What is Price to Free Cash Flow?

Price to Free Cash Flow is a financial ratio that is used to evaluate the valuation of a company’s stock. It is calculated by dividing the market price per share by the free cash flow per share.

Market price per share refers to the current price at which a company’s stock is trading in the market. It is determined by the supply and demand dynamics of the stock market.

Free cash flow per share is a measure of the cash generated by a company’s operations that is available to be distributed to investors. It is calculated by subtracting capital expenditures from operating cash flow and dividing the result by the number of shares outstanding.

The Price to Free Cash Flow ratio is considered to be a more reliable valuation metric than the Price to Earnings ratio because it takes into account the actual cash generated by a company, rather than just its reported earnings. It provides investors with a clearer picture of a company’s financial health and its ability to generate cash.

This ratio is often used by investors to identify undervalued or overvalued stocks. A low Price to Free Cash Flow ratio indicates that a stock may be undervalued, while a high ratio suggests that it may be overvalued. However, it is important to consider other factors and perform a comprehensive analysis before making any investment decisions.

Overall, the Price to Free Cash Flow ratio is a valuable tool for investors to assess the valuation of a company’s stock and make informed investment decisions. It provides a more accurate representation of a company’s financial performance and its ability to generate cash, which is crucial for long-term sustainability and growth.

Definition and Explanation

Price to Free Cash Flow (P/FCF) is a financial ratio used in fundamental analysis to evaluate the investment potential of a company. It measures the relationship between the market price of a company’s stock and its free cash flow.

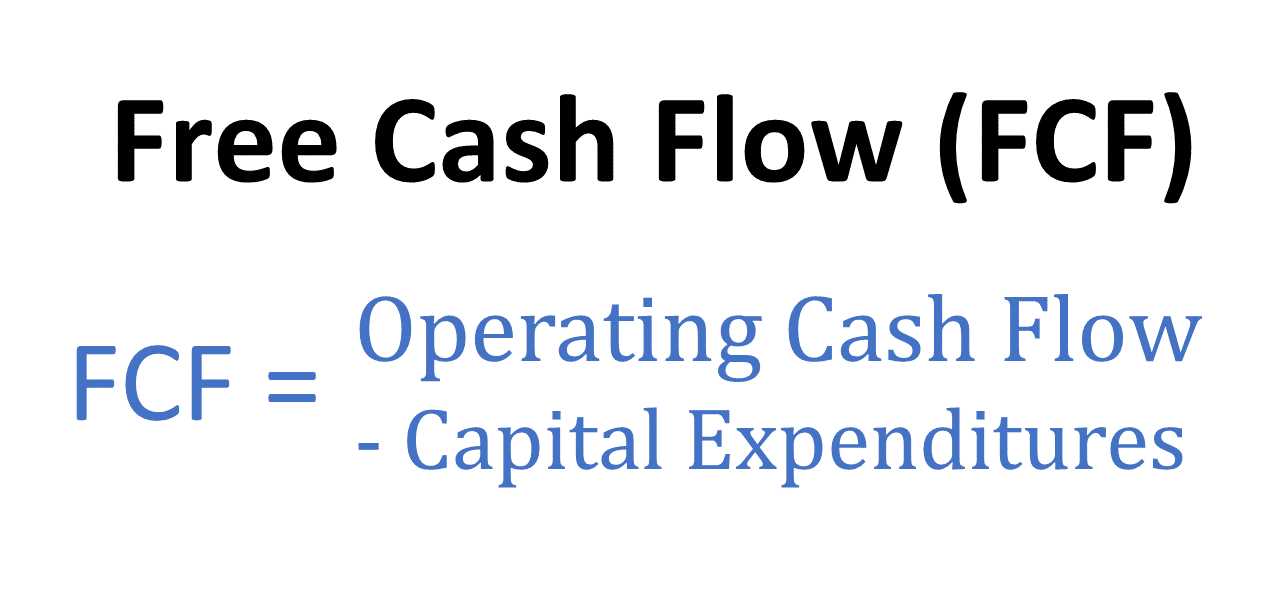

Free cash flow is the cash generated by a company’s operations that is available to be distributed to investors, reinvested in the business, or used to pay down debt. It is calculated by subtracting capital expenditures from operating cash flow.

The P/FCF ratio is calculated by dividing the market price per share of a company’s stock by its free cash flow per share. It provides investors with an indication of how much they are paying for each dollar of free cash flow generated by the company.

