What is an Ultra-High-Net-Worth Individual (UHNWI)?

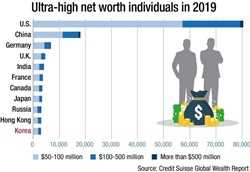

An Ultra-High-Net-Worth Individual (UHNWI) refers to an individual who possesses a significant amount of wealth. UHNWIs are often considered to be the richest individuals in the world, with a net worth that exceeds a certain threshold. This threshold can vary depending on the source and the criteria used to define UHNWIs.

UHNWIs are typically individuals who have accumulated their wealth through various means, such as successful business ventures, investments, inheritance, or a combination of these factors. They have achieved a level of financial success that sets them apart from the average individual.

One of the defining characteristics of UHNWIs is their ability to maintain their wealth and continue to grow it over time. They often have access to a wide range of financial resources and investment opportunities, which allows them to generate significant returns on their assets.

UHNWIs play a crucial role in the global economy. Their wealth and financial influence can have a significant impact on various sectors, including real estate, luxury goods, philanthropy, and the financial markets. They are often sought after by businesses and organizations for their investment potential and their ability to drive economic growth.

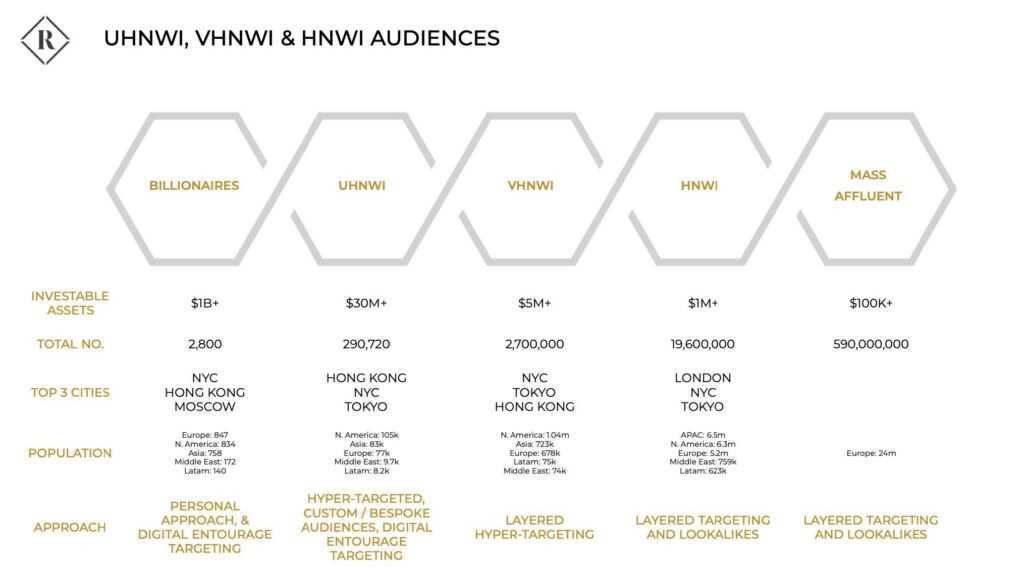

Defining wealth categories is essential in order to differentiate between various levels of affluence. The categorization of wealth is typically based on the amount of investable assets an individual possesses, excluding personal assets such as primary residences and consumer durables.

UHNWIs are typically classified as individuals with a net worth of $30 million or more. This includes their financial assets, such as stocks, bonds, and real estate investments. It is important to note that this net worth threshold may vary depending on the source or organization providing the definition.

Criteria for classifying UHNWIs go beyond just the monetary value of their assets. Other factors that may be considered include the individual’s level of influence, their business or professional success, and their overall impact on the global economy. UHNWIs often have significant control over businesses and investments, and their decisions can have a substantial impact on markets and industries.

Defining Wealth Categories

1. High-Net-Worth Individuals (HNWIs)

The first wealth category is that of High-Net-Worth Individuals (HNWIs). HNWIs are individuals who have a net worth of at least $1 million, excluding their primary residence. This category includes individuals who have accumulated a significant amount of wealth through various means, such as investments, business ventures, or inheritance.

HNWIs often have a diverse portfolio of assets, including stocks, bonds, real estate, and other high-value investments. They typically have access to a wide range of financial services and investment opportunities, and their wealth allows them to maintain a comfortable lifestyle and achieve financial security.

2. Very-High-Net-Worth Individuals (VHNWIs)

Next, we have the category of Very-High-Net-Worth Individuals (VHNWIs). VHNWIs are individuals who have a net worth of at least $5 million, excluding their primary residence. This category represents a higher level of wealth compared to HNWIs and includes individuals who have amassed significant fortunes through successful business ventures, investments, or other means.

VHNWIs often have a more extensive and diversified portfolio of assets, including luxury properties, private jets, yachts, and other high-value assets. They have access to exclusive financial services and investment opportunities, and their wealth allows them to enjoy a luxurious lifestyle and have a significant impact on the global economy.

3. Ultra-High-Net-Worth Individuals (UHNWIs)

The highest wealth category is that of Ultra-High-Net-Worth Individuals (UHNWIs). UHNWIs are individuals who have a net worth of at least $30 million, excluding their primary residence. This category represents the pinnacle of wealth and includes individuals who have achieved extraordinary financial success through exceptional business acumen, investments, or other exceptional means.

UHNWIs often have a vast and diverse portfolio of assets, including multiple luxury properties, private islands, art collections, and other high-value assets. They have access to exclusive financial services and investment opportunities, and their wealth allows them to lead extravagant lifestyles and make significant contributions to the global economy through philanthropy and investments.

