Definition of Notching Debt

Notching debt is a term used in the financial industry to describe the practice of assigning different credit ratings to different tranches or levels of debt within a single entity or issuer. This practice is commonly employed by credit rating agencies to differentiate the risk levels associated with various types of debt.

When an issuer has multiple tranches of debt, each with different characteristics and levels of risk, credit rating agencies may assign different credit ratings to each tranche. This allows investors to better understand the risk profile of the debt and make informed investment decisions.

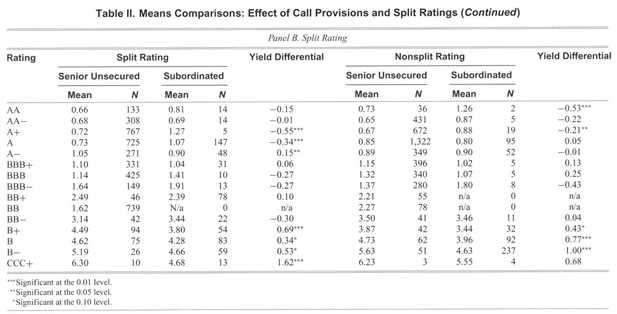

For example, a company may issue both senior secured debt and subordinated debt. The senior secured debt may have a higher credit rating due to its priority in repayment and the presence of collateral, while the subordinated debt may have a lower credit rating due to its lower priority and lack of collateral.

Notching debt is an important tool for credit rating agencies to accurately assess the risk associated with different types of debt. It provides investors with valuable information to make informed investment decisions and helps maintain the integrity and transparency of the financial markets.

Importance of Credit Rating Agencies

One of the key reasons why credit rating agencies are important is that they help to reduce information asymmetry in the financial markets. Information asymmetry occurs when one party has more or better information than another party, which can lead to adverse selection and moral hazard problems. Credit rating agencies help to bridge this gap by providing objective and reliable information about the creditworthiness of borrowers.

By assigning credit ratings to different borrowers, credit rating agencies provide a standardized measure of credit risk. This allows investors and lenders to compare the creditworthiness of different borrowers and make more informed decisions about where to allocate their capital. For example, a higher credit rating indicates a lower risk of default, which may attract more investors and lenders to a particular borrower.

Credit rating agencies also contribute to the stability and efficiency of financial markets. Their assessments help to promote transparency and accountability, as borrowers are incentivized to maintain a good credit rating in order to access capital at favorable terms. Furthermore, credit ratings are often used as benchmarks for regulatory purposes, such as determining capital requirements for banks and other financial institutions.

Role of Credit Rating Agencies:

1. Assessing creditworthiness: Credit rating agencies evaluate the ability of borrowers to repay their debts and assign credit ratings based on their assessment.

2. Providing information: Credit rating agencies provide independent and objective information about the creditworthiness of borrowers, which helps investors and lenders make informed decisions.

3. Standardizing credit risk: Credit ratings provide a standardized measure of credit risk, allowing for easier comparison between different borrowers.

4. Promoting transparency: Credit rating agencies contribute to the transparency and accountability of financial markets by incentivizing borrowers to maintain good credit ratings.

5. Regulatory benchmark: Credit ratings are often used as benchmarks for regulatory purposes, such as determining capital requirements for financial institutions.

Conclusion:

Impact of Notching Debt on Credit Ratings

One of the main reasons why notching debt is important is because it helps credit rating agencies provide a more accurate assessment of the risk associated with different types of debt. By assigning different ratings to different types of debt, credit rating agencies can better reflect the varying levels of risk and potential default associated with each type of debt.

How does notching debt impact credit ratings?

On the negative side, notching debt can also lead to confusion and complexity in the credit rating process. Assigning different ratings to different types of debt can make it more difficult for investors to compare and evaluate the creditworthiness of different entities. This can create challenges for investors who are trying to make informed decisions about where to allocate their capital.

Considerations for investors

Investors should also be aware that notching debt is not a standardized practice across all credit rating agencies. Different agencies may have different methodologies and criteria for notching debt, which can result in variations in credit ratings for the same entity.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.