What is a Management Buyout?

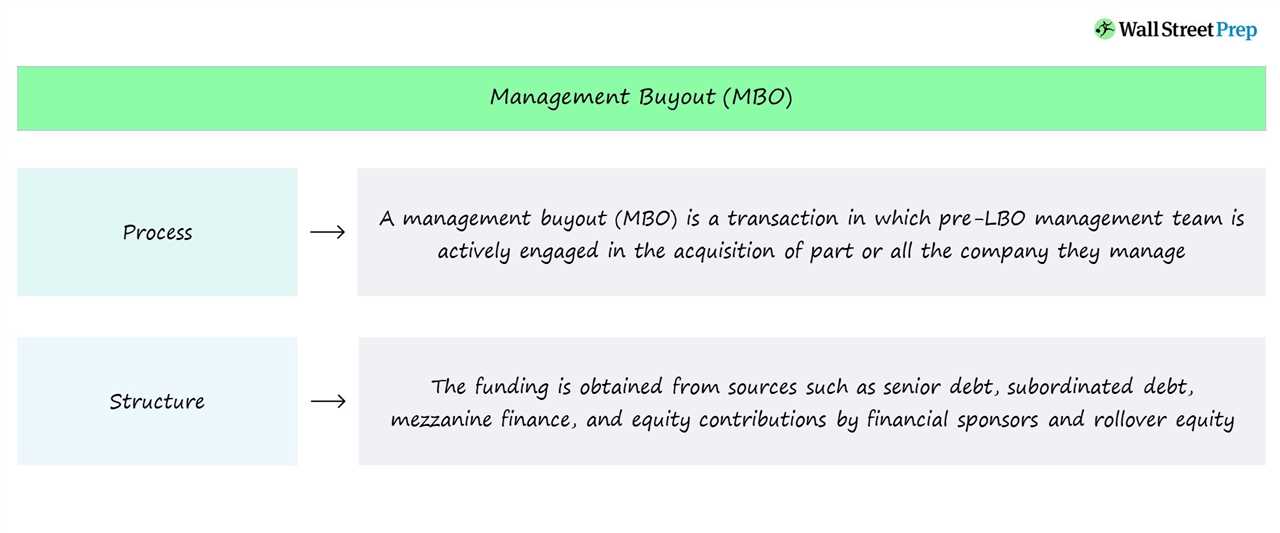

A management buyout (MBO) is a transaction in which the current management team of a company purchases a controlling stake or the entire business from its existing owners. This type of acquisition allows the managers to become the new owners of the company, giving them the opportunity to shape its future direction and strategy.

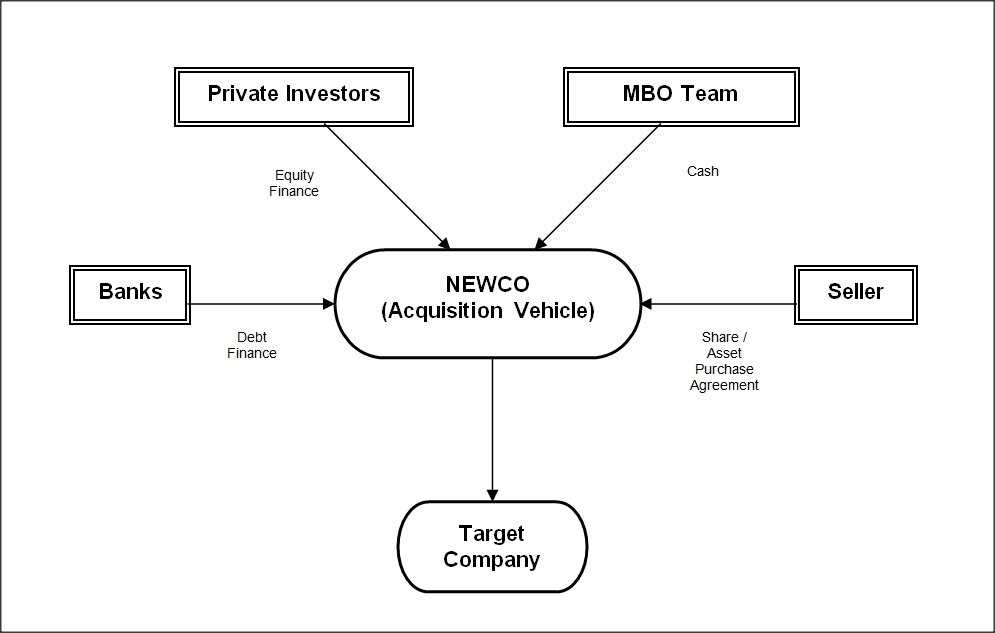

During a management buyout, the management team typically forms a new entity, such as a private equity firm or a holding company, to acquire the business. They may also seek financial backing from external investors, such as banks or private equity funds, to provide the necessary capital for the purchase.

