Importance of Good Credit

Having good credit is essential for financial stability and success. Your credit score is a reflection of your financial responsibility and trustworthiness, and it significantly impacts your ability to secure loans, credit cards, and favorable interest rates.

A good credit score demonstrates to lenders and financial institutions that you are a reliable borrower who pays bills on time and manages debt responsibly. This makes you a lower risk for lenders, increasing your chances of getting approved for loans and credit cards with favorable terms.

Good credit also plays a crucial role in other areas of your life. For example, landlords often check credit scores when considering rental applications, and employers may review credit history as part of the hiring process, particularly for positions that involve financial responsibilities.

Having good credit can also save you money. With a high credit score, you are more likely to qualify for lower interest rates on loans, mortgages, and credit cards. This means you will pay less in interest over time, resulting in significant savings.

Furthermore, good credit provides you with financial flexibility. It allows you to access credit when you need it, whether it’s for emergencies, major purchases, or investments. It also gives you the ability to negotiate better terms and conditions with lenders, putting you in a stronger position to achieve your financial goals.

Building and maintaining good credit is a long-term commitment that requires responsible financial habits. It involves paying bills on time, keeping credit card balances low, and avoiding excessive debt. By prioritizing good credit, you are investing in your financial future and setting yourself up for greater opportunities and financial security.

| Key Points: |

| – Good credit is crucial for financial stability and success. |

| – It increases your chances of getting approved for loans and credit cards with favorable terms. |

| – Good credit can help you save money by qualifying for lower interest rates. |

| – It provides financial flexibility and the ability to negotiate better terms. |

| – Building and maintaining good credit requires responsible financial habits. |

Factors that Affect Your Credit Score

Payment History

One of the most significant factors that affect your credit score is your payment history. Lenders want to see that you consistently make your payments on time. Late payments, missed payments, or defaults can have a negative impact on your credit score. It is crucial to pay your bills and loan installments promptly to maintain a good credit score.

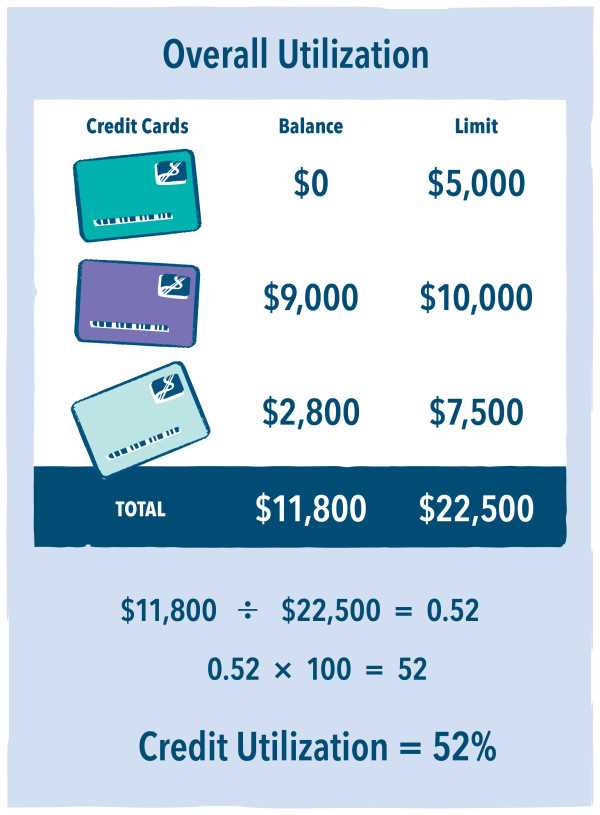

Credit Utilization Ratio

Your credit utilization ratio is the amount of credit you are currently using compared to your total available credit. Lenders prefer to see a low credit utilization ratio, typically below 30%. If you consistently max out your credit cards or have a high credit utilization ratio, it can indicate that you rely heavily on credit and may be a higher risk for lenders.

Length of Credit History

The length of your credit history also plays a role in determining your credit score. Lenders like to see a longer credit history as it provides them with more information about your borrowing habits and repayment patterns. If you are just starting to build your credit, it may take some time to establish a solid credit history.

Credit Mix

Having a diverse mix of credit accounts can positively impact your credit score. This includes credit cards, loans, and other types of credit. Lenders want to see that you can handle different types of credit responsibly. However, it is essential to manage your credit accounts wisely and avoid taking on more credit than you can handle.

