What is the Merton Model?

The Merton Model is a financial model that was developed by economist Robert C. Merton in 1974. It is used to assess the credit risk of a company and estimate the probability of default. The model is based on the assumption that the value of a company’s assets follows a lognormal distribution and that the company will default if the value of its assets falls below a certain threshold.

The Merton Model is widely used in the field of corporate finance and is particularly useful for assessing the credit risk of companies that issue debt. It provides a quantitative measure of a company’s creditworthiness and can help investors and lenders make informed decisions about whether to invest in or lend to a particular company.

Assumptions of the Merton Model

The Merton Model is based on several key assumptions:

- Lognormal distribution: The model assumes that the value of a company’s assets follows a lognormal distribution. This means that the distribution of asset values is skewed to the right, with a few extreme values on the high end.

- Constant volatility: The model assumes that the volatility of a company’s assets is constant over time. This means that the riskiness of the company’s assets does not change.

- Zero-coupon debt: The model assumes that the company’s debt is zero-coupon, meaning that it does not pay interest. This simplifies the calculation of the probability of default.

- Continuous-time framework: The model is formulated in continuous time, which allows for more precise calculations and modeling of the company’s credit risk.

A Brief History of the Merton Model

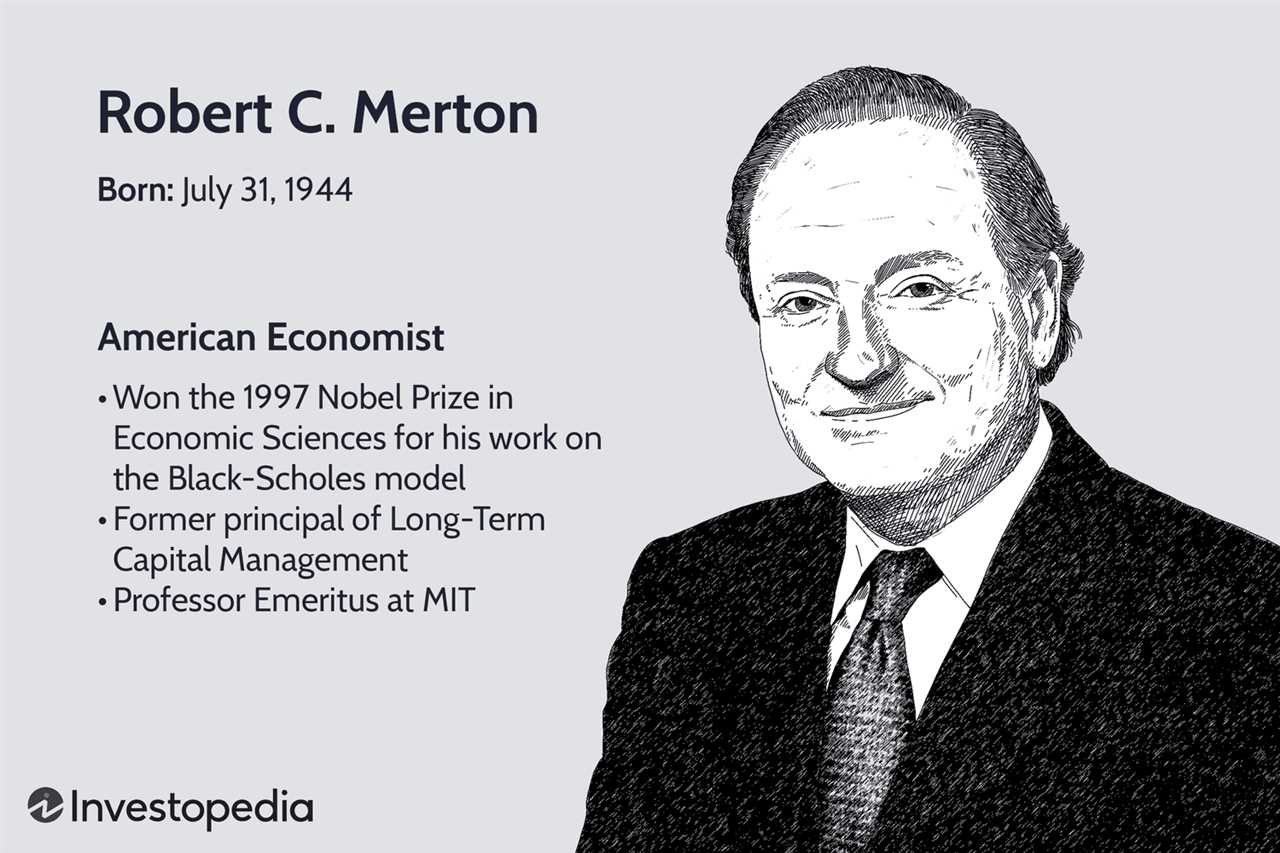

Robert C. Merton, an American economist and Nobel laureate, developed the Merton Model while working at the Massachusetts Institute of Technology (MIT). He was awarded the Nobel Prize in Economic Sciences in 1997 for his contributions to the development of financial economics, including the Merton Model.

The Merton Model was inspired by the Black-Scholes-Merton model, which is used to price options. Merton applied the concepts of option pricing to corporate debt and developed a framework for valuing corporate bonds and estimating the probability of default.

Prior to the development of the Merton Model, credit risk assessment was primarily based on qualitative factors such as financial statements and credit ratings. The Merton Model introduced a quantitative approach to credit risk assessment, taking into account the firm’s asset value, debt structure, and volatility.

The Merton Model assumes that the value of a firm’s assets follows a geometric Brownian motion and that the firm defaults when the value of its assets falls below its debt obligations. By estimating the probability distribution of the firm’s asset value, the Merton Model can calculate the probability of default and the expected loss in the event of default.