Importance of Price to Free Cash Flow

The P/FCF ratio is an important tool for investors because it helps them assess the value of a company’s stock relative to its cash generating ability. A low P/FCF ratio may indicate that a company’s stock is undervalued, while a high P/FCF ratio may suggest that the stock is overvalued.

By comparing the P/FCF ratio of a company to its industry peers or the overall market, investors can gain insights into the company’s financial health and growth prospects. A company with a lower P/FCF ratio than its competitors may be more attractive to investors as it suggests that the company is generating more cash flow relative to its stock price.

Calculation of Price to Free Cash Flow

The P/FCF ratio is calculated by dividing the market price per share of a company’s stock by its free cash flow per share. The formula is as follows:

P/FCF = Market Price per Share / Free Cash Flow per Share

To calculate the free cash flow per share, divide the free cash flow by the number of shares outstanding. The market price per share can be obtained from financial websites or stock exchanges.

It is important to use the most recent financial statements and market price data when calculating the P/FCF ratio to ensure accuracy.

Interpretation and Analysis

The interpretation of the P/FCF ratio depends on the context and industry in which the company operates. Generally, a lower P/FCF ratio indicates that the company’s stock is undervalued, while a higher P/FCF ratio suggests that the stock is overvalued.

Investors should compare the P/FCF ratio of a company to its historical values, as well as to its industry peers and the overall market, to assess its relative valuation. A significant deviation from the industry average or historical values may indicate potential investment opportunities or risks.

Uses and Importance

The price to free cash flow ratio is an important tool in fundamental analysis, as it helps investors assess the value of a company’s stock. By comparing the price of a stock to its free cash flow, investors can determine whether the stock is overvalued or undervalued.

Investors also use the price to free cash flow ratio to compare the valuation of different companies within the same industry. By comparing the price to free cash flow ratios of similar companies, investors can identify which companies are trading at a higher or lower valuation relative to their free cash flow. This can help investors identify potential investment opportunities or overvalued stocks to avoid.

Another important use of the price to free cash flow ratio is in determining the fair value of a company’s stock. By calculating the ratio and comparing it to historical data or industry averages, investors can assess whether the current stock price is reasonable or if it is overpriced or underpriced. This can help investors make informed decisions about buying or selling stocks.

Overall, the price to free cash flow ratio is a valuable tool for investors to assess the value and potential of a company’s stock. It provides insights into a company’s financial health, relative valuation, and fair value, helping investors make informed investment decisions.

Calculation of Price to Free Cash Flow

Calculating the Price to Free Cash Flow ratio involves a simple formula that can provide valuable insights into a company’s financial health and investment potential. The ratio is calculated by dividing the market price per share by the free cash flow per share.

To calculate the Price to Free Cash Flow ratio, follow these steps:

Step 1: Determine the Market Price per Share

The market price per share can be obtained from financial websites, stock exchanges, or brokerage platforms. It represents the current price at which the company’s shares are trading in the market.

Step 2: Calculate the Free Cash Flow per Share

The free cash flow per share is derived from the company’s financial statements, specifically the cash flow statement. It is calculated by dividing the free cash flow by the total number of outstanding shares.

Free cash flow is a measure of the cash generated by a company’s operations that is available for distribution to investors, bondholders, or for reinvestment in the business. It is calculated by subtracting capital expenditures from operating cash flow.

Step 3: Divide the Market Price per Share by the Free Cash Flow per Share

Once you have obtained the market price per share and the free cash flow per share, divide the former by the latter to calculate the Price to Free Cash Flow ratio. The resulting ratio indicates how much investors are willing to pay for each unit of free cash flow generated by the company.

A low Price to Free Cash Flow ratio suggests that the company is generating a significant amount of free cash flow relative to its market price, which may indicate an undervalued stock. Conversely, a high ratio may suggest that the stock is overvalued.

Interpretation and Analysis

On the other hand, a high Price to Free Cash Flow ratio suggests that a company’s stock may be overvalued. Investors are paying a premium for each dollar of free cash flow, which could indicate that the company’s future cash flow prospects are already priced into the stock. This could present a selling opportunity for investors looking to take profits.

It is also important to compare the Price to Free Cash Flow ratio of a company to its industry peers and the overall market. This can provide insight into how the company’s valuation compares to its competitors and the broader market. A higher ratio compared to peers could indicate that the company is performing well and is expected to generate strong free cash flow in the future.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.