No-Load Fund: Definition, How It Works, Benefits, and Examples

A no-load fund is a type of mutual fund that does not charge any sales fees or commissions to investors. This means that when you invest in a no-load fund, 100% of your money goes directly towards purchasing shares of the fund. There are no additional costs or expenses deducted from your investment.

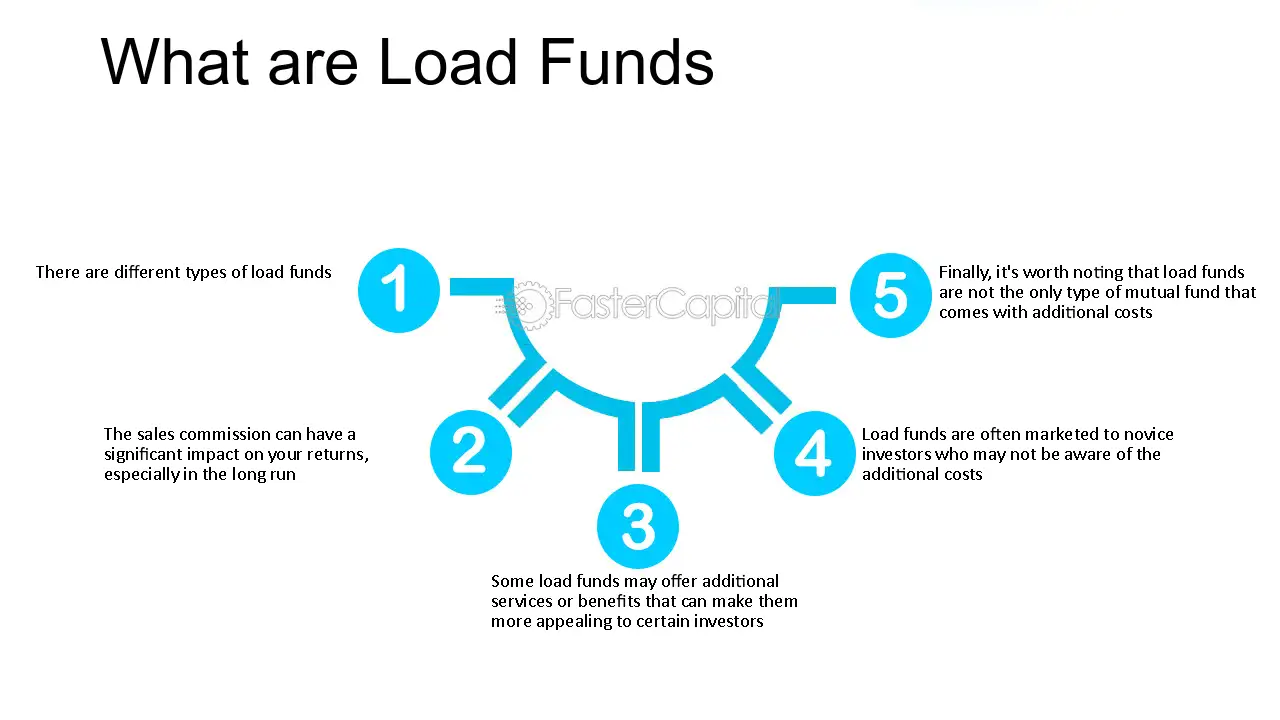

Unlike load funds, which charge a sales fee or commission, no-load funds are designed to be more cost-effective for investors. This makes them an attractive option for those who want to maximize their investment returns without incurring unnecessary fees.

When you invest in a no-load fund, you are essentially buying shares of a diversified portfolio of securities, such as stocks, bonds, or a combination of both. The fund is managed by professional portfolio managers who make investment decisions on behalf of the investors.

One of the key benefits of investing in a no-load fund is the potential for higher returns. Since there are no sales fees or commissions, more of your money is invested in the fund, which can lead to greater long-term growth. Additionally, no-load funds often have lower expense ratios compared to load funds, which can further enhance your investment returns.

Another advantage of no-load funds is their flexibility. You can buy or sell shares of a no-load fund at any time, without incurring any additional fees or penalties. This makes it easier to adjust your investment portfolio as your financial goals and risk tolerance change over time.

Examples of popular no-load funds include Vanguard Total Stock Market Index Fund, Fidelity Contrafund, and T. Rowe Price Equity Income Fund. These funds offer investors a wide range of investment options and have a track record of delivering solid returns over the long term.

