What are Withdrawal Credits?

Withdrawal credits are a crucial aspect of a pension plan that allow participants to withdraw funds from their account before reaching retirement age. These credits represent the contributions made by the participant and any investment gains or losses associated with those contributions.

When an individual contributes to a pension plan, a portion of their salary is deducted and deposited into their account. Over time, these contributions accumulate and earn returns based on the performance of the pension plan’s investments. These returns, along with the original contributions, make up the withdrawal credits.

Importance of Withdrawal Credits

Withdrawal credits provide flexibility and financial security to participants in a pension plan. They allow individuals to access their funds in case of emergencies or unforeseen circumstances. For example, if a participant needs to cover medical expenses or pay for their child’s education, they can withdraw a portion of their withdrawal credits to meet these financial obligations.

Furthermore, withdrawal credits can also be used to bridge the gap between retirement and the eligibility age for pension benefits. In some cases, individuals may need to retire earlier than the designated retirement age due to health issues or other reasons. Withdrawal credits can help provide income during this transition period until they become eligible for regular pension benefits.

Limitations of Withdrawal Credits

Additionally, withdrawing funds from a pension plan reduces the overall balance and potential growth of the account. This means that individuals who withdraw a significant portion of their withdrawal credits may have less money available for retirement. It is important for participants to carefully consider the long-term impact of withdrawing funds and weigh the benefits against the potential drawbacks.

Conclusion

Withdrawal credits are an essential component of a pension plan, providing participants with the ability to access their funds before retirement age. They offer flexibility and financial security, allowing individuals to meet unexpected expenses or bridge the gap between retirement and pension eligibility. However, it is important for participants to understand the limitations and potential consequences of withdrawing funds early. Proper planning and consideration are crucial to ensure a secure retirement.

How are Withdrawal Credits Calculated?

Withdrawal credits in a pension plan are calculated based on various factors, including the employee’s years of service, salary history, and the specific rules of the pension plan. The calculation method can vary depending on the plan’s provisions, but there are some common approaches.

Vesting Period

Before an employee can start accumulating withdrawal credits, they must first meet the vesting period requirement. The vesting period is the length of time an employee must work for the company before they become entitled to the employer’s contributions to the pension plan. Once the vesting period is met, the employee becomes vested, and their withdrawal credits start to accumulate.

Service Credits

Withdrawal credits are typically calculated based on the employee’s years of service. Each year of service earns the employee a certain percentage of their salary as withdrawal credits. The percentage can vary depending on the plan, but it is often based on a formula that takes into account the employee’s salary history and the number of years of service.

For example, a pension plan may provide that an employee earns 2% of their average salary for each year of service. If an employee has worked for the company for 20 years and their average salary during that period is $50,000, they would earn 2% of $50,000 for each year of service, resulting in a total of $20,000 in withdrawal credits.

Salary History

The employee’s salary history also plays a role in the calculation of withdrawal credits. Some pension plans use the employee’s final average salary, which is the average of their highest consecutive years of earnings, to determine the amount of withdrawal credits. Other plans may use the average salary over the entire period of employment.

Additional Contributions

In some cases, employees may have the option to make additional contributions to their pension plan, which can increase their withdrawal credits. These additional contributions are often voluntary and can be made through salary deductions or lump-sum payments. The amount of additional contributions and their impact on withdrawal credits will depend on the specific rules of the pension plan.

It is important for employees to understand how their withdrawal credits are calculated in their pension plan, as it can have a significant impact on their retirement income. Consulting with a financial advisor or reviewing the plan’s documentation can provide further clarification on the calculation method and any additional factors that may affect the accumulation of withdrawal credits.

Types of Withdrawal Credits

Withdrawal credits in a pension plan can be categorized into two main types: vested and non-vested withdrawal credits.

Vested Withdrawal Credits:

Vested withdrawal credits are the portion of the pension plan that the employee is entitled to keep even if they leave the company before retirement. These credits are considered the employee’s own contributions to the plan, as well as any employer contributions that have vested over a certain period of time. Vesting typically occurs after a certain number of years of service, and once vested, the employee has a legal right to these credits.

For example, if an employee has worked for a company for five years and the vesting period is three years, they would be entitled to keep the portion of the pension plan that has vested over those three years.

Non-Vested Withdrawal Credits:

Non-vested withdrawal credits are the portion of the pension plan that the employee is not entitled to keep if they leave the company before reaching the vesting period. These credits may include employer contributions that have not yet vested, as well as any earnings or interest that have accumulated on the non-vested portion of the plan.

Using the previous example, if an employee leaves the company before reaching the three-year vesting period, they would not be entitled to keep any of the employer contributions or earnings that have not yet vested.

Implications of Withdrawing Credits

Withdrawing credits from a pension plan can have significant implications for individuals. It is important to carefully consider the potential consequences before making any decisions.

1. Tax Implications

One of the main implications of withdrawing credits from a pension plan is the potential tax consequences. Depending on the type of pension plan and the individual’s tax bracket, withdrawals may be subject to income tax. It is important to consult with a tax professional to understand the specific tax implications and potential strategies to minimize the tax burden.

