What is a Testamentary Trust?

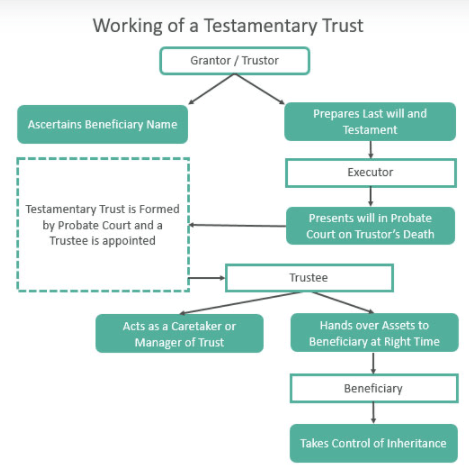

Unlike other types of trusts that are created during a person’s lifetime, a testamentary trust is established through a will and does not take effect until the testator passes away. This means that the testator has full control over their assets while they are alive and can make changes to the trust at any time.

Definition and Explanation

A testamentary trust is a trust that is created through a person’s will and takes effect after their death. It is a legal arrangement that allows the testator to specify how their assets will be managed and distributed to their beneficiaries.

When creating a testamentary trust, the testator must name a trustee who will be responsible for managing the trust and distributing the assets according to the testator’s instructions. The trustee can be a family member, friend, or a professional trustee such as a lawyer or a financial institution.

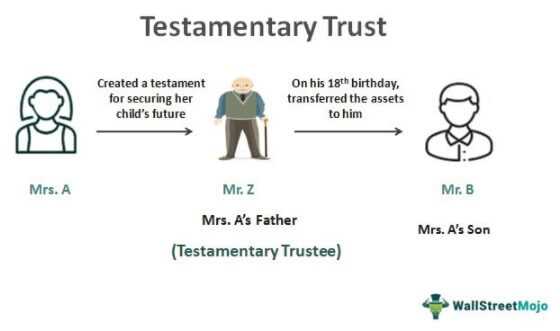

The testator can also specify certain conditions or restrictions on how the assets should be distributed. For example, they can set an age at which the beneficiaries will receive their inheritance or require that the assets be used for specific purposes, such as education or healthcare.

Examples of Testamentary Trusts

There are many different scenarios in which a testamentary trust can be used. Here are a few examples:

Minor Beneficiaries: If the testator has minor children or grandchildren, they can create a testamentary trust to ensure that their assets are managed for the benefit of the minors until they reach a certain age.

Special Needs Beneficiaries: If the testator has a beneficiary with special needs, they can create a testamentary trust to provide for their care and support without jeopardizing their eligibility for government benefits.

Charitable Beneficiaries: If the testator wants to leave a portion of their assets to a charitable organization, they can create a testamentary trust to ensure that the funds are used for the intended charitable purposes.

Case Studies and Scenarios

To better understand how testamentary trusts work, let’s look at a couple of case studies:

Case Study 2: Mary has a son with special needs who requires ongoing care and support. She wants to ensure that her son is provided for after her death without jeopardizing his eligibility for government benefits. In her will, Mary creates a testamentary trust and names a professional trustee who has experience in managing trusts for beneficiaries with special needs. The trust specifies that the assets should be used for her son’s care, support, and medical expenses.

Pros of Testamentary Trusts

There are several advantages of using a testamentary trust:

- Flexibility: The testator has full control over their assets while they are alive and can make changes to the trust at any time.

- Protection: A testamentary trust can provide protection for beneficiaries who may not be capable of managing their own finances, such as minors or individuals with special needs.

- Privacy: Unlike other types of trusts, a testamentary trust is not subject to public disclosure, providing a level of privacy for the testator and beneficiaries.

Cons of Testamentary Trusts

While testamentary trusts offer many benefits, there are also some disadvantages to consider:

- Probate Process: A testamentary trust is created through a will, which means it is subject to the probate process. This can result in delays and additional costs.

- Lack of Immediate Effect: Unlike other types of trusts that take effect immediately, a testamentary trust only comes into effect after the testator’s death.

- Less Control: Once the testator passes away, they no longer have control over how the assets are managed and distributed, as this responsibility falls on the trustee.

