What is Ordinary Income?

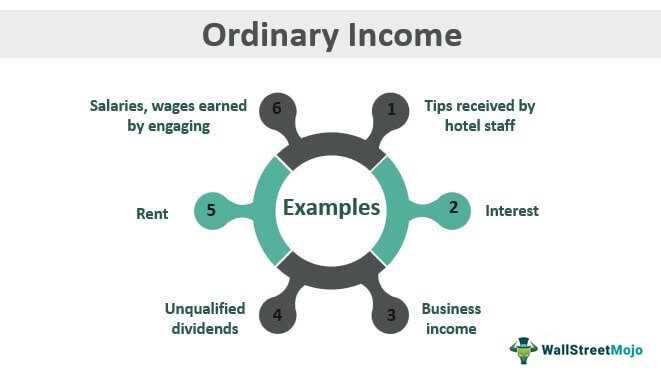

Ordinary income refers to the regular income that individuals or businesses earn through their everyday activities. It includes wages, salaries, commissions, bonuses, tips, and self-employment income. Ordinary income is different from capital gains, which are the profits made from the sale of investments or assets.

Ordinary income can come from various sources, such as employment, business operations, rental properties, and investments. It is generally considered taxable by the government and is subject to income tax.

Types of Ordinary Income

There are several types of ordinary income:

- Wages and Salaries: This is the income earned by employees through their employment. It includes regular pay, overtime pay, and bonuses.

- Self-Employment Income: This is the income earned by individuals who work for themselves or own their own business. It includes income from freelancing, consulting, and running a business.

- Business Income: This is the income earned by businesses through their operations. It includes profits from selling products or services.

- Rental Income: This is the income earned by individuals or businesses from renting out properties. It includes rental payments from tenants.

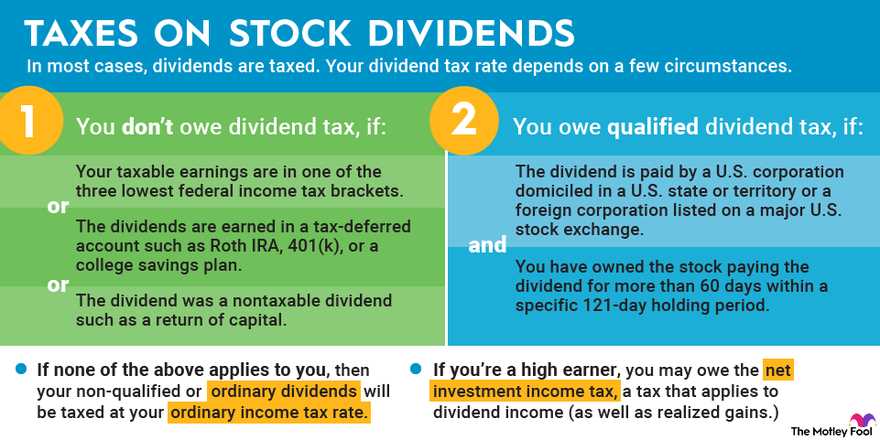

- Interest and Dividends: This is the income earned from investments, such as interest earned from savings accounts or dividends received from stocks.

- Capital Gain Distributions: This is the income earned from mutual funds or real estate investment trusts (REITs) when they distribute capital gains to their shareholders.

