Short Interest Ratio Definition

The short interest ratio is a financial metric used in stock trading to assess the level of short interest in a particular stock. Short interest refers to the number of shares of a stock that have been sold short by investors, meaning they have borrowed and sold the shares in the hope of buying them back at a lower price in the future.

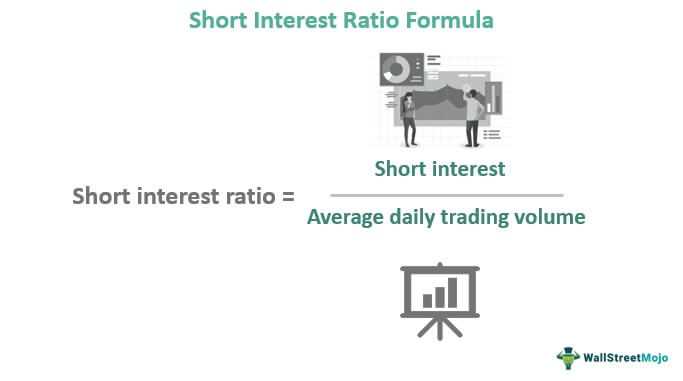

The short interest ratio is calculated by dividing the total number of shares sold short by the average daily trading volume of the stock. It is expressed as a ratio or a percentage.

This ratio is important because it provides insight into market sentiment and investor behavior. A high short interest ratio indicates that there is a large number of investors betting against the stock, which can be a bearish signal. On the other hand, a low short interest ratio suggests that there is less pessimism surrounding the stock, which can be a bullish signal.

Traders and investors can use the short interest ratio as a tool to gauge market sentiment and make informed trading decisions. For example, if the short interest ratio is high, it may indicate that there is potential for a short squeeze, where short sellers are forced to buy back shares to cover their positions, driving up the stock price.

Overall, the short interest ratio provides valuable information about the level of short interest in a stock and can be used as a tool in stock trading strategies and analysis.

What is Short Interest Ratio?

The Short Interest Ratio is a financial metric used by investors and traders to assess the level of short interest in a particular stock. Short interest refers to the number of shares that have been sold short by investors, betting that the stock price will decrease. The Short Interest Ratio is calculated by dividing the total number of shares sold short by the average daily trading volume.

Short interest is an important indicator because it can provide insight into market sentiment and potential price movements. If there is a high level of short interest in a stock, it suggests that many investors are bearish on the stock and expect its price to decline. Conversely, a low level of short interest indicates that investors are more bullish on the stock.

How to Calculate Short Interest Ratio?

To calculate the Short Interest Ratio, you need to know two key pieces of information: the total number of shares sold short and the average daily trading volume. The formula for calculating the Short Interest Ratio is as follows:

Short Interest Ratio = Total Number of Shares Sold Short / Average Daily Trading Volume

For example, if a stock has 1 million shares sold short and an average daily trading volume of 500,000 shares, the Short Interest Ratio would be 2. This means that it would take 2 days of average trading volume to cover all the short positions in the stock.

How to Use Short Interest Ratio?

The Short Interest Ratio can be used in several ways by investors and traders. Firstly, it can help identify potential short squeeze opportunities. A short squeeze occurs when a heavily shorted stock starts to rise in price, forcing short sellers to buy back shares to cover their positions. This buying pressure can further drive up the stock price, creating a feedback loop.

Secondly, the Short Interest Ratio can be used as a contrarian indicator. If the Short Interest Ratio is high, indicating a high level of short interest, it may suggest that the stock is oversold and due for a rebound. Conversely, if the Short Interest Ratio is low, it may indicate that the stock is overbought and due for a pullback.

Lastly, the Short Interest Ratio can be used to gauge market sentiment. If the Short Interest Ratio is increasing over time, it may suggest that investors are becoming more bearish on the stock. On the other hand, if the Short Interest Ratio is decreasing, it may indicate that investors are becoming more bullish.

How to Calculate Short Interest Ratio?

The Short Interest Ratio is a financial metric used to measure the level of short interest in a particular stock. It is calculated by dividing the total number of shares sold short by the average daily trading volume.

Step 1: Determine the Total Number of Shares Sold Short

To calculate the Short Interest Ratio, you first need to determine the total number of shares sold short. This information can usually be found in the company’s financial statements or through financial data providers.

