Macroeconomic Factors: Definition, Types, Examples, and Impact

Definition of Macroeconomic Factors

Macroeconomic factors refer to the broad indicators that impact the overall economic performance of a country or region. These factors are typically measured on a large scale and provide insights into the health and stability of the economy. They are influenced by both internal and external forces, including government policies, global economic trends, and market conditions.

Some of the key macroeconomic factors include:

- Gross Domestic Product (GDP): GDP is a measure of the total value of goods and services produced within a country’s borders during a specific period. It serves as an indicator of economic growth and is often used to compare the performance of different economies.

- Inflation: Inflation refers to the general increase in prices of goods and services over time. It erodes the purchasing power of money and can have a significant impact on consumers, businesses, and the overall economy.

- Unemployment: Unemployment measures the number of people who are actively seeking employment but are unable to find work. High unemployment rates can indicate a weak economy and have social and economic consequences.

- Interest Rates: Interest rates determine the cost of borrowing money and influence consumer spending, investment, and business activities. Central banks often use interest rates as a tool to control inflation and stimulate economic growth.

- Government Policies: Government policies, such as fiscal and monetary policies, can have a significant impact on the overall economy. These policies include taxation, government spending, and regulations, which can influence consumer behavior, business investment, and economic stability.

Types of Macroeconomic Factors

Macroeconomic factors can be classified into two main types: leading indicators and lagging indicators. Leading indicators provide insights into the future direction of the economy, while lagging indicators reflect the past performance.

Leading Indicators: Leading indicators are used to predict changes in the economy and provide early signals of economic trends. These indicators include stock market performance, consumer confidence, housing starts, and business investment. Analysts and policymakers closely monitor these indicators to anticipate economic shifts and make informed decisions.

Lagging Indicators: Lagging indicators, on the other hand, reflect the past performance of the economy. These indicators include unemployment rates, inflation rates, and GDP growth. They are useful for assessing the overall health of the economy and evaluating the effectiveness of past policies and actions.

Examples and Impact of Macroeconomic Factors

The impact of macroeconomic factors can be seen in various aspects of the economy. For example, a high GDP growth rate indicates a thriving economy with increased production and consumption. This can lead to job creation, higher wages, and improved living standards for the population.

On the other hand, high inflation rates can erode the purchasing power of consumers, leading to decreased consumer spending and business investment. This can result in economic slowdown or recession. Similarly, high unemployment rates can lead to social unrest and reduced consumer confidence, further affecting economic growth.

Government policies, such as changes in tax rates or interest rates, can also have a significant impact on the economy. For instance, a decrease in interest rates can encourage borrowing and stimulate consumer spending and business investment. Conversely, an increase in tax rates can reduce disposable income, leading to decreased consumer spending and economic activity.

Importance of Macroeconomic Factors

Macroeconomic factors provide insights into the health and stability of an economy. They help policymakers make informed decisions regarding monetary and fiscal policies to promote economic growth and stability. For example, if the inflation rate is high, policymakers may implement measures to control it, such as increasing interest rates. Similarly, if the unemployment rate is high, policymakers may introduce policies to stimulate job creation and reduce unemployment.

Measuring Macroeconomic Factors

Macroeconomic factors are typically measured using various economic indicators. These indicators provide quantitative data that can be analyzed to assess the state of the economy. Some commonly used indicators include:

| Indicator | Description |

|---|---|

| Gross Domestic Product (GDP) | The total value of goods and services produced within a country’s borders in a specific period. |

| Inflation Rate | The rate at which the general level of prices for goods and services is rising and, consequently, the purchasing power of currency is falling. |

| Unemployment Rate | The percentage of the labor force that is unemployed and actively seeking employment. |

| Interest Rates | The cost of borrowing money or the return on investment. |

| Exchange Rates | The value of one currency in relation to another currency. |

These indicators are often published by government agencies, central banks, and international organizations. Analysts and economists use this data to assess the current state of the economy, predict future trends, and make informed decisions.

