What is Discretionary Investment Management?

This type of management is often sought by individuals or institutions who lack the time, expertise, or desire to actively manage their investments. By delegating the investment decisions to a professional, clients can benefit from their expertise and knowledge of the financial markets.

Discretionary investment management involves a collaborative process between the client and the investment manager. The client provides information about their financial goals, risk tolerance, and investment preferences, while the investment manager uses this information to create and manage a tailored investment portfolio.

The investment manager’s role includes conducting research, analyzing market trends, selecting appropriate investment vehicles, and monitoring the portfolio’s performance. They aim to maximize returns while managing risk and ensuring the portfolio aligns with the client’s investment objectives.

Overall, discretionary investment management offers convenience, expertise, and personalized investment strategies for clients. It allows individuals and institutions to delegate the day-to-day investment decisions to professionals, freeing up their time and potentially enhancing their investment outcomes.

Discretionary investment management is a type of portfolio management service where a professional investment manager makes investment decisions on behalf of the client. This approach allows the investment manager to have full discretion in managing the client’s portfolio, including buying and selling securities without requiring prior approval from the client.

How Does Discretionary Investment Management Work?

When a client opts for discretionary investment management, they provide the investment manager with a mandate outlining their investment objectives, risk tolerance, and any specific preferences or restrictions. Based on this mandate, the investment manager creates and manages a portfolio tailored to the client’s needs.

The investment manager utilizes their expertise and market analysis to identify investment opportunities and make informed decisions on asset allocation, security selection, and timing of trades. They have the flexibility to make adjustments to the portfolio as market conditions change, without needing to consult the client for every decision.

The Benefits of Discretionary Investment Management

1. Enhanced Portfolio Diversification and Risk Management:

By entrusting the investment decisions to a professional, clients can benefit from a well-diversified portfolio that spreads risk across different asset classes, sectors, and geographic regions. The investment manager can also actively monitor and adjust the portfolio to mitigate risks and take advantage of market opportunities.

2. Professional Expertise and Active Portfolio Monitoring:

Discretionary investment managers are experienced professionals who have in-depth knowledge of financial markets and investment strategies. They continuously monitor the portfolio, keeping up with market trends and news, and making adjustments as necessary. This active management can potentially lead to better investment outcomes.