Definition and Explanation

Unlike other types of trusts that are created during the lifetime of the grantor, a testamentary trust is established after the testator’s death and is governed by the terms and conditions specified in their will. The testator can designate a trustee who will be responsible for managing and distributing the assets according to the instructions outlined in the will.

One of the main purposes of a testamentary trust is to provide for the financial needs and well-being of the beneficiaries, especially if they are minors or lack the ability to manage their own finances. The trust can be structured in a way that allows for regular distributions or specific payments to be made to the beneficiaries for their education, healthcare, housing, or any other designated purposes.

Another advantage of a testamentary trust is that it can help minimize estate taxes and protect the assets from potential creditors. By placing the assets in a trust, they are no longer considered part of the testator’s estate and may be subject to different tax rules and regulations. Additionally, the assets held in a trust may be shielded from creditors’ claims, providing an added layer of protection.

It is important to note that a testamentary trust is irrevocable, meaning that once it is established, it cannot be easily changed or revoked. The terms and conditions of the trust, as specified in the testator’s will, are legally binding and must be followed by the trustee.

Examples of Testamentary Trusts

There are several examples of testamentary trusts that can be created depending on the specific needs and circumstances of the testator:

1. Minor’s Trust:

A minor’s trust is a testamentary trust that is created to provide financial support and management for minor children or grandchildren. The trust can specify how the assets are to be used for the benefit of the minors, such as for education, healthcare, or general living expenses. The trust can also include provisions for the distribution of the remaining assets once the minors reach a certain age.

2. Special Needs Trust:

A special needs trust is a testamentary trust that is created to provide for the financial needs of a person with disabilities or special needs. The trust can be used to supplement government benefits and ensure that the person’s needs are met throughout their lifetime. It can also include provisions for the appointment of a trustee who will manage the trust and make decisions on behalf of the beneficiary.

3. Charitable Trust:

A charitable trust is a testamentary trust that is created to support charitable causes or organizations. The trust can specify how the assets are to be used for charitable purposes, such as funding scholarships, supporting medical research, or preserving historical landmarks. The trust can also provide tax benefits for the testator’s estate by reducing the amount of estate taxes that need to be paid.

4. Spendthrift Trust:

A spendthrift trust is a testamentary trust that is created to protect the assets of a beneficiary who may not be capable of managing their own finances. The trust can include provisions that restrict the beneficiary’s access to the principal and income of the trust, preventing them from wasting or mismanaging the assets. The trust can also provide for the appointment of a trustee who will oversee the management and distribution of the assets.

These are just a few examples of testamentary trusts that can be created to meet specific needs and goals. It is important to consult with an attorney or estate planner to determine the best type of trust for your individual circumstances.

Case Studies and Scenarios

Case Study 1: Protecting Minor Children

John and Mary are a married couple with two young children. They want to ensure that their children are financially secure in the event of their untimely death. By setting up a testamentary trust in their wills, they can appoint a trusted individual or a professional trustee to manage the children’s inheritance until they reach a certain age. This ensures that the children’s financial needs are taken care of and that the assets are not mismanaged or squandered.

Case Study 2: Preserving Family Wealth

The Smith family has accumulated significant wealth over the years through their successful business. They want to ensure that their wealth is preserved for future generations and not easily accessible to creditors or spendthrift heirs. By establishing a testamentary trust, they can create a structure that protects their assets and allows for controlled distributions to their heirs. This helps safeguard the family’s wealth and ensures its longevity.

Case Study 3: Special Needs Planning

Emily has a child with special needs who requires ongoing care and support. She wants to ensure that her child’s financial needs are met even after she is no longer around. By creating a testamentary trust, Emily can set aside funds specifically for her child’s care, appoint a trustee who understands the unique needs of her child, and provide instructions on how the funds should be used. This gives Emily peace of mind knowing that her child will be taken care of in the future.

These case studies highlight the versatility and importance of testamentary trusts in various situations. Whether it’s protecting minor children, preserving family wealth, or planning for special needs, a testamentary trust can provide the necessary structure and control to ensure that your wishes are carried out and your loved ones are taken care of.

Pros of Testamentary Trusts

1. Control over distribution

One of the main advantages of a testamentary trust is that it allows the grantor to maintain control over the distribution of their assets even after their death. The grantor can specify how and when the assets should be distributed to the beneficiaries, ensuring that their wishes are followed.

