Last Will and Testament: Definition, Types, and How to Write One

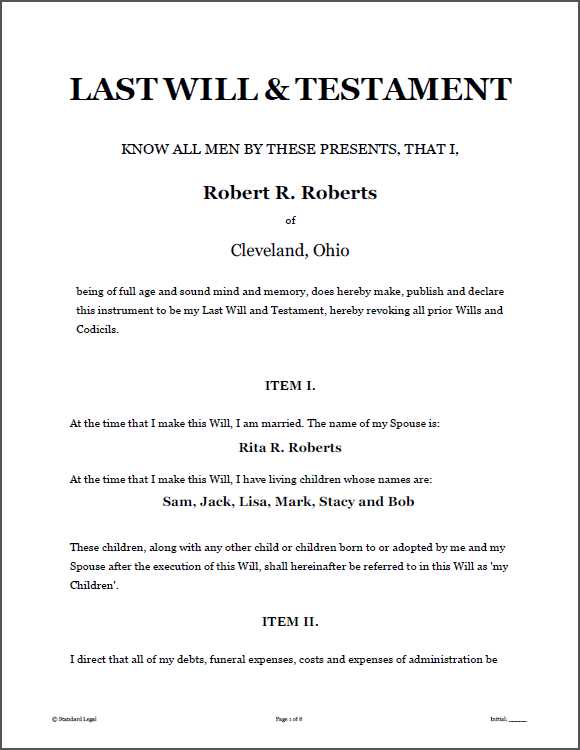

A Last Will and Testament is a legal document that outlines how a person’s assets and properties should be distributed after their death. It is an essential part of estate planning and ensures that the individual’s wishes are carried out according to their instructions.

There are different types of Last Will and Testament, depending on the specific circumstances and preferences of the individual. The most common types include:

1. Simple Will: This is a basic document that outlines the distribution of assets and appoints an executor to carry out the instructions.

2. Testamentary Trust Will: This type of Will establishes a trust that will be created upon the death of the individual. It is often used to provide for the financial needs of minor children or individuals with special needs.

3. Joint Will: This is a Will created by a married couple, which outlines how their assets will be distributed after both of their deaths. It is often used to ensure that the surviving spouse is taken care of.

4. Living Will: This is a document that outlines an individual’s wishes regarding medical treatment and end-of-life decisions. It is not the same as a Last Will and Testament, but it is an important part of estate planning.

Writing a Last Will and Testament requires careful consideration and attention to detail. Here are some steps to follow:

1. Start by listing all your assets, including real estate, bank accounts, investments, and personal belongings.

2. Determine how you want your assets to be distributed. You can specify specific items or amounts to be given to certain individuals or organizations.

3. Choose an executor who will be responsible for carrying out your instructions. Make sure to discuss this with the person beforehand to ensure their willingness to take on the role.

4. Consult with an attorney who specializes in estate planning to ensure that your Last Will and Testament meets all legal requirements and is enforceable.

Having a Last Will and Testament is of utmost importance. It allows you to have control over the distribution of your assets and ensures that your loved ones are taken care of according to your wishes. Without a Will, the distribution of your assets will be determined by the state laws, which may not align with your intentions.

The last will and testament is a legal document that outlines a person’s wishes regarding the distribution of their assets and the care of their dependents after their death. It is an essential part of estate planning and provides instructions for the executor of the will to follow.

What is a Last Will and Testament?

A last will and testament, commonly referred to as a will, is a legally binding document that allows an individual to specify how their property and assets should be distributed upon their death. It also allows the person to name an executor who will be responsible for carrying out the instructions outlined in the will.

Additionally, a will can be used to appoint a guardian for minor children or dependents, specify funeral arrangements, and even express personal wishes or messages to loved ones.

Why is a Last Will and Testament Important?

Having a last will and testament is important for several reasons:

- Asset Distribution: A will ensures that your assets are distributed according to your wishes. Without a will, the distribution of your assets will be determined by the laws of intestacy, which may not align with your intentions.

- Guardianship: If you have minor children or dependents, a will allows you to appoint a guardian who will be responsible for their care in the event of your death.

- Executor Appointment: By naming an executor in your will, you can choose someone you trust to handle the administration of your estate and ensure that your wishes are carried out.

- Funeral Arrangements: You can use a will to specify your funeral or memorial service preferences, providing your loved ones with guidance during a difficult time.

- Peace of Mind: Creating a will gives you peace of mind, knowing that your affairs are in order and your loved ones will be taken care of according to your wishes.

How to Create a Last Will and Testament

While it is possible to create a simple will on your own, it is highly recommended to consult an attorney who specializes in estate planning to ensure that your will is legally valid and covers all necessary aspects. An attorney can provide guidance, answer any questions you may have, and help you navigate the complexities of estate planning.

When creating a last will and testament, consider the following steps:

- Inventory your assets: Make a list of all your assets, including bank accounts, real estate, investments, and personal belongings.

- Choose an executor: Select someone you trust to carry out your wishes and handle the administration of your estate.

- Decide on beneficiaries: Determine who will inherit your assets and specify their shares.

- Appoint a guardian: If you have minor children or dependents, name a guardian who will be responsible for their care.

- Specify funeral arrangements: If desired, outline your preferences for your funeral or memorial service.

- Consult an attorney: Seek the assistance of an attorney who specializes in estate planning to ensure that your will is legally valid and covers all necessary aspects.

- Review and update: Regularly review and update your will to reflect any changes in your assets, beneficiaries, or personal circumstances.

