Expected Loss Ratio (ELR) Method Overview

The Expected Loss Ratio (ELR) method is a commonly used approach in the insurance industry to estimate the potential losses that an insurer may incur. It is a key component in determining the premium rates for insurance policies.

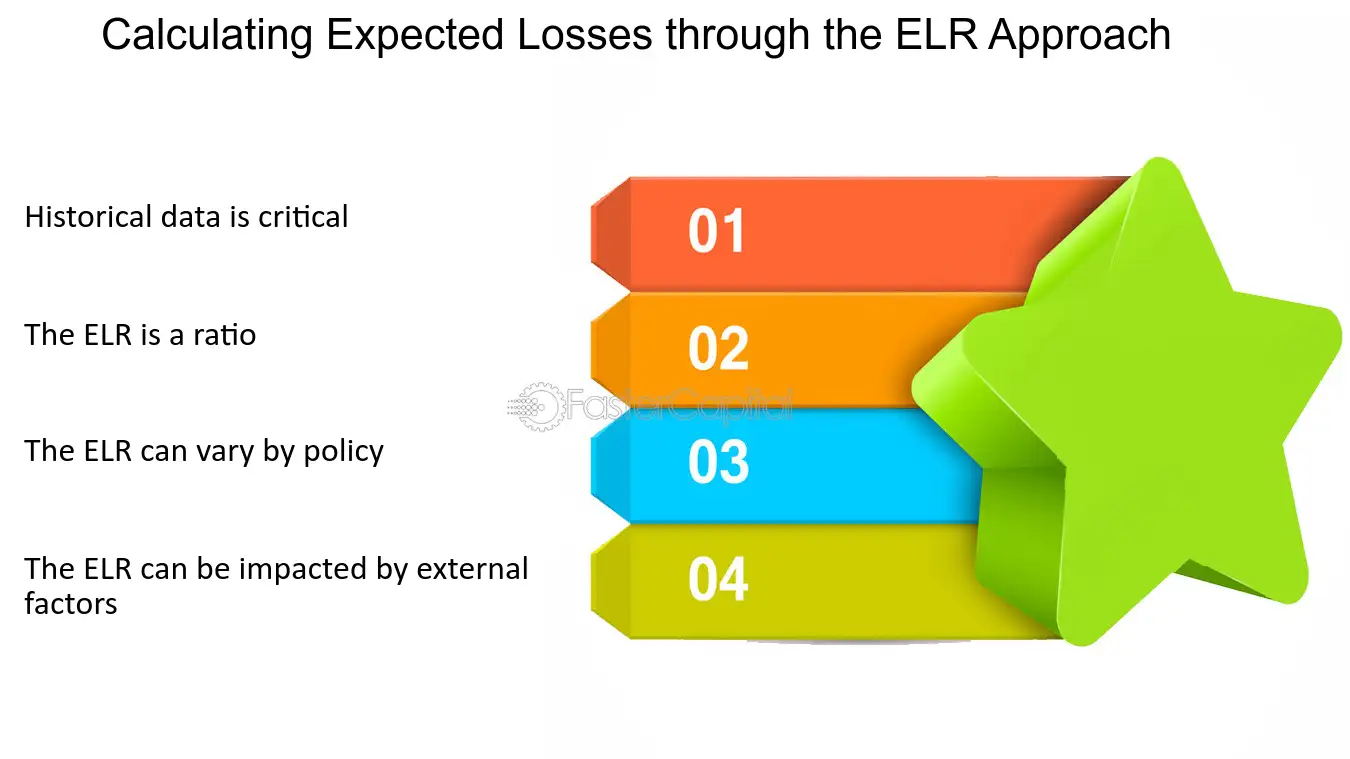

The ELR method involves calculating the expected loss ratio, which is the ratio of expected losses to the earned premiums. This ratio helps insurers assess the risk associated with a particular line of business or policy. By analyzing historical data and industry trends, insurers can estimate the likelihood and severity of potential losses.

Calculation of Expected Loss Ratio

The calculation of the expected loss ratio involves several steps:

- Estimating the expected losses: Using the historical loss data, insurers can estimate the average or expected losses for a given line of business or policy. This estimation takes into account factors such as inflation, changes in regulations, and emerging risks.

- Calculating the earned premiums: Insurers calculate the earned premiums by multiplying the written premiums by a factor that represents the portion of the policy term that has been completed.

- Determining the expected loss ratio: The expected loss ratio is calculated by dividing the estimated losses by the earned premiums. This ratio is expressed as a percentage.

The expected loss ratio is a critical factor in determining the premium rates for insurance policies. Insurers use this ratio, along with other factors such as expenses and profit margins, to set the appropriate premium rates that cover the expected losses and ensure the financial stability of the company.

Overall, the Expected Loss Ratio (ELR) method provides insurers with a quantitative tool to assess and manage risk in the insurance industry. By analyzing historical data and estimating potential losses, insurers can make informed decisions on pricing and underwriting policies.

Calculation Formulas for Corporate Insurance

- Expected Loss Ratio (ELR) Formula: The ELR is calculated by dividing the expected losses by the earned premiums. The formula is as follows:

ELR = (Expected Losses / Earned Premiums) x 100 - Expected Losses Formula: The expected losses can be calculated by multiplying the exposure base by the loss rate. The formula is as follows:

Expected Losses = Exposure Base x Loss Rate - Earned Premiums Formula: Earned premiums can be calculated by subtracting the unearned premiums from the total premiums. The formula is as follows:

- Exposure Base Formula: The exposure base represents the unit of measurement used to determine the potential losses. It can be calculated by multiplying the number of units by the unit value. The formula is as follows:

Exposure Base = Number of Units x Unit Value - Loss Rate Formula: The loss rate is the ratio of expected losses to the exposure base. It can be calculated by dividing the expected losses by the exposure base. The formula is as follows:

Loss Rate = (Expected Losses / Exposure Base) x 100

By using these calculation formulas, insurance companies can assess the risk associated with providing corporate insurance coverage and determine the appropriate premiums to charge their clients. These formulas provide a quantitative approach to estimating potential losses and help ensure that insurance companies remain financially stable while providing adequate coverage to their policyholders.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.