2. Protection of assets

A testamentary trust can provide protection for the assets held within it. By placing assets in a trust, they are shielded from creditors, lawsuits, and other potential risks. This can be particularly beneficial if there are concerns about the financial stability or responsibility of the beneficiaries.

3. Tax advantages

Testamentary trusts can also offer tax advantages. Depending on the jurisdiction, assets held within a trust may be subject to lower tax rates or may be able to take advantage of certain tax deductions or exemptions. This can help to minimize the tax burden on the beneficiaries.

4. Flexibility

Testamentary trusts provide flexibility in terms of how the assets are managed and distributed. The grantor can set specific conditions or requirements that must be met before the assets are distributed, such as reaching a certain age or achieving certain milestones. This allows for customization and tailoring of the trust to meet the unique needs and circumstances of the beneficiaries.

5. Privacy

Unlike some other types of trusts, testamentary trusts do not require public disclosure. This means that the details of the trust, including the assets held within it and the beneficiaries, can remain private. This can be particularly important for individuals who value their privacy or who have concerns about potential disputes or conflicts.

Advantages and Benefits of Testamentary Trusts

A testamentary trust offers several advantages and benefits for individuals who want to ensure the proper management and distribution of their assets after their death. Some of the key advantages of testamentary trusts include:

1. Control over asset distribution:

With a testamentary trust, you have the ability to dictate how your assets will be distributed after your death. This allows you to ensure that your assets are distributed according to your wishes and in a manner that aligns with your values and priorities.

2. Protection of assets:

A testamentary trust can provide protection for your assets, especially in situations where beneficiaries may be minors, have special needs, or lack the financial knowledge or responsibility to manage their inheritance. By placing assets in a trust, you can appoint a trustee who will manage and distribute the assets in a way that protects them from potential risks or mismanagement.

3. Tax planning:

Testamentary trusts can also offer tax planning benefits. By structuring the trust properly, you may be able to minimize estate taxes, income taxes, and capital gains taxes. This can help preserve more of your assets for your beneficiaries and reduce the tax burden on your estate.

4. Flexibility:

Testamentary trusts provide flexibility in terms of how assets are distributed and managed. You can specify conditions and restrictions on the distribution of assets, such as age requirements, educational milestones, or the achievement of certain goals. This allows you to tailor the trust to the unique needs and circumstances of your beneficiaries.

5. Privacy:

Unlike a will, which becomes a public record upon your death, a testamentary trust offers privacy. The terms of the trust and the details of your assets and beneficiaries are not made public, providing a level of confidentiality and discretion.

6. Continuity of asset management:

A testamentary trust ensures that your assets will continue to be managed and invested according to your instructions, even after your death. This can provide peace of mind knowing that your assets will be handled by a trusted individual or institution who will act in the best interests of your beneficiaries.

Cons of Testamentary Trusts

While testamentary trusts offer several benefits, there are also some drawbacks to consider. It is important to weigh these cons against the pros before deciding whether a testamentary trust is the right option for your estate planning needs.

1. Time-consuming and complex

Creating and administering a testamentary trust can be a time-consuming and complex process. It requires careful planning, drafting of legal documents, and ongoing management. This can be particularly challenging for individuals who are not familiar with trust laws and regulations.

2. Legal and administrative costs

Establishing a testamentary trust involves legal fees and administrative costs. Hiring an attorney to draft the necessary documents and provide guidance throughout the process can be expensive. Additionally, ongoing administrative tasks, such as filing tax returns and managing trust assets, may require professional assistance, incurring further costs.

3. Limited control over assets

4. Potential for disputes and conflicts

Testamentary trusts can sometimes lead to disputes and conflicts among beneficiaries. The terms of the trust may not be clear or may be subject to interpretation, leading to disagreements and potential legal battles. This can create tension and strain relationships among family members.

5. Limited flexibility

Unlike revocable living trusts, testamentary trusts are irrevocable and cannot be easily modified or revoked once established. This lack of flexibility can be a disadvantage if circumstances change or if the grantor wishes to make adjustments to the trust’s terms.

Overall, while testamentary trusts can offer significant advantages in terms of asset protection and control, it is essential to consider the potential drawbacks and consult with legal and financial professionals to determine the best estate planning strategy for your specific situation.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.