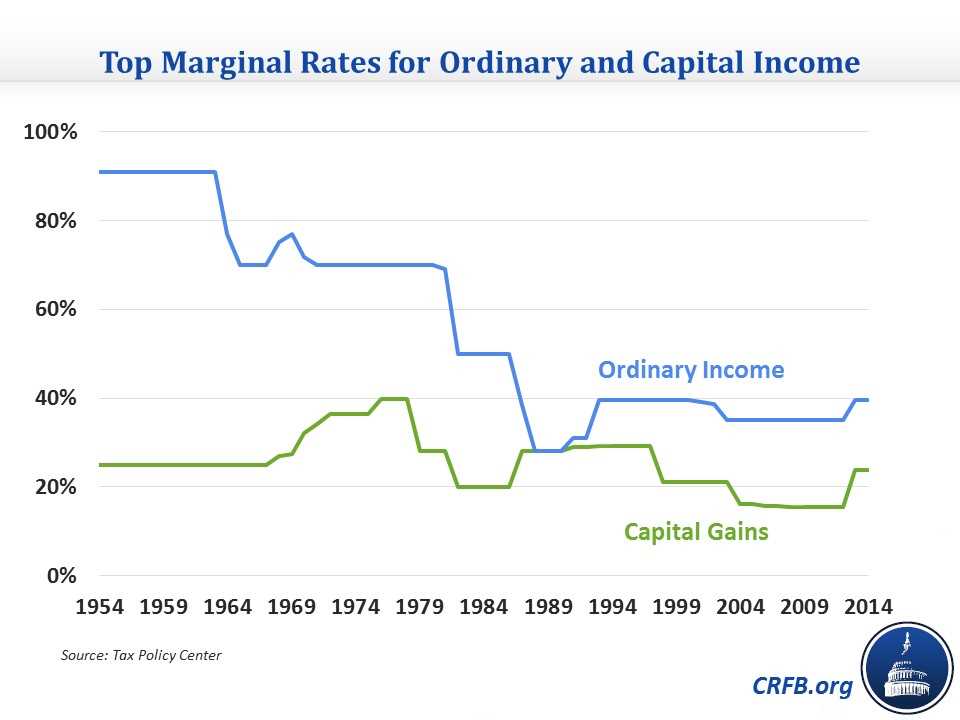

Taxation of Ordinary Income

Ordinary income is generally subject to federal, state, and local income taxes. The tax rates vary depending on the individual’s or business’s income level and filing status.

For individuals, ordinary income is reported on Form 1040 and is taxed at different rates based on the tax brackets. The tax rates range from 10% to 37% for the year 2021.

For businesses, ordinary income is reported on the appropriate business tax return, such as Form 1120 for corporations or Schedule C for sole proprietors. The tax rates for businesses also vary depending on the business structure and income level.

It is important for individuals and businesses to understand their tax obligations related to ordinary income and to properly report and pay their taxes to avoid penalties and legal issues.

How is Ordinary Income Taxed?

In addition to federal taxes, individuals may also be subject to state and local income taxes, which can vary depending on the jurisdiction. These taxes are usually based on a percentage of the individual’s taxable income, similar to the federal tax system.

Conclusion

Examples of Ordinary Income

Ordinary income can come from various sources and can take different forms. Here are some examples of ordinary income:

- Salaries and wages: This is the most common source of ordinary income for individuals. It includes the income earned from employment, such as salaries, wages, bonuses, and tips.

- Self-employment income: If you are self-employed, the income you earn from your business or profession is considered ordinary income. This can include income from freelancing, consulting, or running a small business.

- Interest and dividends: Income generated from interest on savings accounts, certificates of deposit, bonds, or dividends from stocks is also considered ordinary income. This income is typically reported on Form 1099-INT or Form 1099-DIV.

- Rental income: If you own rental properties, the rental income you receive is considered ordinary income. This includes income from residential or commercial properties.

- Capital gains: While capital gains are generally taxed at a different rate, short-term capital gains are considered ordinary income. Short-term capital gains are the profits made from selling assets that were held for one year or less.

- Unemployment compensation: If you receive unemployment benefits, they are considered ordinary income and are subject to federal income tax.

- Alimony: Alimony payments received as part of a divorce settlement are considered ordinary income and must be reported on your tax return.

- Prizes and awards: If you win a cash prize or receive a valuable award, the value of the prize or award is considered ordinary income and must be reported on your tax return.

Strategies for Managing Ordinary Income Taxes

1. Take Advantage of Tax Deductions

One of the most common ways to reduce ordinary income taxes is by taking advantage of tax deductions. Deductions are expenses that can be subtracted from your taxable income, reducing the amount of income that is subject to tax. Some common deductions include business expenses, mortgage interest, medical expenses, and charitable contributions. Keeping detailed records and working with a tax professional can help ensure that you take advantage of all available deductions.

2. Utilize Tax Credits

3. Consider Tax-Advantaged Retirement Accounts

4. Plan Capital Gains and Losses

Capital gains and losses can have a significant impact on your overall tax liability. By strategically timing the sale of investments, you can potentially minimize your tax burden. For example, if you have investments with significant gains, you may want to consider holding onto them for at least one year to qualify for long-term capital gains rates, which are typically lower than ordinary income tax rates. On the other hand, if you have investments with losses, you may want to consider selling them to offset any gains and reduce your taxable income.

5. Explore Tax-Advantaged Investments

Investing in tax-advantaged vehicles, such as municipal bonds or qualified opportunity zones, can provide additional tax benefits. Municipal bond interest is often exempt from federal income tax and may also be exempt from state and local taxes, depending on where you live. Qualified opportunity zones offer tax incentives for investing in economically distressed areas, including the deferral or reduction of capital gains taxes.

6. Seek Professional Advice

Managing ordinary income taxes can be complex, and tax laws are constantly changing. Seeking the advice of a qualified tax professional can help ensure that you are taking advantage of all available strategies and staying compliant with tax regulations. A tax professional can provide personalized guidance based on your specific financial situation and help you make informed decisions to minimize your tax liability.

By implementing these strategies, individuals and businesses can effectively manage their ordinary income taxes and potentially reduce their overall tax liability. It is important to stay informed about changes in tax laws and consult with a tax professional to ensure that you are maximizing your tax savings while remaining compliant with tax regulations.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.