Characteristics of UHNWIs

Ultra-High-Net-Worth Individuals (UHNWIs) are a unique segment of the global population who possess significant wealth and financial resources. These individuals are characterized by several distinct qualities and attributes that set them apart from other wealthy individuals:

1. Vast Financial Resources

UHNWIs have amassed substantial financial resources, typically exceeding $30 million in net worth. Their wealth is often diversified across various asset classes, including real estate, stocks, bonds, private equity, and alternative investments.

2. Global Influence

UHNWIs possess significant global influence due to their vast wealth and connections. They often play a crucial role in shaping economic policies, investment decisions, and philanthropic initiatives. Their opinions and actions can have a profound impact on the global economy.

3. Entrepreneurial Spirit

Many UHNWIs have achieved their wealth through entrepreneurial endeavors. They are innovative thinkers, risk-takers, and visionaries who have successfully built and scaled businesses. Their entrepreneurial spirit drives economic growth and creates job opportunities.

4. Access to Exclusive Opportunities

UHNWIs have access to exclusive investment opportunities and luxury goods and services. They can invest in high-end real estate, private equity funds, luxury yachts, private jets, and other exclusive assets. This access allows them to maintain and grow their wealth while enjoying a luxurious lifestyle.

5. Global Mobility

UHNWIs often have the freedom to travel and reside in multiple countries. They can take advantage of favorable tax regimes, business opportunities, and lifestyle preferences in different jurisdictions. This global mobility enables them to optimize their wealth and enjoy diverse cultural experiences.

6. Philanthropic Initiatives

Many UHNWIs are actively involved in philanthropic activities and initiatives. They use their wealth and resources to support charitable causes, fund research, and address social and environmental issues. Their philanthropic efforts contribute to positive societal change and make a significant difference in the world.

Criteria for Classifying UHNWIs

Classifying individuals as Ultra-High-Net-Worth Individuals (UHNWIs) requires the application of specific criteria. These criteria are used to determine the level of wealth and financial status of an individual. The following are some of the key criteria used in classifying UHNWIs:

- Wealth Threshold: UHNWIs are typically defined as individuals with a net worth of at least $30 million or more. This threshold ensures that only individuals with significant wealth are classified as UHNWIs.

- Net Worth Calculation: Net worth is calculated by subtracting an individual’s liabilities from their assets. This includes the value of their investments, real estate, businesses, and other financial assets.

- Global Standard: The criteria for classifying UHNWIs are generally consistent across different countries and regions. This allows for a standardized definition and comparison of wealth across the global economy.

- Wealth Source: The source of an individual’s wealth is also taken into consideration. UHNWIs may have acquired their wealth through various means, such as inheritance, entrepreneurship, investments, or successful careers in industries like finance, technology, or entertainment.

- Financial Influence: UHNWIs often have a significant impact on the global economy. Their financial decisions and investments can influence markets, industries, and even countries. This level of financial influence is an important factor in classifying individuals as UHNWIs.

- Lifestyle and Consumption: UHNWIs typically enjoy a luxurious lifestyle and have a high level of consumption. Their spending habits and preferences for luxury goods and services contribute to their classification as UHNWIs.

- Global Network: UHNWIs often have extensive networks of contacts and connections, both within their own country and internationally. These networks enable them to access exclusive opportunities and resources, further contributing to their classification as UHNWIs.

By considering these criteria, experts and organizations can accurately identify and classify individuals as Ultra-High-Net-Worth Individuals (UHNWIs). This classification provides valuable insights into the wealth distribution and economic influence of this select group of individuals in the global economy.

Importance of UHNWIs in the Global Economy

Ultra-High-Net-Worth Individuals (UHNWIs) play a significant role in the global economy. These individuals, who possess substantial wealth, have a considerable impact on various sectors and contribute to economic growth and development.

Economic Influence

UHNWIs have the financial resources to invest in businesses, start-ups, and innovative ventures. Their investments not only create job opportunities but also stimulate economic growth. By injecting capital into different industries, UHNWIs contribute to the expansion and development of these sectors, leading to increased production, innovation, and competitiveness.

Furthermore, UHNWIs often engage in philanthropic activities, donating substantial amounts of money to charitable causes. Their philanthropic efforts address societal issues and support initiatives in areas such as education, healthcare, and environmental conservation. These contributions have a positive impact on communities and help improve the overall well-being of society.

Market Influence

UHNWIs have significant purchasing power, which allows them to influence consumer trends and market dynamics. Their preferences and consumption patterns shape the demand for luxury goods and services, leading to the growth of industries catering to their needs. This includes sectors such as luxury fashion, high-end real estate, fine dining, and exclusive travel experiences.

Moreover, UHNWIs often invest in financial markets, contributing to liquidity and stability. Their investments in stocks, bonds, and other financial instruments provide capital for companies and governments, facilitating economic activities and enabling businesses to expand and create employment opportunities.

Job Creation

UHNWIs are major job creators. Their investments in businesses and start-ups generate employment opportunities, contributing to job creation and reducing unemployment rates. Additionally, UHNWIs often serve as mentors and advisors to entrepreneurs, sharing their knowledge and expertise to help emerging businesses succeed.

Furthermore, UHNWIs often establish family offices to manage their wealth and investments. These family offices employ professionals from various fields, including finance, law, accounting, and wealth management, creating job opportunities for skilled individuals.

Global Connectivity

UHNWIs are highly connected individuals who often have extensive networks and relationships with influential individuals, including politicians, business leaders, and philanthropists. Their connections enable them to facilitate business collaborations, investment opportunities, and partnerships across borders. This global connectivity fosters international trade, promotes economic cooperation, and encourages cross-cultural exchange.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.