What is an Underlying Asset?

An underlying asset is a financial instrument or physical asset on which a derivative contract is based. It is the foundation or reference point for the value of the derivative. The derivative derives its value from the changes in the price or value of the underlying asset.

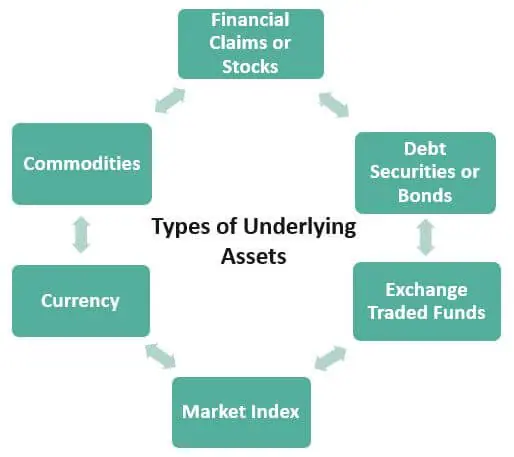

The underlying asset can be a wide range of financial instruments such as stocks, bonds, commodities, currencies, or market indexes. It can also be a physical asset like real estate, gold, oil, or agricultural products.

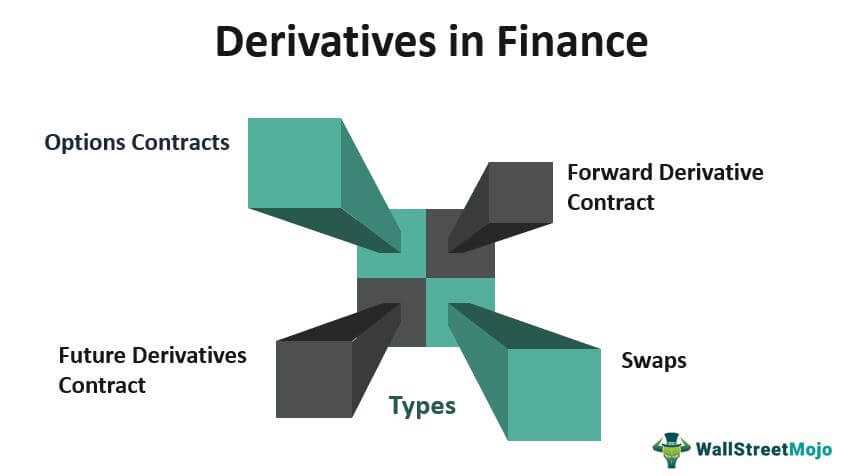

Derivative contracts, such as options, futures, or swaps, are financial instruments that derive their value from the underlying asset. These contracts allow investors to speculate on or hedge against the price movements of the underlying asset without owning the asset itself.

For example, in the case of a stock option, the underlying asset would be the stock itself. The value of the option contract would be influenced by the price movements of the stock. If the stock price goes up, the value of the option may increase, allowing the option holder to profit.

Definition and Explanation

The underlying asset can be a wide range of financial instruments, including stocks, bonds, commodities, currencies, indices, or even interest rates. It can also be a physical asset such as real estate, gold, oil, or agricultural products.

The purpose of using an underlying asset in derivative contracts is to provide investors with exposure to the price movements or fluctuations of the asset without actually owning it. This allows investors to speculate on the future price movements of the asset or hedge their existing positions.

Derivative contracts such as options, futures, swaps, and forwards are all based on underlying assets. For example, an options contract gives the holder the right to buy or sell the underlying asset at a specified price within a specific time period. The value of the options contract is directly influenced by the price movements of the underlying asset.

How Does an Underlying Asset Work?

When an investor purchases a derivative contract, they are essentially entering into an agreement that derives its value from the performance of the underlying asset. The underlying asset can be a wide range of financial instruments, including stocks, bonds, commodities, currencies, or market indices.

Derivative contracts provide investors with the opportunity to speculate on the price movements of the underlying asset without actually owning it. This allows for greater flexibility and potential profit, as investors can profit from both rising and falling markets.

Furthermore, the use of underlying assets in derivative contracts allows for risk management and hedging strategies. For example, a company that relies heavily on a particular commodity for its operations may enter into a futures contract to hedge against price fluctuations. If the price of the commodity increases, the company can offset its losses by profiting from the futures contract.

Definition and Explanation

An underlying asset refers to the financial instrument or security on which a derivative contract is based. It can be a stock, bond, commodity, currency, index, or any other tradable asset. The value of the derivative contract is derived from the performance or price movement of the underlying asset.

Derivative contracts, such as options, futures, and swaps, provide investors with the opportunity to speculate on the price movement of the underlying asset without owning it outright. These contracts enable investors to leverage their positions and potentially profit from both upward and downward price movements.

How Does an Underlying Asset Work?

When an investor or trader enters into a derivative contract, they are essentially entering into an agreement to buy or sell the underlying asset at a future date and at a predetermined price. The value of the derivative contract is directly influenced by the price movement of the underlying asset.