Benefits of a Management Buyout

There are several benefits associated with management buyouts:

- Flexibility: With the ability to make decisions independently, the management team can react quickly to market changes and implement strategic initiatives without having to seek approval from external shareholders.

Overall, a management buyout can be an attractive option for both the existing owners and the management team, as it provides an opportunity for a smooth transition of ownership and allows the managers to take control of their own destiny.

Definition of Management Buyout

A management buyout (MBO) is a transaction in which the current management team of a company acquires a controlling interest or complete ownership of the company from its existing owners, typically through the use of debt financing. In an MBO, the management team, often with the assistance of external investors or lenders, purchases the company’s shares or assets, allowing them to gain control over the company’s operations and strategic direction.

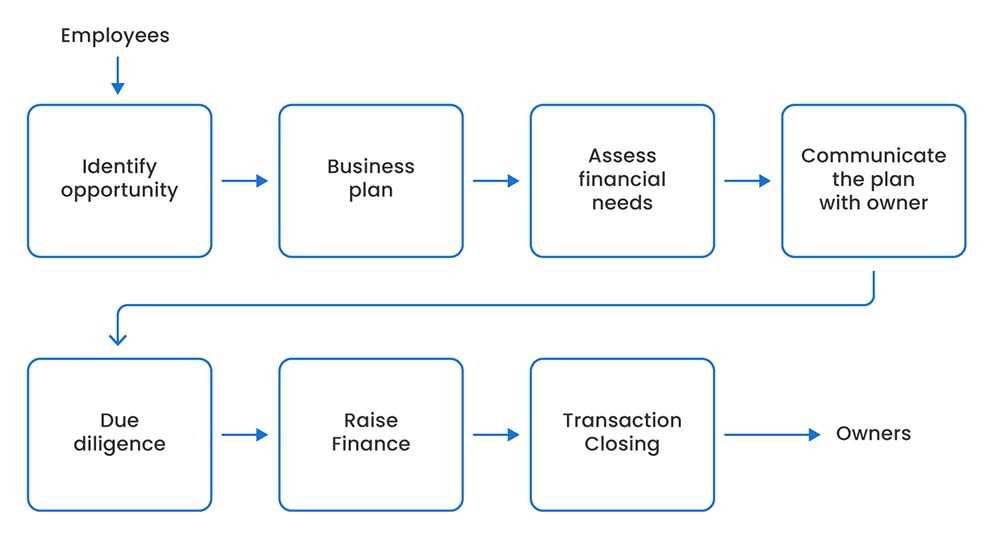

During a management buyout, the management team usually forms a new company or a special purpose vehicle (SPV) to facilitate the acquisition. The management team may contribute their own funds or seek external financing to finance the purchase. The financing for an MBO can come from various sources, such as bank loans, private equity firms, or venture capitalists.

Benefits of Management Buyouts

Management buyouts offer several benefits for both the management team and the company being acquired. Firstly, an MBO allows the existing management team to take control of the company, giving them the opportunity to implement their own strategic vision and make decisions without interference from external shareholders or owners.

Considerations for Management Buyouts

While management buyouts offer various benefits, they also involve certain considerations and risks. One key consideration is the availability of financing. The management team needs to secure sufficient funding to acquire the company, which can be challenging, especially in cases where the company has significant debt or requires substantial investment.

Another consideration is the valuation of the company. The management team needs to determine a fair price for the company’s shares or assets, taking into account factors such as its financial performance, market conditions, and growth potential. Valuation can be complex and may require the assistance of financial advisors or valuation experts.

Additionally, management buyouts may face resistance from existing shareholders or other stakeholders who may have different objectives or concerns. It is important for the management team to effectively communicate their plans and address any potential issues or objections to gain support for the buyout.

Importance of Management Buyouts

1. Continuity and Stability

One of the main reasons why management buyouts are important is that they provide continuity and stability for the company. When a management team takes over the ownership of the business, they are already familiar with its operations, culture, and vision. This ensures a smooth transition and minimizes disruptions in the day-to-day operations of the company.

2. Alignment of Interests

Management buyouts align the interests of the management team with those of the company’s shareholders. Since the management team becomes the owners of the business, they have a vested interest in its success. This alignment of interests can lead to increased motivation, dedication, and commitment from the management team, which can ultimately drive the company’s growth and profitability.