Types of Macroeconomic Factors

Macroeconomic factors are the key variables that influence the overall performance of an economy. These factors can be broadly categorized into four main types:

1. Economic Growth Factors

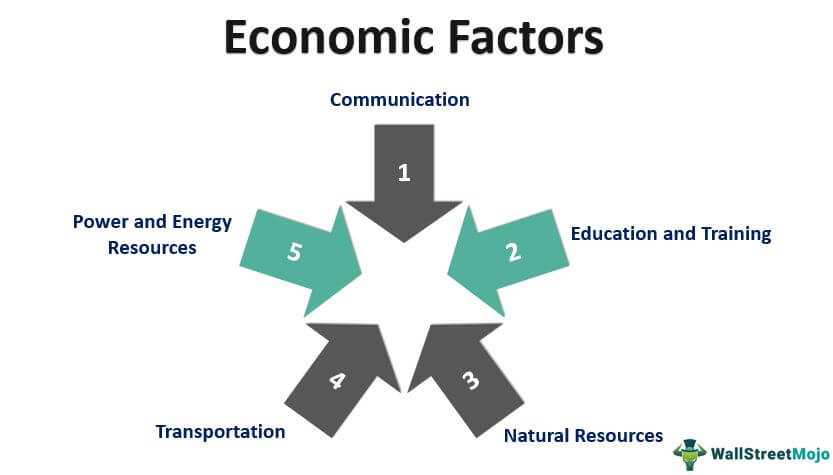

Economic growth factors refer to the conditions that contribute to the expansion of an economy over time. These factors include investment in physical and human capital, technological advancements, improvements in infrastructure, and favorable government policies. Economic growth factors play a crucial role in determining the overall health and prosperity of an economy.

2. Inflation Factors

Inflation factors refer to the conditions that affect the rate at which prices of goods and services increase over time. These factors include changes in the money supply, demand and supply imbalances, changes in production costs, and government policies. Inflation factors have a significant impact on the purchasing power of consumers and the profitability of businesses.

3. Unemployment Factors

Unemployment factors refer to the conditions that determine the level of joblessness in an economy. These factors include changes in labor market conditions, technological advancements, changes in demand for goods and services, and government policies. Unemployment factors have a direct impact on the standard of living and social well-being of individuals.

4. Fiscal and Monetary Policy Factors

Fiscal and monetary policy factors refer to the actions taken by the government and central bank to manage the overall performance of the economy. Fiscal policy factors include government spending, taxation, and borrowing, while monetary policy factors include interest rates, money supply, and exchange rates. These factors play a crucial role in influencing economic growth, inflation, and unemployment rates.

Examples and Impact of Macroeconomic Factors

Macroeconomic factors can have a significant impact on the overall economy and various sectors within it. Here are some examples of macroeconomic factors and their effects:

- Interest Rates: Changes in interest rates can have a profound impact on borrowing costs for individuals and businesses. When interest rates are low, it becomes cheaper to borrow money, which can stimulate spending and investment. Conversely, high interest rates can discourage borrowing and slow down economic growth.

- Inflation: Inflation refers to the general increase in prices over time. Moderate inflation can be beneficial as it encourages spending and investment. However, high inflation erodes the purchasing power of consumers and can lead to economic instability.

- Unemployment: The level of unemployment in an economy is a crucial macroeconomic factor. High unemployment rates indicate a lack of job opportunities and can lead to reduced consumer spending and economic stagnation. Conversely, low unemployment rates signify a healthy job market and increased consumer confidence.

- Government Spending: Government spending plays a significant role in stimulating economic growth. Increased government spending on infrastructure projects, education, and healthcare can create jobs and boost economic activity. However, excessive government spending can lead to budget deficits and inflationary pressures.

- Exchange Rates: Exchange rates determine the value of one currency relative to another. Fluctuations in exchange rates can impact international trade and investment. A strong domestic currency can make exports more expensive and imports cheaper, which can negatively affect a country’s trade balance. On the other hand, a weak currency can make exports cheaper and imports more expensive, potentially boosting exports and narrowing the trade deficit.

- Consumer Confidence: Consumer confidence reflects the sentiment and expectations of consumers regarding the overall state of the economy. High consumer confidence levels indicate optimism and a willingness to spend, which can drive economic growth. Conversely, low consumer confidence can lead to reduced spending and economic contraction.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.