Tangible Book Value Per Share (TBVPS) Definition

Tangible Book Value Per Share (TBVPS) is a financial metric that measures the value of a company’s tangible assets per share of common stock outstanding. It provides investors with insight into the company’s net worth after deducting intangible assets such as goodwill and intellectual property.

Tangible assets are physical assets that have a monetary value and can be touched or seen. Examples of tangible assets include cash, inventory, property, plant, and equipment. On the other hand, intangible assets are non-physical assets that cannot be touched or seen, such as patents, trademarks, and copyrights.

TBVPS is an important measure for investors because it provides a more conservative estimate of a company’s value compared to book value per share, which includes both tangible and intangible assets. By focusing on tangible assets only, TBVPS gives a clearer picture of the company’s financial health and its ability to generate value from its physical resources.

To calculate TBVPS, the company’s total tangible assets are divided by the number of common shares outstanding. This gives investors an indication of how much each share of common stock is worth in terms of tangible assets.

Investors can use TBVPS to compare the value of a company’s stock to its market price. If the TBVPS is higher than the market price per share, it may indicate that the stock is undervalued and could be a good investment opportunity. Conversely, if the TBVPS is lower than the market price per share, it may suggest that the stock is overvalued.

Overall, Tangible Book Value Per Share is a useful metric for investors to assess the intrinsic value of a company’s stock based on its tangible assets. It provides a more conservative estimate of a company’s net worth and can help investors make informed investment decisions.

What is Tangible Book Value Per Share?

Tangible Book Value Per Share (TBVPS) is a financial metric that measures the tangible assets of a company per outstanding share of common stock. It provides investors with an indication of the value of a company’s tangible assets that can be used to support its stock price.

Tangible assets are physical assets that have a clear market value, such as buildings, equipment, and inventory. They exclude intangible assets like patents, trademarks, and goodwill. By focusing on tangible assets, TBVPS provides a more conservative measure of a company’s value, as it excludes assets that may be difficult to value or sell.

TBVPS is often used by investors and analysts to assess the financial health and value of a company. A higher TBVPS indicates that a company has a larger amount of tangible assets per share, which can be seen as a positive sign. It suggests that the company has a solid foundation and may be less risky compared to companies with lower TBVPS.

Investors may use TBVPS to compare companies within the same industry or sector. It can help identify companies that are undervalued or overvalued relative to their tangible assets. However, it is important to consider other factors, such as earnings, growth prospects, and industry trends, when making investment decisions.

In summary, Tangible Book Value Per Share (TBVPS) is a financial metric that measures the tangible assets of a company per outstanding share of common stock. It provides investors with insight into the value of a company’s tangible assets and can be used to assess its financial health and value.

How is Tangible Book Value Per Share Calculated?

Tangible Book Value Per Share (TBVPS) is a financial metric that measures the value of a company’s tangible assets per outstanding share of common stock. It provides investors with an indication of the company’s net worth on a per-share basis, excluding intangible assets such as goodwill and intellectual property.

The formula for calculating Tangible Book Value Per Share is:

- Step 1: Determine the company’s total assets, which can be found on the balance sheet.

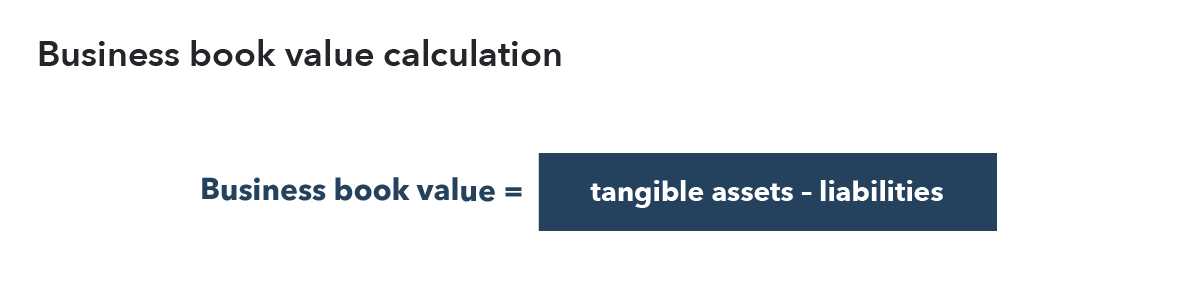

- Step 2: Subtract the company’s intangible assets from the total assets. Intangible assets include items such as patents, trademarks, and goodwill.