By following these steps and seeking professional advice, you can create a comprehensive and legally valid last will and testament that ensures your wishes are fulfilled and your loved ones are taken care of.

Types of Last Will and Testament

1. Simple Will

A simple will is the most basic type of Last Will and Testament. It outlines how your assets will be distributed after your death and appoints an executor to carry out your wishes. This type of will is suitable for individuals with straightforward estates and uncomplicated family situations.

2. Testamentary Trust Will

A testamentary trust will includes provisions for creating a trust upon your death. This type of will is often used when you want to provide for the financial needs of minor children or individuals with special needs. The trust will be managed by a trustee who will distribute the assets according to your instructions.

3. Joint Will

A joint will is a single will that is created by two individuals, usually spouses or partners. This type of will is often used when both individuals want to leave their assets to each other and have similar wishes for the distribution of their assets after both of their deaths. It is important to note that a joint will cannot be changed after the death of one of the individuals.

4. Mutual Will

5. Living Will

These are just a few examples of the types of Last Will and Testament that are available. It is important to consult with an attorney who specializes in estate planning to determine which type of will is best suited for your individual needs and circumstances.

Importance of Having a Last Will and Testament

Having a last will and testament is of utmost importance for individuals who want to ensure that their final wishes are carried out after their death. A last will and testament is a legal document that outlines how a person’s assets and property should be distributed upon their death. It allows individuals to have control over what happens to their belongings and ensures that their loved ones are taken care of.

One of the main reasons why having a last will and testament is important is that it helps to avoid disputes and conflicts among family members. Without a will, the distribution of assets can become a source of tension and disagreement, leading to potential legal battles. By clearly stating your wishes in a will, you can minimize the chances of family disputes and ensure that your loved ones are not left with any confusion or resentment.

In addition, a last will and testament can also be used to name guardians for minor children. If you have children who are under the age of 18, it is essential to designate a guardian who will take care of them in the event of your death. Without a will, the court will have to decide who will be the guardian, which may not align with your wishes. By including this provision in your will, you can ensure that your children will be taken care of by someone you trust.

Furthermore, a last will and testament can also be used to specify any funeral or burial arrangements that you may have. By including these instructions in your will, you can relieve your loved ones of the burden of making these decisions during a difficult time. It allows you to have control over your final arrangements and ensures that your wishes are respected.

How to Write a Last Will and Testament

Writing a last will and testament is an important step in estate planning. It allows you to determine how your assets will be distributed after your death and ensures that your wishes are followed. Here are some steps to guide you in writing your last will and testament:

1. Determine your assets and beneficiaries

2. Appoint an executor

An executor is responsible for carrying out the instructions in your will. Choose someone you trust to handle your affairs and make sure they are willing to take on this role. It is advisable to appoint an alternate executor in case your first choice is unable or unwilling to fulfill the duties.

3. Decide on guardianship for minor children

If you have minor children, you should specify who will be their guardian in your will. This is important to ensure that your children are taken care of by someone you trust in the event of your death.

4. Consult an attorney

While it is possible to write your own will, consulting an attorney specializing in estate planning can provide valuable guidance and ensure that your will is legally valid. They can also help you navigate complex situations, such as tax implications and unique family circumstances.

5. Write the will

When writing your will, include a clear statement that it is your last will and testament. Specify your name, address, and the date of the document. Clearly state your intentions regarding the distribution of your assets and the appointment of your executor and guardian.

6. Sign and witness the will

For a will to be legally valid, it must be signed by you in the presence of at least two witnesses who are not beneficiaries or related to beneficiaries. The witnesses should also sign the will to confirm its authenticity.

7. Keep the will in a safe place

Once your will is complete, store it in a safe and accessible place. Inform your executor and loved ones about the location of the will, so it can be easily found when needed.

Remember, it is important to review and update your will periodically, especially after major life events such as marriage, divorce, or the birth of children. By taking the time to write a last will and testament, you can have peace of mind knowing that your wishes will be carried out and your loved ones will be taken care of.

Consulting an Attorney for Last Will and Testament

An attorney can provide valuable guidance on the legal requirements and formalities involved in creating a will. They can help you understand the different types of wills and assist in choosing the most appropriate one for your specific circumstances. Additionally, an attorney can provide insights on estate tax planning and asset distribution, ensuring that your assets are distributed according to your wishes while minimizing tax liabilities.

Benefits of Consulting an Attorney

- Expertise: Attorneys specializing in estate planning have in-depth knowledge of the laws and regulations surrounding wills. They can provide expert advice tailored to your unique situation.

- Customization: An attorney can help you draft a will that reflects your specific wishes and addresses any complex issues or concerns you may have.

- Legal Compliance: By working with an attorney, you can ensure that your will meets all the legal requirements of your jurisdiction. This can help prevent any challenges or disputes in the future.

- Peace of Mind: Knowing that your will has been professionally prepared can provide peace of mind, knowing that your loved ones will be taken care of and your wishes will be respected.

Choosing an Attorney

When selecting an attorney for your estate planning needs, it is important to choose someone who is experienced in wills and trusts. Look for an attorney who is knowledgeable, trustworthy, and has a good reputation in the field. Consider seeking recommendations from friends, family, or other professionals who have used estate planning services.

During your initial consultation with the attorney, ask about their experience, fees, and the process they will follow to create your will. It is also important to discuss any specific concerns or wishes you have regarding your estate.

Remember, creating a last will and testament is an important step in ensuring that your assets are distributed according to your wishes. By consulting an attorney, you can have peace of mind knowing that your will is legally sound and properly reflects your intentions.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.