3. Entrepreneurial Spirit

4. Employee Morale

Management buyouts can have a positive impact on employee morale. When employees see their managers taking ownership of the company, it can instill a sense of pride, loyalty, and job security. This can lead to higher employee satisfaction, productivity, and retention rates. Additionally, the management team, as owners, can implement employee incentive programs and reward systems to further motivate and engage the workforce.

5. Strategic Focus

Management buyouts allow the management team to have a greater strategic focus on the long-term goals and objectives of the company. They can prioritize investments, allocate resources, and make strategic decisions based on their in-depth knowledge of the business and industry. This strategic focus can lead to improved performance, competitive advantage, and value creation for the company.

Reasons for a Management Buyout

A management buyout (MBO) is a transaction in which the current management team of a company acquires a controlling stake or complete ownership of the company. There are several reasons why a management team might choose to pursue a buyout:

1. Entrepreneurial Opportunity

For ambitious managers who have a strong vision for the future of the company, a management buyout can provide the opportunity to take control and shape the company’s direction. By acquiring ownership, managers can have a greater influence on strategic decisions and drive the company towards their own goals.

2. Alignment of Interests

In a management buyout, the interests of the management team are closely aligned with those of the company. This alignment can lead to increased motivation, as managers have a personal stake in the success of the business. They are more likely to work hard, make strategic decisions, and take risks that will benefit the company in the long run.

3. Knowledge and Expertise

4. Continuity and Stability

A management buyout can provide continuity and stability for the company. The existing management team is already familiar with the company’s operations, culture, and employees. By acquiring ownership, they can ensure a smooth transition and maintain the company’s core values and strategies. This can be particularly important during times of change, such as a succession planning or a shift in the industry.

5. Entrepreneurial Spirit

Many managers have an entrepreneurial spirit and a desire to take on new challenges. A management buyout allows them to take on the role of business owners, with the freedom to make decisions and drive growth. This can be highly rewarding and fulfilling, as managers have the opportunity to build something of their own and reap the benefits of their hard work.

Financial Motivations

One of the key motivations behind a management buyout (MBO) is the potential for financial gain. By acquiring the company they manage, the management team can directly benefit from the company’s future success.

Here are some financial motivations that drive management buyouts:

1. Equity Ownership

By acquiring equity, the management team aligns their interests with the company’s success. They have a vested interest in driving growth and profitability, as it directly impacts their personal financial gain.

2. Return on Investment

Management buyouts offer the potential for a significant return on investment (ROI) for the management team. By acquiring the company at a favorable price, they can benefit from future value appreciation.

If the management team successfully grows the business and increases its profitability, the value of their equity stake will also increase. This can result in a substantial financial return when they eventually sell their shares.

3. Control over Financial Decisions

Another financial motivation for management buyouts is the ability to have control over financial decisions. As owners of the company, the management team can make strategic choices that directly impact the company’s financial performance.

| Financial Motivations |

|---|

| Equity Ownership |

| Return on Investment |

| Control over Financial Decisions |

Control Motivations in Management Buyouts

In a management buyout (MBO), control motivations play a crucial role in the decision-making process. Control motivations refer to the desire of the management team to gain control over the company they are currently working for. This desire is often driven by the belief that they can better manage the company and make strategic decisions that will lead to its success.

One of the main control motivations in an MBO is the opportunity for the management team to shape the future direction of the company. By gaining control, they can implement their own vision, strategies, and initiatives without interference from external shareholders or board members. This allows them to focus on long-term goals and make decisions that are in the best interest of the company.

Another control motivation is the ability to make operational and structural changes within the company. The management team may believe that certain changes are necessary for the company to remain competitive or to improve its performance. By gaining control, they have the authority to implement these changes and drive the company towards growth and profitability.

In summary, control motivations are an important aspect of management buyouts. They reflect the management team’s desire to shape the future of the company, make operational changes, have a say in key decisions, and protect the company’s culture. By gaining control, the management team can take ownership of the company and lead it towards success.

Control Motivations

Control motivations can also stem from a desire to implement a new strategic direction or make significant changes to the company’s operations. The management team may believe that they have innovative ideas or a unique vision for the future of the business, and a management buyout allows them to take control and bring these ideas to fruition.

Furthermore, control motivations can be driven by a desire for autonomy and independence. By acquiring the company through a management buyout, the management team can free themselves from the constraints and oversight of external owners or shareholders. This can provide them with the freedom to make decisions and take risks without having to seek approval from others.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.