What is Prime Brokerage?

Prime brokerage is a specialized service offered by financial institutions to institutional clients, such as hedge funds, investment banks, and other professional investors. It provides a comprehensive suite of services that facilitate the trading and investment activities of these clients.

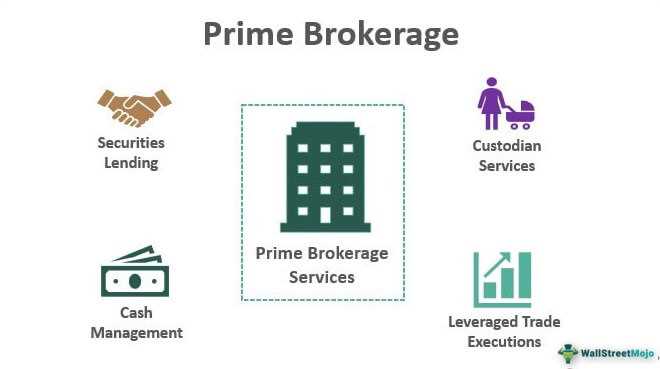

Key Services Offered by Prime Brokerage

Prime brokerage services typically include:

- Execution and clearing of trades: Prime brokers offer efficient and reliable trade execution and clearing services, ensuring that trades are executed promptly and settled correctly.

- Securities lending: Prime brokers provide access to securities lending programs, allowing clients to borrow securities for short-selling or other trading strategies.

- Margin financing: Prime brokers offer margin financing to clients, allowing them to leverage their investments and increase their trading capacity.

- Risk management: Prime brokers help clients manage their risk exposure by providing risk analytics, portfolio margining, and other risk management tools.

- Reporting and analytics: Prime brokers provide clients with comprehensive reporting and analytics tools, allowing them to monitor and analyze their trading activities and performance.

Benefits of Prime Brokerage

Prime brokerage services offer several benefits to institutional clients:

- Access to multiple markets and liquidity: Prime brokers provide access to a wide range of markets and liquidity sources, allowing clients to execute trades efficiently and access diverse investment opportunities.

- Efficiency and cost savings: By consolidating their trading activities with a prime broker, clients can benefit from economies of scale, lower transaction costs, and streamlined operational processes.

- Risk management and compliance support: Prime brokers help clients manage their risk exposure and comply with regulatory requirements by providing sophisticated risk management tools and compliance support.

- Expertise and support: Prime brokers have extensive market knowledge and expertise, and they offer personalized support and advice to clients, helping them optimize their trading strategies and achieve their investment objectives.

Why Prime Brokerage Services are Important?

Prime brokerage services play a crucial role in the financial industry, particularly for institutional investors, hedge funds, and high-net-worth individuals. These services provide a range of benefits and advantages that contribute to the success and efficiency of investment strategies.

1. Access to Multiple Markets

One of the key reasons why prime brokerage services are important is their ability to provide clients with access to multiple markets. Prime brokers have established relationships with various exchanges and liquidity providers, allowing their clients to trade a wide range of financial instruments, including stocks, bonds, options, futures, and currencies. This access to diverse markets enables investors to diversify their portfolios and take advantage of different investment opportunities.

2. Enhanced Liquidity

Prime brokers also offer enhanced liquidity to their clients. By pooling together the assets and trades of multiple clients, prime brokers can provide greater liquidity, allowing investors to execute trades more efficiently and at better prices. This liquidity is especially important for large institutional investors and hedge funds that deal with substantial trading volumes and require quick execution of trades.

3. Risk Management and Margin Financing

Another crucial aspect of prime brokerage services is risk management and margin financing. Prime brokers provide risk management tools and services to help clients monitor and mitigate risks associated with their investment portfolios. Additionally, prime brokers offer margin financing, allowing clients to leverage their positions and potentially increase their returns. This margin financing can be particularly beneficial for hedge funds and other investors looking to maximize their investment strategies.

4. Operational Efficiency

Prime brokerage services also contribute to operational efficiency for investors. Prime brokers handle various administrative tasks, such as trade settlement, clearing, and reporting, on behalf of their clients. This allows investors to focus on their investment strategies and reduces the operational burden associated with managing multiple accounts and transactions. The streamlined operational processes provided by prime brokers help investors save time and resources.

5. Customized Solutions

Prime brokers understand that each client has unique investment needs and requirements. Therefore, they offer customized solutions tailored to individual client preferences. This includes personalized reporting, risk analysis, and access to specific markets or investment products. The ability to receive tailored services ensures that clients receive the support and tools they need to achieve their investment objectives.

Example of Prime Brokerage Services

Prime brokerage services provide a range of financial services to institutional clients, such as hedge funds, asset managers, and other professional investors. These services are designed to facilitate efficient trading and investment management, allowing clients to access various markets and financial instruments.

1. Trade Execution

One of the key services offered by prime brokers is trade execution. They provide access to multiple exchanges and liquidity pools, allowing clients to execute trades quickly and efficiently. This ensures that clients can take advantage of market opportunities and achieve the best possible execution prices.

2. Clearing and Settlement

Prime brokers also handle the clearing and settlement of trades on behalf of their clients. They ensure that all trades are properly recorded, confirmed, and settled in a timely manner. This helps to reduce operational risks and streamline the post-trade process.