2. Impact on Retirement Income

Withdrawing credits from a pension plan can reduce the amount of retirement income an individual will receive. This is because the credits represent a portion of the overall retirement savings. By withdrawing these credits, individuals may be reducing the amount of money available to them during retirement. It is important to carefully consider the impact on future financial security before making any withdrawals.

3. Early Withdrawal Penalties

In some cases, withdrawing credits from a pension plan before a certain age may result in early withdrawal penalties. These penalties are designed to discourage individuals from accessing their retirement savings before they reach retirement age. It is important to understand the specific rules and penalties associated with early withdrawals before making any decisions.

4. Loss of Future Growth

By withdrawing credits from a pension plan, individuals may be missing out on potential future growth. Retirement savings are typically invested in a variety of assets, such as stocks and bonds, with the goal of generating returns over time. By withdrawing credits, individuals may be forfeiting the opportunity for their savings to grow and potentially earn additional income for retirement.

5. Impact on Survivor Benefits

Some pension plans offer survivor benefits, which provide financial support to a spouse or dependents after the individual’s death. Withdrawing credits from a pension plan may reduce or eliminate these survivor benefits, leaving loved ones without the financial support they may need in the future. It is important to consider the impact on survivor benefits before making any withdrawals.

6. Potential Alternatives

Before withdrawing credits from a pension plan, individuals should explore potential alternatives. This may include options such as taking a loan against the pension plan, if allowed, or exploring other sources of income or financial assistance. It is important to consider all available options and their potential implications before making any decisions.

| Implication | Description |

|---|---|

| Tax Implications | Potential income tax on withdrawals |

| Impact on Retirement Income | Reduction in future retirement income |

| Early Withdrawal Penalties | Potential penalties for withdrawing before retirement age |

| Loss of Future Growth | Missed opportunity for savings to grow |

| Impact on Survivor Benefits | Reduction or elimination of survivor benefits |

| Potential Alternatives | Exploring other options before making withdrawals |

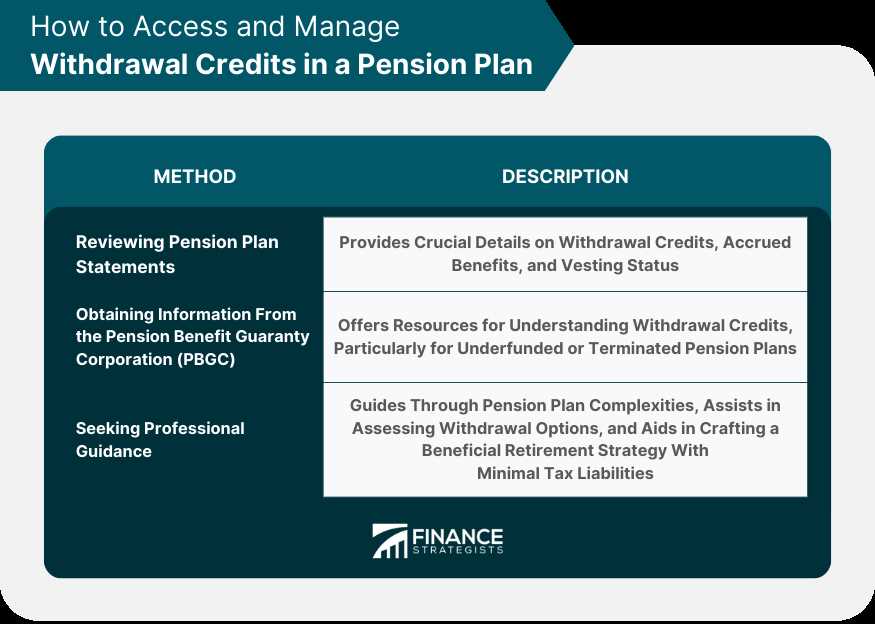

Planning for Withdrawal Credits

1. Review the pension plan: The first step in planning for withdrawal credits is to review the specific details of your pension plan. Understand the rules and regulations regarding withdrawal credits, including any limitations or restrictions that may apply.

2. Determine your eligibility: Find out when you become eligible to start withdrawing credits from your pension plan. Some plans may allow withdrawals at a certain age or after a certain number of years of service.

3. Assess your financial needs: Evaluate your financial situation and determine how much money you will need to withdraw from your pension plan. Consider factors such as living expenses, healthcare costs, and any other financial obligations you may have.

4. Calculate the potential impact: Calculate the potential impact of withdrawing credits from your pension plan. Consider how it will affect your retirement income and whether it will be sufficient to meet your financial needs in the long term.

5. Explore other options: Consider alternative options for generating income during retirement. This may include part-time work, investment income, or other sources of income that can supplement your pension plan withdrawals.

6. Seek professional advice: Consult with a financial advisor or retirement planner to get expert advice on planning for withdrawal credits. They can help you assess your financial situation, determine the best withdrawal strategy, and provide guidance on maximizing your retirement income.

7. Regularly review and adjust: Regularly review your withdrawal strategy and adjust it as needed. As your financial needs and circumstances change, you may need to make adjustments to ensure that your withdrawal credits are sufficient to meet your retirement goals.

By following these steps and planning ahead, you can make informed decisions about withdrawal credits in your pension plan and ensure a secure and comfortable retirement.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.