Step 2: Calculate the Average Daily Trading Volume

The next step is to calculate the average daily trading volume. This can be done by taking the total trading volume over a specific period, such as 30 days, and dividing it by the number of trading days in that period.

Step 3: Divide the Total Number of Shares Sold Short by the Average Daily Trading Volume

Finally, divide the total number of shares sold short by the average daily trading volume to calculate the Short Interest Ratio. The formula is as follows:

Short Interest Ratio = Total Number of Shares Sold Short / Average Daily Trading Volume

The resulting ratio will provide you with a numerical value that represents the level of short interest in the stock. A higher ratio indicates a higher level of short interest, while a lower ratio suggests a lower level of short interest.

How to Use Short Interest Ratio

The Short Interest Ratio is a valuable tool for investors and traders to gauge market sentiment and potential price movements. Here are some ways you can use the Short Interest Ratio in your trading strategy:

1. Identify Potential Short Squeezes

When the Short Interest Ratio is high, it indicates that there is a large number of short positions in a particular stock. This means that there is a higher probability of a short squeeze occurring. A short squeeze happens when the price of a stock increases rapidly, forcing short sellers to cover their positions by buying the stock. By monitoring the Short Interest Ratio, you can identify stocks that have a higher likelihood of experiencing a short squeeze.

2. Assess Market Sentiment

3. Evaluate Potential Price Movements

By comparing the Short Interest Ratio of different stocks within the same industry or sector, you can assess the potential price movements. A higher Short Interest Ratio indicates that there is a greater possibility of a significant price movement, as short sellers may need to cover their positions. On the other hand, a lower Short Interest Ratio suggests that there may be less volatility in the stock price. By considering the Short Interest Ratio alongside other technical and fundamental indicators, you can make more informed decisions about potential price movements.

Overall, the Short Interest Ratio is a useful tool for investors and traders to gauge market sentiment, identify potential short squeezes, and evaluate potential price movements. By incorporating the Short Interest Ratio into your trading strategy, you can make more informed decisions and potentially improve your overall trading performance.

Example of Short Interest Ratio

Let’s consider an example to understand how the short interest ratio works.

Company XYZ

Company XYZ is a publicly traded company in the retail industry. It has a total of 10 million outstanding shares. The short interest in Company XYZ is 1 million shares.

Calculation

To calculate the short interest ratio, we divide the short interest by the average daily trading volume.

Let’s assume that the average daily trading volume of Company XYZ is 500,000 shares.

Short Interest Ratio = Short Interest / Average Daily Trading Volume

Short Interest Ratio = 1,000,000 / 500,000

Short Interest Ratio = 2

Interpretation

A short interest ratio of 2 means that it would take 2 days of average daily trading volume for all the short positions in Company XYZ to be covered or closed. This ratio indicates the level of short interest in a stock and can be used by investors to gauge market sentiment.

If the short interest ratio is high, it suggests that there is a significant amount of short selling in the stock, which may indicate bearish sentiment. On the other hand, a low short interest ratio suggests that there is less short selling activity and may indicate bullish sentiment.

Investors can use the short interest ratio as a tool to make informed decisions about their investment strategies. It can provide insights into market sentiment and help identify potential trading opportunities.

However, it is important to note that the short interest ratio should not be the sole factor in making investment decisions. It should be used in conjunction with other fundamental and technical analysis tools to get a comprehensive view of the stock’s potential.

Stock Trading Strategy & Education

What is Short Interest Ratio?

The Short Interest Ratio is a financial metric that measures the number of shares sold short (i.e., borrowed and sold) in relation to the average daily trading volume. It is used to gauge investor sentiment towards a particular stock or market.

How to Calculate Short Interest Ratio?

To calculate the Short Interest Ratio, you need to divide the total number of shares sold short by the average daily trading volume. The formula is as follows:

Short Interest Ratio = Total Shares Sold Short / Average Daily Trading Volume

How to Use Short Interest Ratio?

Example of Short Interest Ratio

Let’s say Company XYZ has a total of 1 million shares sold short and an average daily trading volume of 500,000 shares. The Short Interest Ratio would be calculated as follows:

Short Interest Ratio = 1,000,000 / 500,000 = 2

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.