Examples of Underlying Assets

Underlying assets can vary widely depending on the type of derivative contract. Some common examples of underlying assets include:

- Stocks: Shares of publicly traded companies

- Bonds: Debt securities issued by governments or corporations

- Commodities: Physical goods like gold, oil, wheat, or natural gas

- Currencies: Foreign exchange rates between different countries’ currencies

- Indices: Broad market indicators like the S&P 500 or Dow Jones Industrial Average

These are just a few examples, and there are many more underlying assets available for trading in the derivatives market.

Examples of Underlying Assets

Underlying assets are an integral part of derivatives trading. They provide the foundation for the value and performance of derivative contracts. Here are some examples of underlying assets:

1. Stocks

Stocks are one of the most common types of underlying assets. Derivative contracts, such as options and futures, can be based on the value of individual stocks or stock indices. Traders can speculate on the price movement of stocks without owning the actual shares.

2. Commodities

Commodities, such as gold, oil, natural gas, and agricultural products, can also serve as underlying assets. Derivatives tied to commodities allow investors to hedge against price fluctuations or speculate on future price movements. For example, a farmer can use commodity futures to lock in the price of their crops before harvest.

3. Currencies

Currencies are another popular choice for underlying assets. Foreign exchange derivatives, such as currency futures and options, enable traders to speculate on the exchange rate between different currencies. These contracts are commonly used by multinational corporations to manage currency risk.

4. Bonds

Bonds can be used as underlying assets for derivative contracts. For instance, interest rate swaps are based on the value of fixed-income securities, such as government bonds or corporate bonds. These derivatives allow parties to exchange fixed and floating interest rate payments.

5. Indices

These are just a few examples of the diverse range of underlying assets that can be used in derivatives trading. The choice of underlying asset depends on the investor’s objectives, risk appetite, and market conditions. It is important to thoroughly understand the characteristics and dynamics of the underlying asset before engaging in derivative trading.

Overall, underlying assets play a crucial role in derivatives markets, providing the basis for price determination and risk management. They offer investors a wide range of opportunities to profit from or protect against market movements, making derivatives an essential tool in modern financial markets.

Examples of Underlying Assets

Underlying assets are an integral part of derivatives trading. They provide the foundation for the value and performance of derivative contracts. Here are some examples of underlying assets:

1. Stocks

Stocks are one of the most common types of underlying assets. Derivative contracts such as options and futures can be based on the performance of individual stocks or stock indices. Traders can speculate on the price movements of specific stocks or the overall stock market.

2. Commodities

Commodities like gold, oil, natural gas, and agricultural products can also serve as underlying assets. Derivatives based on commodities allow traders to hedge against price fluctuations or speculate on future price movements. These contracts are widely used in industries such as energy, agriculture, and mining.

3. Currencies

4. Interest Rates

Interest rates are crucial in the financial markets, and derivatives based on interest rates are widely traded. For example, interest rate futures allow traders to hedge against changes in interest rates or speculate on future rate movements. These contracts are essential for managing risk in areas like banking, mortgages, and corporate finance.

5. Indices

6. Bonds

Bonds are debt instruments issued by governments, municipalities, or corporations. They can also be used as underlying assets for derivatives. Bond futures and options allow traders to hedge against changes in interest rates or speculate on the future price movements of bonds. These contracts are essential for fixed-income investors and bond traders.

These are just a few examples of the diverse range of underlying assets available in derivatives trading. Each asset class has its unique characteristics and risk factors, offering traders various opportunities to profit or manage risk in the financial markets.

| Underlying Asset | Derivative Contracts |

|---|---|

| Stocks | Options, futures |

| Commodities | Options, futures |

| Currencies | Options, futures |

| Interest Rates | Futures, swaps |

| Indices | Options, futures |

| Bonds | Options, futures |

Derivatives Guide: Underlying Asset

Definition and Explanation

An underlying asset can be any financial instrument, such as stocks, bonds, commodities, currencies, or indices. It can also be a physical asset, like real estate or commodities. The value of the derivative is derived from the price movements of the underlying asset.

The underlying asset is an essential component of a derivative contract as it determines the potential risks and rewards associated with the derivative. The performance of the underlying asset directly affects the value and profitability of the derivative.

How Does an Underlying Asset Work?

When trading derivatives, investors or traders enter into contracts that derive their value from the underlying asset. The derivative can be a futures contract, options contract, or any other derivative instrument.

For example, if an investor purchases a call option on a stock, the underlying asset would be the stock itself. The value of the call option will fluctuate based on the price movements of the underlying stock. If the stock price increases, the value of the call option will also increase.

Similarly, in the case of futures contracts, the underlying asset is the commodity or financial instrument that the contract represents. The value of the futures contract will vary based on the price movements of the underlying asset.

The relationship between the derivative and the underlying asset is crucial to understand. Changes in the value of the underlying asset directly impact the value of the derivative. Traders and investors analyze the price movements and trends of the underlying asset to make informed decisions about trading derivatives.

Examples of Underlying Assets

There is a diverse range of underlying assets that can be used in derivative contracts. Some common examples include:

| Asset Class | Examples of Underlying Assets |

|---|---|

| Equities | Stocks, indices |

| Bonds | Government bonds, corporate bonds |

| Commodities | Gold, oil, wheat |

| Currencies | USD, EUR, JPY |

| Real Estate | Residential properties, commercial properties |

These are just a few examples, and there are many other underlying assets that can be used in derivative contracts.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.