What is London Interbank Bid Rate (Libid)?

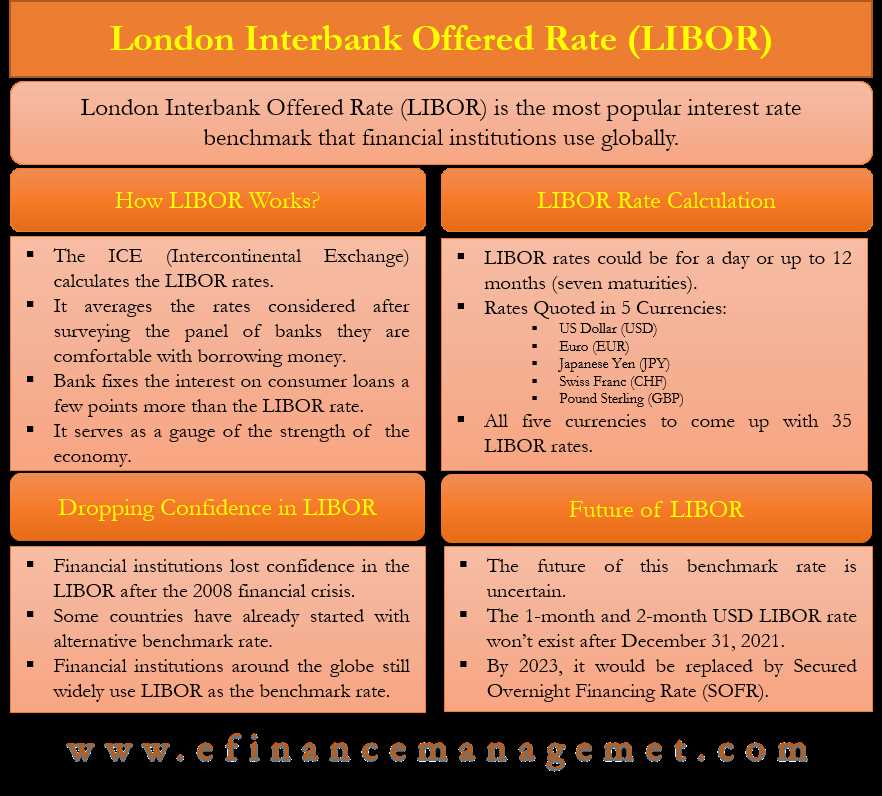

The London Interbank Bid Rate (Libid) is a key interest rate used in the financial industry. It represents the rate at which banks are willing to borrow funds from each other in the London interbank market. Libid is an important benchmark rate that influences various financial transactions and products.

Libid is a measure of the cost of funds for banks. It is calculated based on the rates at which banks submit their bids to borrow funds from other banks. The rate is determined by the supply and demand dynamics in the interbank market.

Libid is typically used as a reference rate for short-term lending and borrowing transactions between banks. It is commonly used in the calculation of interest rates for financial products such as loans, derivatives, and bonds.

Utilizing London Interbank Bid Rate (Libid)

Financial institutions and market participants utilize Libid in various ways:

| 1. Pricing Financial Products | Libid serves as a benchmark for pricing financial products, especially those with short-term maturities. The rate is used as a reference point to determine the interest rates charged on loans and other financial instruments. |

| 2. Risk Management | Libid is used in risk management strategies to assess the cost of borrowing and lending funds. It helps financial institutions in evaluating the profitability and risk associated with their lending and borrowing activities. |

| 3. Market Analysis | Libid is closely monitored by market participants as an indicator of market conditions and liquidity. Changes in Libid can reflect changes in the overall health of the financial system and can influence market sentiment. |

Overall, Libid plays a crucial role in the functioning of the financial system by providing a benchmark for short-term borrowing and lending rates. It is an important tool for financial institutions and market participants in managing their interest rate risk and making informed investment decisions.

Stay tuned for the next sections of this article, where we will explore the benefits and applications of the London Interbank Bid Rate (Libid) in more detail.

What is Libid?

Libid is a benchmark interest rate that is used as a reference for various financial transactions. It is calculated based on the average interest rates at which a panel of banks in London is willing to lend to each other. The rate is typically quoted for various currencies and different maturities, ranging from overnight to one year.

Importance of Libid

Libid is an important indicator of the overall health of the banking system and the liquidity in the market. It reflects the confidence that banks have in each other’s creditworthiness and their willingness to lend. Changes in Libid can have a significant impact on borrowing costs for financial institutions, which in turn can affect interest rates for loans and other financial products.

