Key Differences

When comparing an offering memorandum and a prospectus, it is important to understand the key differences between the two documents. These differences can impact the information provided, the legal requirements, and the target audience.

1. Purpose and Use

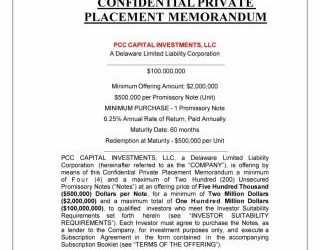

An offering memorandum is typically used in private placements or offerings to a select group of investors. It provides detailed information about the investment opportunity, including the terms, risks, and financial projections. The purpose of an offering memorandum is to inform potential investors and solicit their interest in the investment.

A prospectus, on the other hand, is used in public offerings or initial public offerings (IPOs). It is a legal document that is required by securities regulators to provide detailed information about the company and the securities being offered. The purpose of a prospectus is to provide transparency and protect investors by ensuring they have access to all relevant information before making an investment decision.

2. Legal Requirements

An offering memorandum is not typically subject to as many legal requirements as a prospectus. It may be exempt from certain disclosure requirements and may not need to be filed with securities regulators. However, it still needs to comply with applicable securities laws and regulations.

A prospectus, on the other hand, is subject to strict legal requirements. It must be filed with securities regulators and comply with specific disclosure requirements, including financial statements, risk factors, and management information. The prospectus must also be approved by the securities regulators before the offering can proceed.

3. Information Included

A prospectus includes comprehensive information about the company, including its business operations, financial statements, risk factors, and management information. It provides a complete picture of the company’s financial health, performance, and prospects. The prospectus must provide all material information that a reasonable investor would need to make an informed investment decision.

4. Target Audience

The target audience for an offering memorandum is typically a select group of sophisticated investors, such as institutional investors, high-net-worth individuals, or venture capital firms. These investors have the financial resources and expertise to evaluate the investment opportunity and understand the risks involved.

A prospectus is targeted at a wider audience, including retail investors and the general public. It is designed to provide information to investors of all levels of sophistication and ensure that they have access to all relevant information before making an investment decision.

Legal Requirements

Offering Memorandum:

An offering memorandum is typically used in private placements and does not need to be registered with the Securities and Exchange Commission (SEC). However, it still needs to comply with certain regulations, such as Regulation D under the Securities Act of 1933. This regulation provides exemptions for certain private offerings, allowing companies to raise capital without going through the full registration process.

Prospectus:

A prospectus, on the other hand, is required for public offerings and needs to be registered with the SEC. It provides detailed information about the company, its financials, risks, and other relevant information that potential investors need to make an informed decision. The prospectus is subject to review and approval by the SEC before it can be distributed to the public.

It is important to note that the legal requirements may vary depending on the jurisdiction and the type of offering. Companies should consult with legal professionals to ensure compliance with all applicable laws and regulations.

Information Included in an Offering Memorandum and Prospectus

An offering memorandum and a prospectus are both legal documents that provide important information about an investment opportunity to potential investors. While they serve similar purposes, there are differences in the information included in each document.

Offering Memorandum

An offering memorandum typically includes the following information:

- Executive Summary: A brief overview of the investment opportunity, including key highlights and potential risks.

- Business Description: Detailed information about the company or project, including its history, products or services, and competitive advantages.

- Financial Information: Financial statements, such as balance sheets, income statements, and cash flow statements, that provide insight into the company’s financial health.

- Management Team: Background information on the key individuals involved in the company or project, including their qualifications and experience.

- Risk Factors: A discussion of the potential risks and uncertainties associated with the investment, such as market conditions, regulatory changes, or competition.

- Legal and Regulatory Information: Details about any legal or regulatory requirements that may impact the investment, such as licenses, permits, or compliance obligations.

- Terms and Conditions: The terms of the investment, including the amount of capital required, the expected return on investment, and any restrictions or limitations.

Prospectus

A prospectus, on the other hand, typically includes the following information:

- Summary of the Offering: An overview of the investment opportunity, including the purpose of the offering, the number of securities being offered, and the offering price.

- Business Overview: Information about the company’s business operations, including its products or services, markets, and competitive position.

- Financial Information: Financial statements and related information, such as management’s discussion and analysis, that provide insight into the company’s financial performance and prospects.

- Risk Factors: A discussion of the potential risks and uncertainties associated with the investment, including market risks, regulatory risks, and operational risks.

- Management and Board of Directors: Background information on the key individuals involved in the company, including their qualifications, experience, and compensation.

- Legal and Regulatory Information: Details about any legal or regulatory requirements that may impact the investment, such as licenses, permits, or compliance obligations.

- Terms and Conditions: The terms of the offering, including the amount of securities being offered, the offering price, and any restrictions or limitations.

It is important for potential investors to carefully review the information included in an offering memorandum or prospectus before making an investment decision. This information can help investors assess the risks and potential rewards of the investment opportunity and make an informed decision.

Purpose and Use of Offering Memorandum and Prospectus

The purpose and use of an offering memorandum and prospectus are crucial in providing potential investors with essential information about a company or investment opportunity. While both documents serve similar purposes, there are some key differences in their use and intended audience.

Offering Memorandum:

- An offering memorandum is typically used in private placements or offerings of securities to a limited number of investors.

- It provides detailed information about the investment opportunity, including the company’s financials, business model, risks, and terms of the offering.

- The primary purpose of an offering memorandum is to attract potential investors and provide them with the necessary information to make an informed investment decision.

- It is often used by companies seeking to raise capital from institutional investors, high-net-worth individuals, or sophisticated investors.

- Offering memorandums are not typically filed with regulatory authorities and are not subject to the same level of scrutiny as prospectuses.

Prospectus:

- It provides detailed information about the company, its financials, business operations, risks, and terms of the offering.

- The primary purpose of a prospectus is to provide potential investors with all the necessary information to make an informed investment decision.

- Prospectuses are typically used in initial public offerings (IPOs) or other public offerings of securities.

- They are subject to strict regulatory requirements and must comply with securities laws and regulations.

In summary, offering memorandums are used in private placements to attract potential investors and provide them with detailed information about the investment opportunity. Prospectuses, on the other hand, are required for public offerings and must comply with regulatory requirements to provide potential investors with all the necessary information to make an informed investment decision.

Target Audience

Offering Memorandum

Prospectus

On the other hand, the prospectus is aimed at a wider audience, including retail investors and the general public. Retail investors are individuals who invest smaller amounts of money and may have limited knowledge of the financial markets. The prospectus provides them with the necessary information to make informed investment decisions. It is also required by regulatory authorities to ensure transparency and protect the interests of investors.

Overall, the target audience for the offering memorandum and prospectus differs in terms of their level of sophistication, investment goals, and risk appetite. While the offering memorandum is tailored towards sophisticated investors seeking alternative investment opportunities, the prospectus caters to a broader range of investors, including retail investors.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.