Since its introduction, the Merton Model has become a widely used tool in credit risk management. It has been applied to various financial instruments, including corporate bonds, loans, and credit derivatives. The model has also been extended to incorporate more complex factors such as multiple debt obligations and correlated default risks.

Despite its widespread use, the Merton Model has its limitations. It assumes that the firm’s asset value follows a continuous process and that the market is efficient. These assumptions may not hold in real-world situations, leading to potential inaccuracies in the model’s predictions.

Nevertheless, the Merton Model remains an important tool in assessing credit risk and has contributed to the development of the field of financial economics. Its insights and framework have paved the way for further research and advancements in credit risk management.

The Formula Behind the Merton Model

The Merton Model is a widely used financial model that calculates the probability of default for a company based on its capital structure and the value of its assets. The model was developed by economist Robert C. Merton in 1974 and has since become a cornerstone of modern finance.

The Merton Model is based on the idea that the value of a company’s assets can be thought of as a call option on the company’s equity. In other words, if the value of the assets exceeds the company’s debt obligations, the equity holders will benefit. However, if the value of the assets falls below the debt obligations, the equity holders will lose their investment and the company may default.

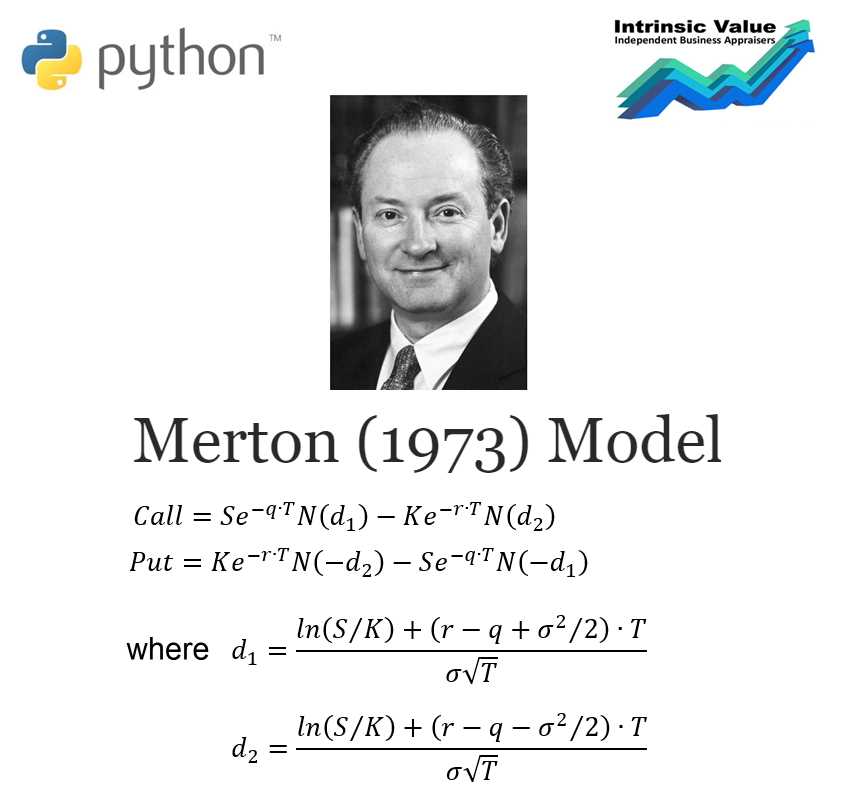

The Merton Model uses the Black-Scholes-Merton option pricing formula to calculate the probability of default. This formula takes into account various factors, including the company’s debt, the volatility of its assets, and the time to maturity of its debt. By plugging these variables into the formula, the model can estimate the likelihood of default over a given time period.

The Inputs and Outputs of the Merton Model

The Merton Model requires several inputs to calculate the probability of default. These inputs include the market value of the company’s assets, the face value of its debt, the risk-free interest rate, the volatility of the company’s assets, and the time to maturity of its debt. By inputting these values into the model, analysts can generate a probability of default for the company.

The output of the Merton Model is the probability of default, expressed as a percentage. This probability can be used by investors, lenders, and other stakeholders to assess the creditworthiness of a company and make informed decisions about lending, investing, or doing business with the company.

Limitations and Criticisms of the Merton Model

While the Merton Model is a powerful tool for assessing credit risk, it is not without its limitations and criticisms. One limitation is that the model assumes a constant volatility of the company’s assets, which may not always hold true in practice. Additionally, the model relies on certain assumptions about the behavior of financial markets, which may not be accurate in all situations.

Insights from the Merton Model

1. Probability of Default

One of the key insights provided by the Merton Model is the probability of default. This metric helps investors and creditors assess the likelihood of a company defaulting on its debt obligations. By considering the company’s asset value, debt level, and volatility, the model calculates the probability of the company’s assets falling below its debt obligations. A higher probability of default indicates a higher credit risk.

2. Credit Spreads

The Merton Model also provides insights into credit spreads, which represent the additional yield that investors demand for holding a risky debt instrument compared to a risk-free instrument. By estimating the probability of default, the model helps determine the appropriate credit spread for a company’s debt. This information is crucial for pricing and trading debt securities in the financial markets.

3. Capital Structure Analysis

Another important insight from the Merton Model is its ability to analyze a company’s capital structure. By considering the company’s asset value and debt level, the model helps determine the optimal mix of debt and equity for a company. This analysis is valuable for companies looking to optimize their capital structure and minimize their cost of capital.

4. Stress Testing

The Merton Model can also be used for stress testing, which involves assessing the impact of adverse events on a company’s credit risk. By simulating different scenarios and analyzing the probability of default under each scenario, the model helps identify potential vulnerabilities and weaknesses in a company’s financial position. This information is crucial for risk management and contingency planning.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.