What is Delivered Duty Paid (DDP)?

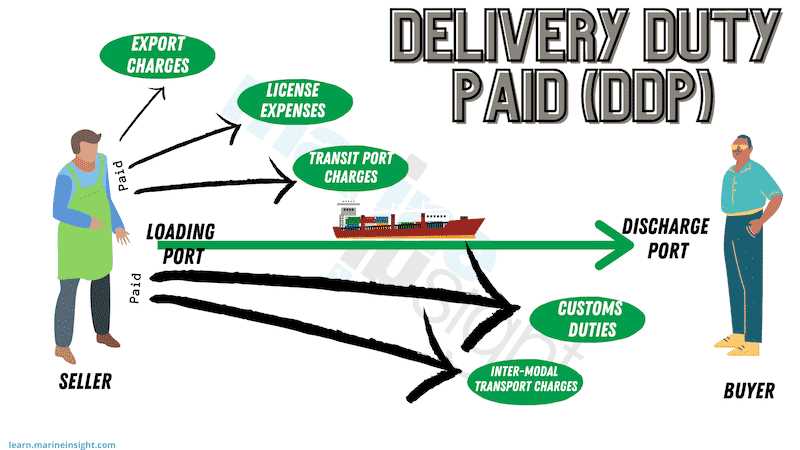

Delivered Duty Paid (DDP) is an international trade term that specifies that the seller is responsible for delivering the goods to the buyer’s designated location, and is also responsible for paying any import duties or taxes that may be applicable.

Under DDP terms, the seller assumes all risks and costs associated with delivering the goods, including transportation, customs clearance, and any additional fees or charges. This means that the buyer does not have to worry about arranging transportation or dealing with customs procedures.

Benefits of using DDP

- Cost savings: By including all costs in the price of the goods, the buyer can avoid unexpected expenses and budget more effectively.

- Reduced risk: With the seller assuming responsibility for the goods until they reach the buyer’s location, the buyer is protected from any potential damage or loss during transit.

Delivered Duty Paid (DDP) is an international trade term that places the maximum responsibility on the seller. When importing goods under DDP terms, the seller is responsible for delivering the goods to the buyer’s chosen destination and paying all costs and taxes associated with the import process.

Under DDP terms, the seller is responsible for arranging transportation, completing all necessary export and import documentation, paying customs duties and taxes, and delivering the goods to the buyer’s specified location. This means that the importer does not have to worry about arranging transportation or dealing with customs procedures.

Importers should also be aware that under DDP terms, they are still responsible for providing accurate and complete information to the seller, as any errors or omissions in the documentation can lead to delays or additional costs. It is important for importers to work closely with their suppliers and customs brokers to ensure that all necessary information is provided in a timely manner.

Exporters play a crucial role in the Delivered Duty Paid (DDP) process. DDP is a trade term that places the responsibility of delivering goods to the buyer’s specified location, including all costs and risks, on the exporter. This means that as an exporter, you are responsible for ensuring that the goods are delivered to the buyer’s location and for paying any duties or taxes associated with the importation of the goods.

When exporting goods under DDP terms, it is important to understand the following key points:

| 1. Delivery Obligations | As an exporter, you are responsible for delivering the goods to the buyer’s specified location. This includes arranging transportation, handling customs clearance, and ensuring that the goods are delivered in good condition. |

| 2. Customs Clearance | Under DDP terms, you are responsible for handling all customs clearance procedures. This includes preparing and submitting the necessary documentation, paying any applicable duties or taxes, and ensuring compliance with import regulations. |

| 3. Cost Allocation | |

| 4. Risk Transfer | Under DDP terms, the risk of loss or damage to the goods transfers from the exporter to the buyer once the goods have been delivered to the specified location. It is important to ensure that you have adequate insurance coverage to protect against any potential risks. |

Exporting goods under DDP terms can offer several advantages, such as simplifying the import process for the buyer and providing a competitive edge in international trade. However, it is important to carefully consider the responsibilities and costs associated with DDP before entering into any export agreements.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.