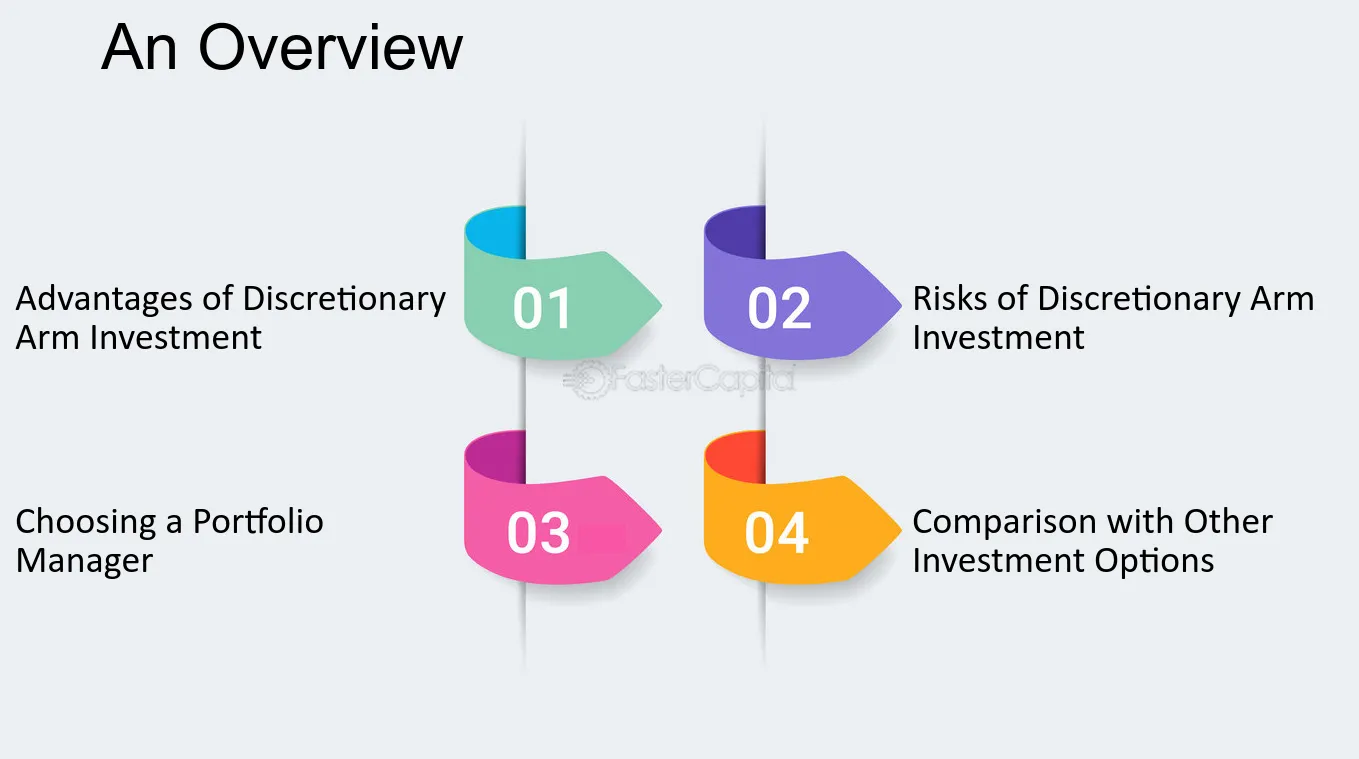

Risks and Considerations of Discretionary Investment Management

While discretionary investment management offers numerous benefits, it is important to consider the potential risks involved:

- Loss of Control: Clients relinquish control over their investment decisions to the investment manager, which means they may not have direct input on specific investment choices.

- Costs: Discretionary investment management services typically come with fees, which can vary depending on the provider and the size of the portfolio.

- Compatibility: It is crucial to ensure that the investment manager’s investment style and approach align with the client’s objectives and risk tolerance.

- Market Risk: Investments are subject to market fluctuations and there is always the potential for loss.

Before opting for discretionary investment management, individuals should carefully assess their financial goals, risk tolerance, and the fees associated with the service. It is also advisable to conduct thorough research and due diligence on potential investment managers to ensure they have a strong track record and are reputable in the industry.

Benefits of Discretionary Investment Management

Discretionary investment management offers several benefits to investors, making it an attractive option for those looking to grow their wealth and achieve their financial goals. Here are some of the key advantages of discretionary investment management:

| 1. Professional Expertise | Discretionary investment management allows investors to tap into the expertise of professional portfolio managers. These managers have extensive knowledge and experience in the financial markets, allowing them to make informed investment decisions on behalf of their clients. By leveraging their expertise, investors can benefit from the skills and insights of seasoned professionals. |

| 2. Active Portfolio Monitoring | With discretionary investment management, portfolio managers actively monitor and adjust the investment portfolio based on market conditions and the investor’s objectives. This proactive approach ensures that the portfolio remains aligned with the investor’s goals and takes advantage of potential opportunities. Regular monitoring also allows for timely adjustments to mitigate risks and optimize returns. |

| 3. Customized Investment Strategy | Discretionary investment management offers the flexibility to tailor the investment strategy to the investor’s unique needs and risk tolerance. Portfolio managers work closely with their clients to understand their financial goals, time horizon, and risk appetite. This personalized approach ensures that the investment portfolio is aligned with the investor’s specific requirements, maximizing the chances of achieving desired outcomes. |

| 4. Enhanced Portfolio Diversification | Diversification is a key principle of successful investing. Discretionary investment management provides access to a wide range of asset classes, including stocks, bonds, real estate, and alternative investments. By diversifying across different asset classes, industries, and geographies, investors can reduce the impact of any single investment on their overall portfolio. This diversification helps to spread risk and potentially enhance returns. |

| 5. Time-saving and Convenience | Managing an investment portfolio requires time, effort, and expertise. Discretionary investment management relieves investors of the burden of day-to-day portfolio management, allowing them to focus on other aspects of their lives. Portfolio managers handle all the investment decisions, research, and monitoring, saving investors valuable time and providing them with peace of mind. |

