Profit Margin Definition

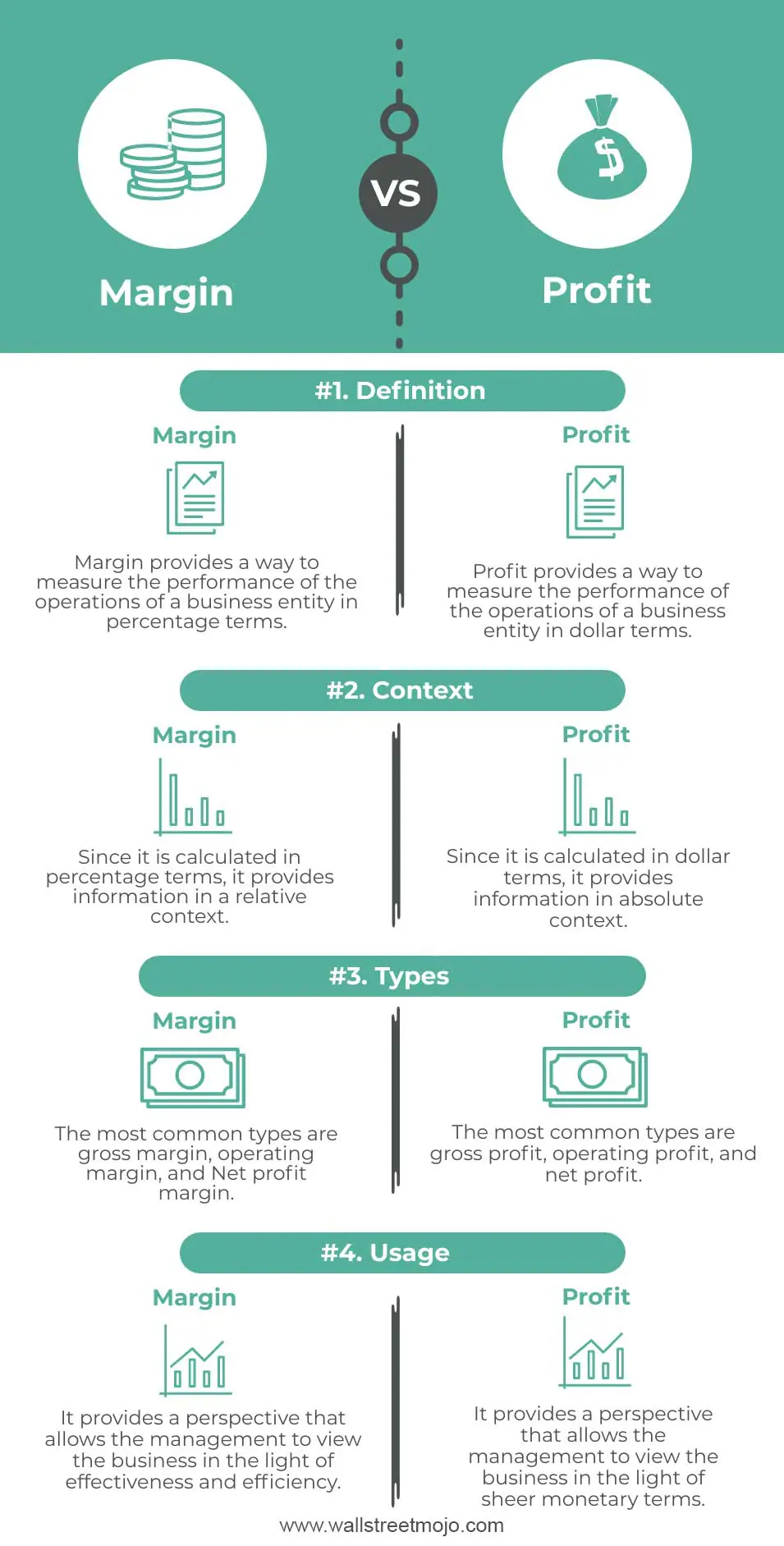

In the world of corporate finance, profit margin is a key financial metric used to assess the profitability of a business or investment. It measures the percentage of revenue that is turned into profit after deducting all expenses associated with the production and sale of goods or services.

How is Profit Margin Calculated?

Profit margin is calculated by dividing the net profit by the total revenue and multiplying the result by 100 to express it as a percentage. The formula for calculating profit margin is as follows:

| Profit Margin | = | (Net Profit / Total Revenue) * 100 |

|---|

Types of Profit Margin

There are several types of profit margin that are commonly used in business and investing:

- Gross Profit Margin: This measures the profitability of a company’s core operations by subtracting the cost of goods sold from the total revenue and dividing the result by the total revenue.