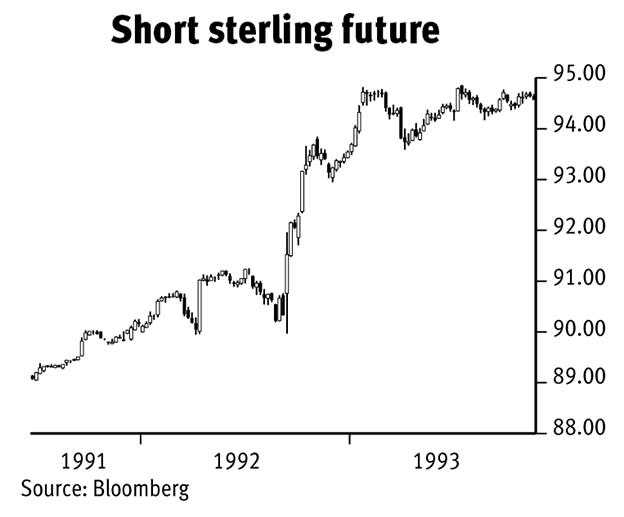

Furthermore, Libid serves as a reference rate for various financial instruments, such as floating-rate notes, interest rate swaps, and futures contracts. These instruments are priced based on Libid, making it a crucial factor in determining their value.

Factors Affecting Libid

Several factors can influence Libid. The most important factor is the supply and demand dynamics in the interbank lending market. If there is a high demand for funds, Libid is likely to increase as banks compete to borrow. On the other hand, if there is excess liquidity in the market, Libid may decrease.

Other factors that can impact Libid include changes in monetary policy set by central banks, economic indicators, and market sentiment. For example, if the central bank raises interest rates, it can lead to an increase in Libid as borrowing becomes more expensive.

Interpreting Libid

Libid is typically quoted as a percentage, representing the annualized interest rate. A higher Libid indicates tighter credit conditions and higher borrowing costs, while a lower Libid suggests looser credit conditions and lower borrowing costs.

Investors and financial institutions closely monitor Libid as it provides insights into the overall market conditions and can help them make informed decisions. For example, if Libid is rising, it may indicate that banks are becoming more cautious and that credit conditions are tightening. This could prompt investors to adjust their investment strategies accordingly.

Conclusion

Utilizing London Interbank Bid Rate (Libid)

1. Assessing the Financial Market

Libid can be used as an indicator to assess the overall health and stability of the financial market. By monitoring the Libid rates, investors and financial institutions can gauge the level of liquidity and the prevailing market conditions. This information can help in making informed investment decisions and managing risks.

2. Evaluating Borrowing Costs

3. Managing Interest Rate Risk

Libid can also be utilized to manage interest rate risk. Individuals and businesses with existing loans or investments that are tied to Libid can monitor the rate movements to assess the potential impact on their financial positions. This information can help in developing strategies to mitigate the risks associated with interest rate fluctuations.

4. Trading and Investment Opportunities

Libid rates can provide trading and investment opportunities for individuals and financial institutions. By analyzing the Libid rates and their relationship with other key interest rates, investors can identify potential arbitrage opportunities and make profitable trades. Additionally, Libid rates can also influence the pricing and performance of various financial instruments, such as bonds and derivatives, providing opportunities for investors to capitalize on market inefficiencies.

5. International Financial Transactions

Benefits and Applications of the Key Interest Rate

1. Benchmark for Interest Rates

The Libid serves as an important benchmark for other interest rates. It is used as a reference rate for pricing and valuing various financial instruments, such as loans, bonds, and derivatives. By using the Libid as a benchmark, financial institutions can determine the interest rates they offer to their customers and assess the risk associated with different financial products.

2. Risk Management

The Libid is also used for risk management purposes. Financial institutions use this rate to calculate the cost of borrowing and lending funds in the interbank market. By monitoring the Libid, banks can assess the liquidity and stability of the market and make informed decisions about their lending and investment activities. It helps them manage their exposure to interest rate fluctuations and mitigate potential risks.

3. Investment Decision Making

Investors and fund managers rely on the Libid to make informed investment decisions. By analyzing the Libid, they can assess the overall market conditions and identify potential investment opportunities. The rate provides valuable insights into the state of the economy and the financial sector, helping investors allocate their funds effectively and maximize their returns.

4. Monetary Policy Analysis

The Libid is closely monitored by central banks and policymakers as it reflects the overall health of the financial system. By analyzing the Libid, central banks can assess the effectiveness of their monetary policies and make necessary adjustments to maintain price stability and promote economic growth. The rate provides valuable information about the supply and demand dynamics in the interbank market, helping policymakers shape their decisions.

5. Market Transparency

The availability of the Libid rate enhances market transparency. It allows market participants to access reliable and up-to-date information about the cost of borrowing and lending funds in the interbank market. This transparency fosters competition and efficiency in the financial markets, benefiting both borrowers and lenders. It also promotes trust and confidence among market participants, contributing to the overall stability of the financial system.

| Benefits | Applications |

|---|---|

| 1. Benchmark for interest rates | 1. Pricing and valuing financial instruments |

| 2. Risk management | 2. Calculating borrowing and lending costs |

| 3. Investment decision making | 3. Assessing market conditions |

| 4. Monetary policy analysis | 4. Evaluating the effectiveness of policies |

| 5. Market transparency | 5. Enhancing competition and efficiency |

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.