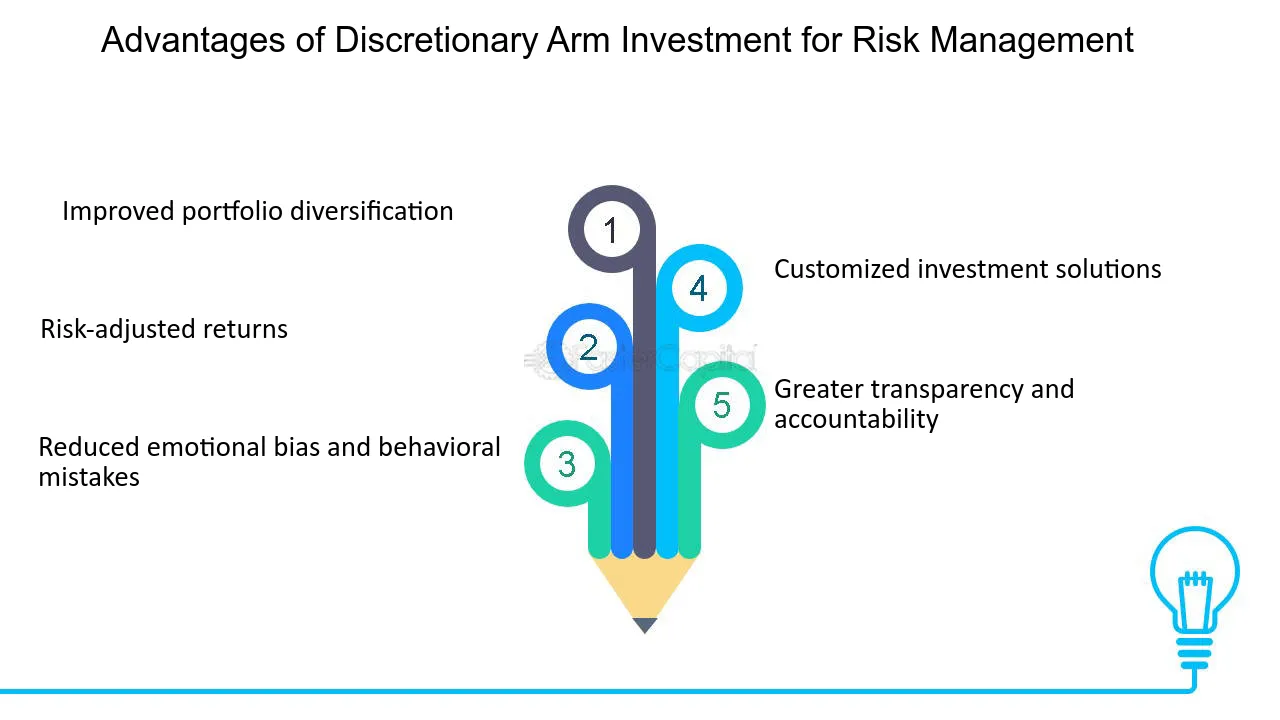

Enhanced Portfolio Diversification and Risk Management

Discretionary investment management offers enhanced portfolio diversification and risk management, making it an attractive option for investors looking to optimize their investment strategy. By entrusting their investments to a professional portfolio manager, investors can benefit from a diversified portfolio that spreads their risk across different asset classes, sectors, and geographic regions.

A diversified portfolio helps to reduce the impact of any single investment’s performance on the overall portfolio. This is because different asset classes, such as stocks, bonds, and commodities, tend to have different levels of correlation with each other. When one asset class is performing poorly, another may be performing well, helping to offset potential losses.

With discretionary investment management, portfolio managers have the flexibility to adjust the portfolio’s asset allocation based on market conditions and their analysis of various investment opportunities. This allows them to take advantage of potential opportunities and mitigate risks by reallocating assets accordingly.

Furthermore, discretionary portfolio managers have access to a wide range of investment instruments, including equities, fixed income securities, derivatives, and alternative investments. This enables them to construct portfolios that are tailored to the specific risk tolerance and investment objectives of each client.

Another benefit of discretionary investment management is the active monitoring of the portfolio by experienced professionals. Portfolio managers continuously analyze market trends, economic indicators, and company-specific information to identify potential risks and opportunities. They can then make informed decisions to adjust the portfolio’s composition and holdings, aiming to maximize returns while managing risk.

By delegating investment decisions to professionals, investors can also benefit from the expertise and knowledge of portfolio managers who have extensive experience in financial markets. These professionals have access to research and analysis tools that individual investors may not have, allowing them to make more informed investment decisions.

Overall, discretionary investment management offers enhanced portfolio diversification and risk management, providing investors with the potential for better returns and reduced risk compared to managing their investments on their own.

Professional Expertise and Active Portfolio Monitoring

Discretionary investment management offers the benefit of professional expertise and active portfolio monitoring. When you entrust your investments to a discretionary investment manager, you are relying on their knowledge, skills, and experience in the financial markets.

Furthermore, discretionary investment managers actively monitor your portfolio on an ongoing basis. They regularly review the performance of your investments and make adjustments as needed to ensure that your portfolio remains aligned with your objectives.

This active monitoring helps to mitigate risks and take advantage of market opportunities. For example, if a particular investment is underperforming, the discretionary investment manager can make the necessary adjustments to minimize losses. On the other hand, if they identify a promising investment opportunity, they can quickly capitalize on it to potentially enhance your returns.

By entrusting your investments to a discretionary investment manager, you can benefit from their professional expertise and active portfolio monitoring, allowing you to focus on other aspects of your life while knowing that your investments are in capable hands.

Risks and Considerations of Discretionary Investment Management

While discretionary investment management offers many benefits, it is important to be aware of the risks and considerations associated with this approach. Here are some key factors to consider:

- Loss of Control: When you opt for discretionary investment management, you are essentially handing over control of your investment decisions to a professional portfolio manager. This means that you may not have the final say in how your money is invested, and you will need to trust the expertise and judgment of the manager.

- Conflicts of Interest: It is crucial to carefully evaluate the credentials and reputation of the portfolio manager or firm you choose to work with. There is always a risk that the manager may have conflicts of interest that could influence their investment decisions. It is important to choose a manager who is transparent and acts in your best interest.

- Fees and Costs: Discretionary investment management typically involves fees and costs that can eat into your investment returns. It is important to carefully review the fee structure and understand the costs associated with the management services. Make sure the potential benefits outweigh the costs.

- Performance Risk: The performance of your portfolio will ultimately depend on the skill and expertise of the portfolio manager. There is always a risk that the manager may underperform or make poor investment decisions, resulting in potential losses. It is important to regularly review and evaluate the performance of your portfolio manager.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.