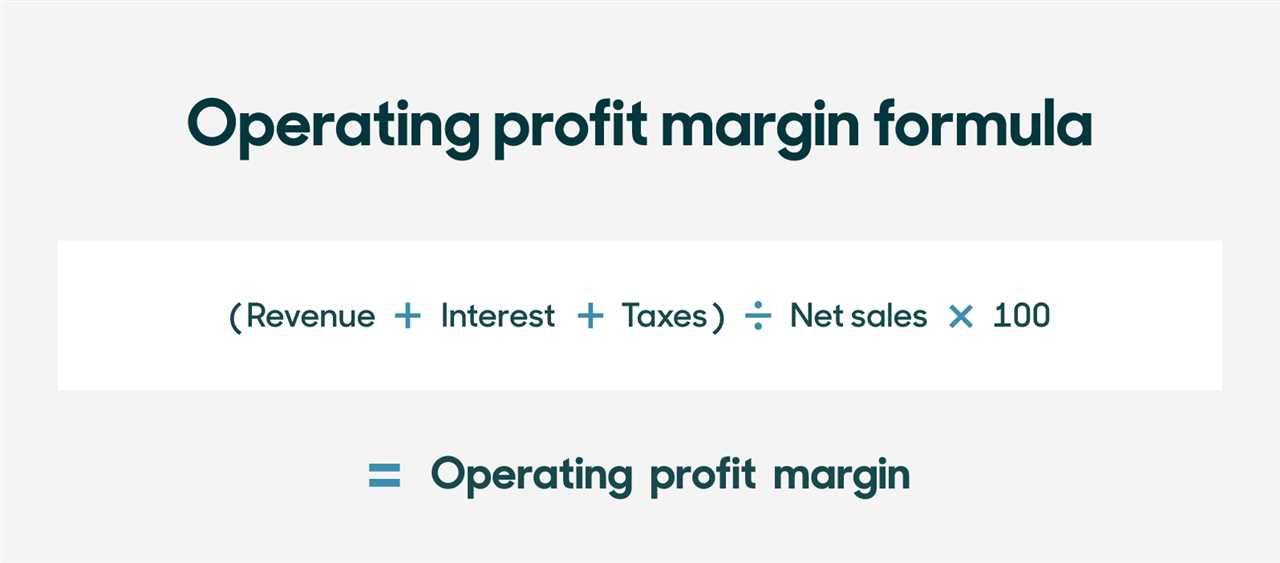

- Operating Profit Margin: This measures the profitability of a company’s operations after deducting both the cost of goods sold and operating expenses from the total revenue.

- Net Profit Margin: This measures the profitability of a company after deducting all expenses, including taxes and interest, from the total revenue.

Each type of profit margin provides valuable insights into different aspects of a company’s financial performance and can be used to make informed business and investment decisions.

What is Profit Margin?

Profit margin is a financial metric that measures the profitability of a business or investment. It is expressed as a percentage and indicates the amount of profit generated per unit of revenue. In other words, it shows how much of each dollar of revenue is turned into profit.

Profit margin is a crucial indicator for businesses and investors as it helps assess the efficiency and profitability of a company’s operations. A high profit margin indicates that a company is generating a significant amount of profit relative to its revenue, while a low profit margin may suggest inefficiencies or challenges in generating profit.

To calculate profit margin, you need to divide the net profit by the revenue and multiply the result by 100 to get the percentage. The formula is as follows:

| Profit Margin Formula |

|---|

| Profit Margin = (Net Profit / Revenue) * 100 |

For example, if a company has a net profit of $100,000 and revenue of $500,000, the profit margin would be:

| Profit Margin Calculation |

|---|

| Profit Margin = ($100,000 / $500,000) * 100 = 20% |

A profit margin of 20% indicates that the company is generating $0.20 of profit for every dollar of revenue.

Profit margin is an essential metric for businesses as it helps assess the financial health and profitability of a company. It is also used by investors to evaluate the attractiveness of an investment opportunity. By comparing the profit margins of different companies or investments, investors can make informed decisions about where to allocate their capital.

Types of Profit Margin

Profit margin is a key financial ratio that measures the profitability of a business. There are several types of profit margin that are commonly used in business and investing:

1. Gross Profit Margin: This is the most basic type of profit margin and is calculated by subtracting the cost of goods sold from the total revenue and then dividing the result by the total revenue. It measures the profitability of a company’s core operations before taking into account other expenses.

2. Operating Profit Margin: This type of profit margin takes into account not only the cost of goods sold, but also other operating expenses such as salaries, rent, and utilities. It is calculated by subtracting the operating expenses from the gross profit and then dividing the result by the total revenue.

3. Net Profit Margin: This is the most comprehensive type of profit margin and takes into account all expenses, including taxes and interest payments. It is calculated by subtracting all expenses from the total revenue and then dividing the result by the total revenue. Net profit margin is a key indicator of a company’s overall profitability.

4. EBITDA Margin: EBITDA stands for Earnings Before Interest, Taxes, Depreciation, and Amortization. This type of profit margin is commonly used in evaluating the profitability of companies in different industries. It is calculated by dividing EBITDA by the total revenue.

5. Operating Margin: This type of profit margin is similar to the operating profit margin, but it is expressed as a percentage of the total revenue. It is calculated by dividing the operating profit by the total revenue and then multiplying the result by 100.

Each type of profit margin provides a different perspective on a company’s profitability and can be used to assess its financial health and performance. By analyzing these different profit margins, investors and business owners can make more informed decisions about their investments and operations.

Uses in Business and Investing

The profit margin is a crucial financial metric that is widely used in business and investing. It provides valuable insights into the financial health and performance of a company. Here are some key uses of profit margin:

1. Financial Analysis: Profit margin is used to evaluate the profitability of a company. By comparing the profit margin of a company with its competitors or industry benchmarks, investors and analysts can assess its financial performance and make informed investment decisions.

2. Performance Measurement: Profit margin is an important measure of a company’s operational efficiency and effectiveness. It helps management evaluate the success of their strategies and identify areas for improvement. By monitoring and analyzing profit margins over time, companies can track their progress and set performance targets.

3. Pricing Strategy: Profit margin plays a crucial role in determining the optimal pricing strategy for a company. By considering the desired profit margin, companies can set prices that cover their costs and generate a reasonable return on investment. Profit margin analysis helps companies find the right balance between competitiveness and profitability.

4. Cost Control: Profit margin analysis helps companies identify and control their costs. By analyzing the components of profit margin, such as gross profit margin and net profit margin, companies can identify cost drivers and implement cost-saving measures. This can lead to improved profitability and competitiveness.

5. Investment Decision-making: Profit margin is a key factor considered by investors when making investment decisions. A company with a high and stable profit margin is often seen as a more attractive investment opportunity. Investors use profit margin to assess the financial viability and growth potential of a company before investing their capital.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.