting it from collapse. This mechanism is designed to prevent taxpayers from bearing the burden of a financial institution’s failure and instead shifts the responsibility to the institution’s creditors and shareholders.

The regulatory framework for bail-in is established by financial authorities, such as central banks and regulatory agencies, to ensure that the process is carried out in a transparent and orderly manner. The framework sets out the rules and procedures for implementing bail-in, including the conditions under which it can be triggered, the hierarchy of creditor claims, and the valuation of the institution’s assets and liabilities.

One of the key objectives of the regulatory framework for bail-in is to protect the stability of the financial system. By imposing losses on creditors and shareholders, bail-in helps to restore the solvency of a failing institution and prevent contagion to other financial institutions. It also promotes market discipline by holding creditors and shareholders accountable for their investment decisions and incentivizing them to conduct proper due diligence before investing in financial institutions.

The regulatory framework for bail-in also aims to ensure fairness and equity in the resolution of a failing institution. It establishes a clear hierarchy of creditor claims, with certain types of debt being more likely to be bailed-in than others. This hierarchy is based on the principle of “no creditor worse off than in liquidation,” which means that creditors should not be worse off in a bail-in scenario compared to a liquidation scenario.

Furthermore, the regulatory framework for bail-in includes provisions for investor protection. It requires financial institutions to disclose relevant information to their creditors and shareholders, allowing them to make informed investment decisions. It also establishes mechanisms for resolving disputes and providing compensation to affected parties in case of any wrongdoing or misconduct during the bail-in process.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.