Risk-Weighted Assets Definition and Place in Basel III

In the context of Basel III, risk-weighted assets (RWAs) play a crucial role in determining the capital adequacy of banks and financial institutions. RWAs represent the total amount of assets held by a bank, weighted according to their riskiness. This weighting is based on the probability of default and the potential loss given default associated with each asset.

The purpose of assigning risk weights to assets is to ensure that banks hold sufficient capital to absorb potential losses. By assigning higher risk weights to riskier assets, regulators aim to encourage banks to hold more capital against these assets, thereby reducing the likelihood of financial instability.

Role of Risk-Weighted Assets in Basel III

In the Basel III framework, risk-weighted assets are a key component in the calculation of a bank’s capital adequacy ratio (CAR). The CAR is a measure of a bank’s capital relative to its risk-weighted assets and is used to assess the bank’s ability to absorb losses. Basel III requires banks to maintain a minimum CAR of 8%, with higher capital requirements for systemically important banks.

By incorporating risk-weighted assets into the CAR calculation, Basel III aims to ensure that banks have sufficient capital to withstand adverse economic conditions and financial shocks. This helps to promote financial stability and reduce the likelihood of bank failures.

| Asset Class | Risk Weight |

|---|---|

| Government bonds | 0% |

| Residential mortgages | 35% |

| Corporate loans | 100% |

| Small business loans | 150% |

The table above provides an example of risk weights assigned to different asset classes. As shown, government bonds have a risk weight of 0%, indicating that they are considered to have no credit risk. On the other hand, small business loans have a risk weight of 150%, reflecting the higher probability of default associated with these loans.

Overall, risk-weighted assets are a fundamental concept in Basel III and play a crucial role in ensuring the stability and resilience of the banking system. By incorporating the riskiness of assets into capital requirements, regulators aim to enhance the safety and soundness of banks, ultimately benefiting the overall economy.

Risk-weighted assets (RWA) are a key concept in the Basel III framework, which is a set of international banking regulations aimed at promoting financial stability. RWA represent the amount of capital that banks are required to hold in relation to the risks they face in their lending and investment activities.

The concept of risk-weighted assets recognizes that not all assets held by banks carry the same level of risk. For example, loans to individuals with low credit scores are considered riskier than loans to individuals with high credit scores. Similarly, investments in government bonds are considered less risky than investments in stocks.

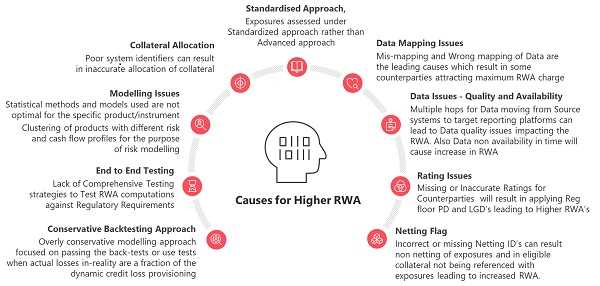

To determine the risk weight of an asset, banks use a standardized approach or an internal ratings-based approach. The standardized approach assigns predetermined risk weights to different categories of assets, while the internal ratings-based approach allows banks to use their own models to assess the risk of individual assets.

Once the risk weights are assigned, banks multiply the risk weights by the value of the assets to calculate the risk-weighted amount. This amount is then used to determine the minimum capital requirement that banks must meet under Basel III.

By requiring banks to hold capital in proportion to the risks they take, risk-weighted assets help to ensure that banks have sufficient buffers to absorb losses and maintain financial stability. This is especially important during times of economic downturns or financial crises when the risks of default and market volatility are higher.

Role of Risk-Weighted Assets in Basel III

The concept of risk-weighted assets (RWA) plays a crucial role in the Basel III framework, which is a set of international banking regulations aimed at promoting financial stability and risk management in the banking sector. RWAs are used to determine the amount of capital that banks need to hold in order to cover potential losses arising from their lending and investment activities.

Under Basel III, banks are required to calculate their RWAs by assigning specific risk weights to different types of assets based on their perceived riskiness. This risk weighting is determined through a standardized approach or an internal ratings-based approach, depending on the bank’s level of sophistication and regulatory approval.

The purpose of assigning risk weights is to reflect the varying levels of credit risk associated with different types of assets. For example, government bonds are typically considered to have lower credit risk and therefore receive a lower risk weight, while loans to small and medium-sized enterprises (SMEs) may have higher credit risk and receive a higher risk weight.

By calculating RWAs, banks are able to quantify the potential losses they may face under adverse economic conditions. This allows regulators to assess the adequacy of a bank’s capital buffer and ensure that it has sufficient capital to absorb losses and maintain solvency. The higher the RWAs, the more capital a bank is required to hold, which acts as a safeguard against unexpected losses.

The role of RWAs in Basel III is to promote a more risk-sensitive approach to capital adequacy, as it takes into account the specific risk profiles of banks’ assets. This helps to ensure that banks are adequately capitalized and can withstand economic downturns without resorting to government bailouts or posing systemic risks to the financial system.

Moreover, RWAs also serve as a tool for comparing the risk profiles of different banks and assessing their overall risk management practices. By analyzing the composition and level of RWAs, regulators and investors can gain insights into a bank’s risk appetite, asset quality, and risk management capabilities.

Implications and Importance of Risk-Weighted Assets

Risk-weighted assets (RWAs) play a crucial role in the Basel III framework, which is a set of international banking regulations aimed at promoting financial stability. RWAs are used to measure the amount of capital that banks need to hold in order to cover their potential losses from various risks.

RWAs are calculated by assigning a risk weight to each asset on a bank’s balance sheet. The risk weight reflects the likelihood of the asset’s value changing due to credit risk, market risk, or operational risk. Higher-risk assets are assigned higher risk weights, which means that banks need to hold more capital to cover potential losses from these assets.

By using RWAs, regulators can ensure that banks have sufficient capital to absorb losses and maintain their solvency. This helps to protect depositors and the overall financial system from the risk of bank failures.

Role of Risk-Weighted Assets in Basel III

Implications and Importance

The use of RWAs has several implications and importance in the banking industry:

1. Risk Management: RWAs provide a framework for banks to assess and manage their risks more effectively. By assigning risk weights to different assets, banks can allocate capital in a way that reflects their risk exposure. This helps to improve risk management practices and reduce the probability of financial losses.

2. Capital Adequacy: RWAs are used to determine the capital adequacy of banks. By requiring banks to hold a certain level of capital in relation to their RWAs, regulators ensure that banks have enough capital to absorb potential losses. This helps to maintain the stability and resilience of the banking system.

3. Investor Confidence: The use of RWAs provides transparency and clarity regarding a bank’s risk profile. This helps to build investor confidence and trust in the banking sector. Investors can make informed decisions based on a bank’s capital adequacy and risk management practices, which contributes to the overall stability of the financial markets.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.