3. Custody Services

Prime brokers offer custody services, which involve the safekeeping and administration of clients’ assets. They hold the securities and other financial instruments on behalf of their clients, providing secure storage and efficient asset servicing. This includes functions such as corporate actions processing, income collection, and proxy voting.

4. Financing and Margin Lending

Prime brokers provide financing solutions to their clients, allowing them to leverage their positions and access additional capital. They offer margin lending facilities, enabling clients to borrow funds against their securities holdings. This can be used to finance new investments, meet margin requirements, or manage liquidity needs.

5. Reporting and Risk Management

Prime brokers offer comprehensive reporting and risk management tools to their clients. They provide regular statements and reports, detailing portfolio positions, transactions, and performance. They also offer risk analytics and monitoring services, helping clients to assess and manage their exposure to market, credit, and operational risks.

Overall, prime brokerage services play a crucial role in the financial industry by providing institutional clients with the infrastructure, tools, and support they need to effectively manage their investments and trading activities.

Overview of Prime Brokerage Services

Prime brokerage services are a comprehensive suite of financial services offered by stockbrokers to institutional clients, such as hedge funds, investment banks, and asset managers. These services are designed to facilitate the efficient execution and settlement of trades, provide access to a wide range of financial markets, and offer various financing and risk management solutions.

Key Services Offered

Prime brokerage services typically include:

- Trade Execution and Clearing: Stockbrokers act as intermediaries, executing trades on behalf of their clients and ensuring the efficient clearing and settlement of these trades.

- Access to Multiple Markets: Prime brokers provide their clients with access to a wide range of financial markets, including equities, fixed income, commodities, and derivatives.

- Securities Lending and Borrowing: Prime brokers facilitate securities lending and borrowing transactions, allowing clients to generate additional income by lending out their securities or borrowing securities for short selling purposes.

- Margin Financing: Prime brokers offer margin financing, allowing clients to leverage their positions and increase their trading capacity.

- Risk Management: Prime brokers provide risk management tools and services to help clients monitor and manage their exposure to various market risks.

- Reporting and Analytics: Prime brokers offer comprehensive reporting and analytics capabilities, providing clients with detailed insights into their trading activities and performance.

Benefits of Prime Brokerage Services

Prime brokerage services offer numerous benefits to institutional clients:

- Efficiency: By consolidating various financial services under one provider, prime brokerage services streamline the trading and settlement process, reducing operational complexities and improving efficiency.

- Access to Markets: Prime brokers provide clients with access to a wide range of financial markets, allowing them to diversify their investment portfolios and take advantage of various trading opportunities.

- Financing Solutions: Prime brokers offer margin financing and securities lending facilities, enabling clients to access additional capital and generate income from their securities holdings.

- Risk Management: Prime brokerage services provide clients with risk management tools and services, helping them monitor and mitigate various market risks.

- Reporting and Analytics: Prime brokers offer comprehensive reporting and analytics capabilities, providing clients with valuable insights into their trading activities and performance.

Overall, prime brokerage services play a crucial role in the success of institutional clients by offering a wide range of financial services, facilitating efficient trading and settlement, and providing access to diverse markets and financing solutions.

Key Features and Benefits

Prime brokerage services offer a range of key features and benefits that can greatly enhance your trading experience. Here are some of the main advantages:

1. Access to Multiple Markets

With prime brokerage services, you gain access to a wide range of markets, including equities, options, futures, and more. This allows you to diversify your portfolio and take advantage of different investment opportunities.

2. Efficient Trade Execution

Prime brokers provide fast and efficient trade execution, ensuring that your orders are executed at the best possible prices. This can help you maximize your returns and minimize slippage.

3. Advanced Trading Tools

Prime brokerage services offer access to advanced trading tools and platforms that can help you analyze the market, identify trading opportunities, and execute trades with precision. These tools can greatly enhance your trading strategies and decision-making process.

4. Customized Solutions

Prime brokers understand that every trader has unique needs and requirements. They offer customized solutions tailored to your specific trading style, risk tolerance, and investment goals. This ensures that you have the support and resources you need to succeed in the market.

5. Risk Management

Prime brokerage services provide robust risk management tools and systems to help you monitor and manage your risk exposure. This includes real-time risk analytics, margin calculations, and portfolio tracking. By effectively managing your risk, you can protect your capital and optimize your returns.

6. Dedicated Client Support

Prime brokers offer dedicated client support to assist you with any trading-related queries or issues. Their experienced team of professionals is available to provide guidance, answer questions, and resolve any problems that may arise. This ensures that you have the support you need to navigate the markets successfully.

| Key Features | Benefits |

|---|---|

| Access to Multiple Markets | Diversify your portfolio and take advantage of different investment opportunities |

| Efficient Trade Execution | Maximize returns and minimize slippage |

| Advanced Trading Tools | Analyze the market, identify trading opportunities, and execute trades with precision |

| Customized Solutions | Support tailored to your specific trading style, risk tolerance, and investment goals |

| Risk Management | Monitor and manage your risk exposure, protect your capital, and optimize returns |

| Dedicated Client Support | Assistance with trading-related queries or issues |

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.