What is a No-Load Fund?

A no-load fund is a type of mutual fund that does not charge any sales fees or commissions to investors when they buy or sell shares. This means that investors can invest their money directly into the fund without incurring any additional costs. The term “no-load” refers to the absence of these sales charges.

No-load funds are attractive to investors because they allow them to keep more of their investment returns. Traditional mutual funds often charge a front-end load, which is a fee paid when shares are purchased, or a back-end load, which is a fee paid when shares are sold. These fees can eat into an investor’s returns and reduce the overall profitability of the investment.

With no-load funds, investors can invest their money without worrying about these additional costs. This can be particularly beneficial for long-term investors who are looking to maximize their returns over time. By avoiding sales charges, investors can potentially earn higher returns on their investments.

No-load funds are typically offered by mutual fund companies that believe in providing investors with a cost-effective way to invest. These funds are often marketed as a way for investors to save money and keep more of their investment returns.

In summary, a no-load fund is a mutual fund that does not charge sales fees or commissions to investors. This can be a cost-effective way for investors to invest their money and potentially earn higher returns. However, investors should still be aware of other fees and expenses associated with these funds.

How Does a No-Load Fund Work?

A no-load fund is a type of mutual fund that does not charge any sales fees or commissions to investors. This means that when you invest in a no-load fund, all of your money goes directly into buying shares of the fund, rather than being used to pay fees to a broker or financial advisor.

When you invest in a no-load fund, you are essentially buying shares of a diversified portfolio of stocks, bonds, or other securities. The fund is managed by a team of professional investment managers who make decisions about which securities to buy and sell in order to achieve the fund’s investment objectives.

Unlike load funds, which charge sales fees that can range from 1% to 5% or more, no-load funds do not have any upfront or backend sales charges. This means that you can invest any amount of money in a no-load fund without incurring any additional costs.

No-load funds are typically sold directly to investors by the fund company, rather than through a broker or financial advisor. This allows investors to bypass the middleman and invest directly in the fund, saving on sales fees and commissions.

One of the key benefits of investing in a no-load fund is that it allows you to keep more of your investment returns. Since there are no sales fees or commissions to pay, all of the money you invest goes directly into buying shares of the fund. This can result in higher overall returns over time.

Another benefit of investing in a no-load fund is that it offers greater flexibility and control over your investments. Since you are not tied to a specific broker or financial advisor, you can buy and sell shares of the fund at any time without incurring additional costs.

Overall, a no-load fund can be a cost-effective and convenient way to invest in a diversified portfolio of securities. By eliminating sales fees and commissions, these funds allow investors to keep more of their investment returns and have greater flexibility and control over their investments.

Benefits of Investing in No-Load Funds

Investing in no-load funds can offer several benefits for investors. Here are some of the key advantages:

1. Lower Costs

No-load funds do not charge a sales load or commission fee when buying or selling shares. This means that investors can avoid paying a percentage of their investment to a broker or financial advisor. As a result, more of the investor’s money can be put to work in the fund, potentially increasing overall returns.

2. Flexibility

No-load funds provide investors with the flexibility to buy and sell shares without incurring additional costs. This can be particularly advantageous for investors who prefer to actively manage their portfolios or make frequent trades. Without the burden of sales loads, investors can easily adjust their investments as market conditions or personal circumstances change.

3. Diversification

No-load funds offer a wide range of investment options across different asset classes, sectors, and regions. This allows investors to diversify their portfolios and spread their risk across multiple investments. By investing in a variety of no-load funds, investors can access a broader range of opportunities and potentially reduce the impact of any individual investment’s performance on their overall portfolio.

4. Transparency

No-load funds typically provide investors with transparent and easily accessible information about their holdings, performance, and fees. This transparency allows investors to make informed decisions and better understand the risks and potential rewards associated with their investments. Additionally, many no-load funds provide regular updates and reports, enabling investors to stay informed about their investments’ progress.

5. Long-Term Focus

No-load funds often encourage a long-term investment approach by discouraging frequent trading. This can be beneficial for investors who are looking to build wealth over time and are willing to ride out short-term market fluctuations. By promoting a long-term focus, no-load funds can help investors avoid making impulsive investment decisions based on short-term market trends or emotions.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.