What is a Systematic Investment Plan (SIP)?

A Systematic Investment Plan (SIP) is a disciplined approach to investing in financial markets. It is a method of investing a fixed amount of money at regular intervals, typically monthly or quarterly, into a specific investment vehicle such as mutual funds or exchange-traded funds (ETFs).

SIPs are popular among individual investors because they provide a convenient and affordable way to invest in the financial markets. They allow investors to start with small amounts of money and gradually build their investment portfolio over time.

How does a Systematic Investment Plan (SIP) work?

When you invest in a SIP, you commit to investing a fixed amount of money at regular intervals, usually on a specific date each month or quarter. This amount is deducted automatically from your bank account and invested in the chosen investment vehicle.

Benefits of a Systematic Investment Plan (SIP)

There are several benefits to investing in a SIP:

- Discipline: SIPs encourage regular investing and help investors develop a disciplined approach to saving and investing.

- Convenience: SIPs are easy to set up and manage. Once you set up the plan, the investment amount is deducted automatically from your bank account, saving you time and effort.

- Flexibility: SIPs offer flexibility in terms of investment amounts and frequencies. You can choose the amount you want to invest and the frequency of investments based on your financial goals and risk tolerance.

- Diversification: SIPs allow you to invest in a diversified portfolio of assets, such as stocks, bonds, and commodities, which can help reduce risk and enhance returns.

- Long-term wealth creation: By investing regularly over a long period, SIPs can help you accumulate wealth and achieve your financial goals, such as retirement planning or buying a house.

Conclusion

A Systematic Investment Plan (SIP) is a popular investment strategy that allows individuals to invest a fixed amount of money at regular intervals in specific investment vehicles. SIPs offer several benefits, including discipline, convenience, flexibility, diversification, and long-term wealth creation. By following a systematic approach to investing, individuals can build their investment portfolio over time and achieve their financial goals.

A Systematic Investment Plan (SIP) is a disciplined approach to investing that allows individuals to invest a fixed amount of money at regular intervals. It is a popular investment strategy that offers several benefits.

One of the key benefits of a SIP is that it helps inculcate a habit of regular saving and investing. By investing a fixed amount at regular intervals, individuals can build a corpus over time, which can be used to achieve their financial goals.

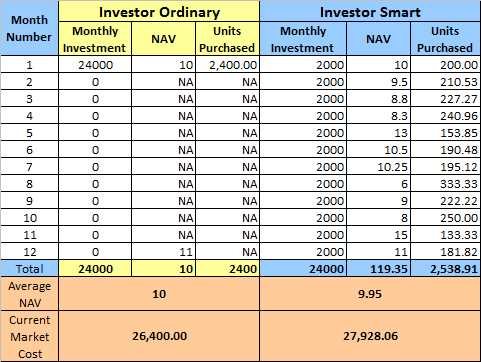

Another benefit of SIP is that it helps in mitigating the risk associated with market volatility. Since investments are made at regular intervals, investors can take advantage of the market’s ups and downs. They can buy more units when the market is down and fewer units when the market is up, thereby averaging out the cost of investment.

SIPs also offer the benefit of rupee cost averaging. When investors invest a fixed amount at regular intervals, they buy more units when the prices are low and fewer units when the prices are high. This helps in reducing the average cost per unit and maximizing returns over the long term.

Overall, a Systematic Investment Plan (SIP) is a simple and effective way to invest in alternative investments. It helps individuals build a disciplined approach to investing, mitigate market risk, take advantage of rupee cost averaging, and benefit from the power of compounding.

Example of a Systematic Investment Plan (SIP)

Let’s consider an example to understand how a Systematic Investment Plan (SIP) works. Suppose you decide to invest in a mutual fund through SIP with a monthly investment of $100 for a period of 5 years. The mutual fund has an average annual return of 8%.

Here is a table that illustrates the investment and returns over the 5-year period:

| Year | Monthly Investment | Total Investment | Annual Return | Total Return | Final Value |

|---|---|---|---|---|---|

| 1 | $100 | $1,200 | $96 | $96 | $1,296 |

| 2 | $100 | $2,400 | $192 | $288 | $2,688 |

| 3 | $100 | $3,600 | $288 | $576 | $4,176 |

| 4 | $100 | $4,800 | $384 | $960 | $5,760 |

| 5 | $100 | $6,000 | $480 | $1,440 | $7,440 |

By investing through SIP, you benefit from the power of compounding, as your returns are reinvested into the mutual fund, leading to exponential growth over time. SIP allows you to invest regularly and systematically, taking advantage of market fluctuations and reducing the impact of market volatility on your investments.

Overall, a Systematic Investment Plan (SIP) is a disciplined approach to investing that allows you to achieve your financial goals by investing regularly and taking advantage of the power of compounding. It provides a convenient and flexible way to invest in alternative investments, such as mutual funds, and can help you build wealth over the long term.

Step-by-Step Guide to Investing in Alternative Investments

Investing in alternative investments can be a great way to diversify your portfolio and potentially earn higher returns. However, it is important to approach these investments with caution and follow a step-by-step guide to ensure you make informed decisions. Here is a comprehensive guide to help you get started with investing in alternative investments.

1. Determine your investment goals and risk tolerance

The first step in investing in alternative investments is to determine your investment goals and risk tolerance. Consider what you hope to achieve with your investments and how much risk you are willing to take. This will help you choose the right alternative investments that align with your objectives.

2. Research different types of alternative investments

There are various types of alternative investments available, such as real estate, private equity, hedge funds, and commodities. Research and understand the characteristics, risks, and potential returns of each type before making any investment decisions. This will help you identify the most suitable options for your portfolio.

3. Consult with a financial advisor

4. Determine your investment amount

Decide how much you are willing to invest in alternative investments. It is important to allocate a portion of your portfolio to alternative investments while maintaining a diversified portfolio.

5. Conduct due diligence

6. Choose a reputable investment provider

Select a reputable investment provider or platform that offers the alternative investments you are interested in. Ensure they have a good track record, transparent fees, and a solid reputation in the industry.

7. Monitor and review your investments

Once you have invested in alternative investments, regularly monitor and review your portfolio. Stay updated on market trends, performance, and any changes in the investment landscape. This will help you make informed decisions and adjust your portfolio as needed.

8. Diversify your alternative investments

To minimize risk, diversify your alternative investments across different asset classes, strategies, and investment managers. This will help spread your risk and potentially enhance your overall returns.

9. Stay informed and adapt your strategy

Keep yourself informed about the latest developments in the alternative investment market. Stay updated on regulatory changes, economic trends, and industry news. This will help you adapt your investment strategy and make informed decisions.

10. Review and revise your investment plan

Regularly review and revise your investment plan based on your changing financial goals, risk tolerance, and market conditions. This will ensure your investment portfolio remains aligned with your objectives and helps you achieve your long-term financial goals.

By following this step-by-step guide, you can approach investing in alternative investments with confidence and make informed decisions that align with your financial goals and risk tolerance.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.