New Credit Applications

Every time you apply for new credit, it can have a temporary negative impact on your credit score. Lenders may view multiple credit applications within a short period as a sign of financial instability. It is important to be selective when applying for new credit and only do so when necessary.

Benefits of Having Good Credit

Having good credit can provide numerous benefits and open up opportunities for financial success. Here are some of the key advantages of maintaining a good credit score:

1. Access to Better Interest Rates:

With a good credit score, you are more likely to qualify for loans and credit cards with lower interest rates. This means that you can save a significant amount of money over time by paying less in interest charges.

2. Easier Approval for Loans and Credit:

Having good credit makes it easier to get approved for loans, mortgages, and credit cards. Lenders and financial institutions are more willing to lend money to individuals with a proven track record of responsible borrowing and repayment.

3. More Favorable Loan Terms:

In addition to lower interest rates, having good credit can also lead to more favorable loan terms. This may include longer repayment periods, higher borrowing limits, and more flexible repayment options.

4. Increased Financial Security:

Good credit provides a sense of financial security. It allows you to have access to emergency funds when needed and provides a safety net in case of unexpected expenses or financial hardships.

5. Better Insurance Rates:

Many insurance companies use credit scores as a factor in determining insurance premiums. With good credit, you may be eligible for lower insurance rates on auto, home, and other types of insurance policies.

6. Enhanced Job Opportunities:

Some employers may check credit scores as part of their hiring process, especially for positions that involve financial responsibility. Having good credit can give you an advantage over other candidates and increase your chances of landing a job.

7. Improved Housing Options:

How to Build and Maintain Good Credit

Building and maintaining good credit is essential for your financial well-being. A good credit score can open doors to better interest rates on loans, credit cards, and even insurance premiums. Here are some steps you can take to build and maintain good credit:

1. Pay your bills on time: One of the most important factors in building good credit is making timely payments on your bills. Late payments can have a negative impact on your credit score, so it’s crucial to pay your bills on time every month.

2. Keep your credit utilization low: Credit utilization refers to the amount of credit you’re using compared to your total credit limit. It’s recommended to keep your credit utilization below 30% to maintain good credit. For example, if you have a credit card with a $10,000 limit, try to keep your balance below $3,000.

3. Diversify your credit: Having a mix of different types of credit, such as credit cards, installment loans, and a mortgage, can positively impact your credit score. Lenders like to see that you can manage different types of credit responsibly.

4. Avoid opening too many new accounts: While having a diverse credit mix is beneficial, opening too many new accounts within a short period can negatively affect your credit score. Each time you apply for new credit, it results in a hard inquiry on your credit report, which can lower your score.

6. Use credit responsibly: It’s crucial to use credit responsibly and avoid maxing out your credit cards or taking on more debt than you can handle. Make sure to only borrow what you can afford to repay and make your payments on time.

By following these steps, you can build and maintain good credit, which will have a positive impact on your financial future. Remember, good credit is an essential tool for achieving your financial goals and securing your financial well-being.

The Role of Credit in Your Financial Future

1. Access to Loans and Credit Cards

Having good credit opens doors to various financial opportunities. Lenders and credit card companies are more likely to approve your applications if you have a strong credit history. With good credit, you can easily obtain loans for major purchases such as a car or a home. Additionally, credit card companies may offer you higher credit limits and better rewards programs.

2. Lower Interest Rates

Good credit can save you a significant amount of money in the long run. Lenders consider borrowers with good credit as less risky, so they offer them lower interest rates. Whether you’re applying for a mortgage, car loan, or personal loan, having good credit can result in substantial savings over the life of the loan.

3. Rental Applications and Employment Opportunities

Landlords often check credit reports when evaluating rental applications. A good credit score can increase your chances of being approved for an apartment or rental property. Similarly, some employers may review credit reports as part of their hiring process, especially for positions that involve financial responsibilities. Maintaining good credit can enhance your chances of securing employment in such roles.

4. Insurance Premiums

Believe it or not, credit can also impact your insurance premiums. Insurance companies often use credit scores as a factor in determining premiums for auto, home, and even life insurance. Individuals with good credit are generally considered more responsible and less likely to file claims, resulting in lower insurance premiums.

5. Financial Flexibility and Peace of Mind

Having good credit provides you with financial flexibility and peace of mind. It allows you to take advantage of favorable financial opportunities and handle unexpected expenses. With good credit, you can secure favorable terms on loans, negotiate lower interest rates, and have access to credit when you need it most. This financial stability can provide peace of mind and help you navigate through life’s uncertainties.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.