- Step 3: Subtract the company’s total liabilities from the result of Step 2. Total liabilities can also be found on the balance sheet and include items such as debt and accounts payable.

- Step 4: Divide the result of Step 3 by the number of outstanding shares of common stock.

For example, let’s say a company has total assets of $1,000,000, intangible assets of $200,000, and total liabilities of $500,000. The number of outstanding shares of common stock is 100,000. The calculation would be as follows:

- $300,000 / 100,000 shares = $3

Therefore, the Tangible Book Value Per Share for this company would be $3.

TBVPS is an important metric for investors as it provides insight into the company’s financial health and the value of its tangible assets. It can be used to compare companies within the same industry or to track a company’s performance over time. However, it should be noted that TBVPS is just one piece of the puzzle and should be used in conjunction with other financial metrics and analysis.

Tangible Book Value Per Share (TBVPS) Formula

Tangible Book Value Per Share (TBVPS) is a financial metric that measures the value of a company’s tangible assets per outstanding share of common stock. It provides investors with an indication of the net worth of a company on a per share basis, after deducting intangible assets such as goodwill and intellectual property.

Formula:

The formula for calculating Tangible Book Value Per Share is as follows:

- Start with the company’s total shareholders’ equity, which can be found on the balance sheet.

- Subtract any intangible assets, such as goodwill and intellectual property, from the total shareholders’ equity.

- Divide the resulting value by the number of outstanding shares of common stock.

The formula can be expressed as:

By calculating TBVPS, investors can assess the value of a company’s tangible assets relative to its outstanding shares. This metric is particularly useful when evaluating companies in industries where tangible assets play a significant role, such as manufacturing or real estate.

Investors can compare the TBVPS of different companies within the same industry to determine which company has a higher value of tangible assets per share. A higher TBVPS may indicate that a company has a stronger financial position and may be considered more attractive to investors.

However, it is important to note that TBVPS is just one financial metric among many that investors should consider when evaluating a company. It should be used in conjunction with other metrics and factors, such as earnings per share, revenue growth, and industry trends, to make a comprehensive investment decision.

The Formula for Tangible Book Value Per Share

Tangible Book Value Per Share (TBVPS) is a financial metric that measures the value of a company’s tangible assets per outstanding share of common stock. It provides investors with insight into the company’s net worth based on its tangible assets, excluding intangible assets such as patents, trademarks, and goodwill.

The formula for calculating Tangible Book Value Per Share is:

To calculate TBVPS, you need to know the total tangible assets of the company, which includes physical assets like buildings, equipment, and inventory. Intangible assets like intellectual property and brand value are excluded from this calculation. You also need to know the total liabilities of the company, which include debts, loans, and other obligations.

Once you have these values, subtract the total liabilities from the total tangible assets to get the net tangible assets. Then, divide the net tangible assets by the number of common shares outstanding to get the Tangible Book Value Per Share.

TBVPS is an important metric for investors as it provides a more conservative estimate of a company’s value compared to other measures like book value per share. By focusing on tangible assets, it gives a clearer picture of the company’s financial health and its ability to generate value for shareholders.

Investors can use TBVPS to compare the value of a company’s stock to its market price. If the TBVPS is higher than the market price per share, it may indicate that the stock is undervalued and could be a good investment opportunity. On the other hand, if the TBVPS is lower than the market price per share, it may suggest that the stock is overvalued and could be a potential risk.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.