What is Weighted Average Cost of Capital?

The Weighted Average Cost of Capital (WACC) is a financial metric that is used to determine the average cost of financing a company’s operations. It represents the average rate of return that a company must earn on its investments to satisfy its shareholders and creditors.

WACC takes into account the different sources of capital that a company uses to finance its operations, including debt and equity. It is calculated by weighting the cost of each source of capital by its proportion in the company’s capital structure.

Components of WACC

There are three main components of WACC:

- Cost of Debt: The cost of debt represents the interest rate that the company pays on its debt. It is calculated by taking into account the interest rate on the company’s outstanding debt and any other costs associated with borrowing.

- Weighted Average Cost of Capital: The weighted average cost of capital is calculated by multiplying the cost of equity and the cost of debt by their respective weights in the company’s capital structure, and then summing them together.

Importance of WACC

WACC is an important metric for both companies and investors. For companies, it is used to determine the minimum rate of return that they need to earn on their investments in order to create value for their shareholders. It helps companies make informed decisions about capital budgeting, project valuation, and financing options.

For investors, WACC is used to assess the risk and potential return of investing in a company. It provides a benchmark for comparing the company’s expected return with the required return. If a company’s expected return is higher than its WACC, it may be considered a good investment opportunity.

Overall, WACC is a useful tool for evaluating the cost of capital and making informed financial decisions. It helps companies and investors understand the relationship between risk and return, and guides them in making optimal investment choices.

Importance of Weighted Average Cost of Capital

The Weighted Average Cost of Capital (WACC) is a crucial financial metric that is used by companies to evaluate the cost of capital and make informed investment decisions. It is an essential tool for determining the minimum rate of return that a company must earn to satisfy its investors and lenders.

1. Cost of Capital

The WACC takes into account the cost of both debt and equity capital. By calculating the weighted average of these costs, it provides a comprehensive measure of the overall cost of financing for a company. This is important because it helps the company determine the optimal mix of debt and equity to minimize its cost of capital.

2. Investment Decision-making

3. Valuation of the Company

4. Cost of Equity

The WACC helps in determining the cost of equity, which is an important input in various financial models and calculations. By subtracting the cost of debt from the WACC, the cost of equity can be derived. This is essential for estimating the required rate of return for equity investors and assessing the attractiveness of investing in a company’s stock.

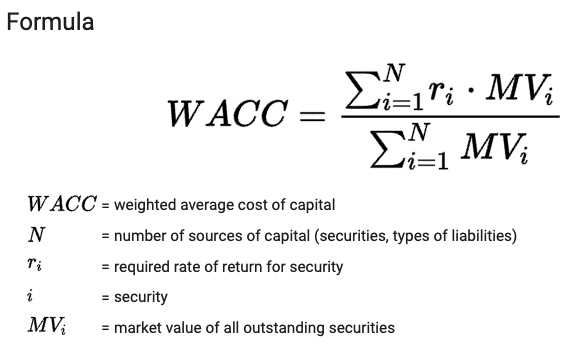

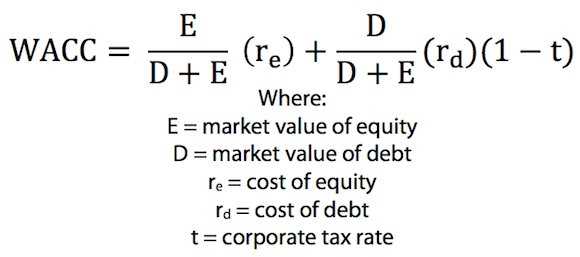

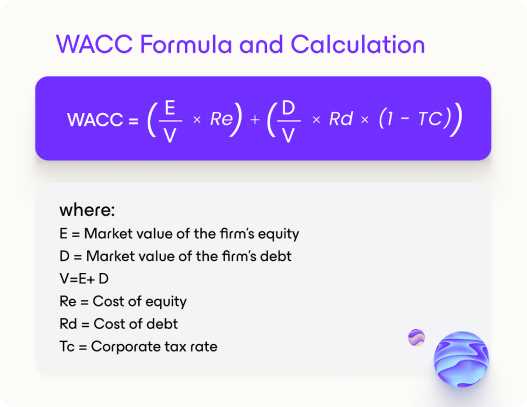

Calculating Weighted Average Cost of Capital

The weighted average cost of capital (WACC) is a financial metric that represents the average cost of financing a company’s operations through a combination of debt and equity. It is an important measure for businesses as it helps determine the minimum return required to satisfy all of the company’s investors, including both debt and equity holders.

To calculate the WACC, several steps need to be followed:

- Determine the company’s capital structure: The first step is to determine the proportion of debt and equity financing used by the company. This can be done by analyzing the company’s balance sheet and financial statements.

- Calculate the cost of debt: The cost of debt is the interest rate that the company pays on its outstanding debt. This can be determined by analyzing the company’s debt agreements or by looking at the current market rates for similar types of debt.

- Weight the cost of debt and equity: Once the cost of debt and equity is determined, they need to be weighted based on the proportion of debt and equity financing used by the company. The weights can be calculated by dividing the market value of debt and equity by the total market value of the company.

- Calculate the weighted average cost of capital: Finally, the weighted average cost of capital can be calculated by multiplying the cost of debt by the weight of debt and adding it to the cost of equity multiplied by the weight of equity. The formula is as follows:

| WACC = (Cost of Debt * Weight of Debt) + (Cost of Equity * Weight of Equity) |

By calculating the WACC, companies can determine the minimum return required to satisfy all of their investors. This information is crucial for making investment decisions, evaluating projects, and determining the overall financial health of the company. It also helps companies compare their cost of capital to the potential return on investment to assess the profitability of different projects or investments.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.