Leveraged Employee Stock Ownership Plan (LESOP) Overview

A Leveraged Employee Stock Ownership Plan (LESOP) is a type of employee benefit plan that allows employees to become owners of the company they work for by purchasing company stock. This plan is designed to provide employees with a stake in the company’s success and to align their interests with those of the shareholders.

Key Features of LESOP:

1. Employee Ownership: LESOP allows employees to own company stock, giving them a sense of ownership and motivation to contribute to the company’s growth and profitability.

2. Tax Advantages: LESOP provides tax advantages for both the company and the employees. Contributions made to the plan are tax-deductible for the company, and employees can defer taxes on their contributions until they withdraw the funds.

3. Leveraged Financing: LESOPs often involve borrowing money to purchase company stock, allowing employees to acquire more shares than they could with their own funds. This leverage can increase the potential return on investment for employees.

4. Vesting Schedule: LESOPs typically have a vesting schedule that determines when employees become fully vested in the company stock. This encourages long-term commitment and loyalty to the company.

Benefits of LESOP:

1. Employee Engagement: LESOPs can increase employee engagement and loyalty by giving employees a sense of ownership and a stake in the company’s success.

2. Retention and Recruitment: LESOPs can be an attractive benefit for both current and prospective employees, helping the company attract and retain top talent.

3. Tax Savings: LESOPs provide tax advantages for both the company and the employees, reducing the tax burden for both parties.

4. Wealth Accumulation: LESOPs can help employees build wealth over time through the appreciation of company stock and potential dividends.

How LESOP Works:

1. Contribution: The company contributes funds to the LESOP, which are used to purchase company stock on behalf of the employees.

2. Employee Contributions: Employees may also have the option to contribute a portion of their salary to the LESOP, further increasing their ownership stake in the company.

3. Stock Purchase: The LESOP uses the contributed funds to purchase company stock, either directly from the company or from existing shareholders.

4. Vesting: Employees typically become vested in the company stock over a period of time, incentivizing long-term commitment to the company.

5. Distribution: When employees leave the company or retire, they can sell their vested shares back to the company or to other employees, providing them with a source of income.

Overall, a Leveraged Employee Stock Ownership Plan (LESOP) offers a range of benefits for both employees and the company, promoting employee engagement, loyalty, and wealth accumulation. It is a valuable tool for companies looking to incentivize and reward their employees while aligning their interests with those of the shareholders.

Benefits of LESOP

Implementing a Leveraged Employee Stock Ownership Plan (LESOP) can provide numerous benefits for both employees and employers. Here are some key advantages:

1. Retirement Savings

2. Tax Advantages

LESOP offers attractive tax benefits for both employees and employers. Contributions made by employees to the plan are tax-deductible, reducing their taxable income. Employers can also enjoy tax deductions for contributions made to the plan.

3. Employee Ownership

LESOP promotes a sense of ownership and loyalty among employees. By giving them a stake in the company’s success, employees are more motivated to work hard and contribute to the company’s growth. This can lead to increased productivity and improved overall performance.

4. Wealth Accumulation

5. Employee Engagement

LESOP can enhance employee engagement and satisfaction. By providing employees with a stake in the company’s success, they feel more connected to the organization and are more likely to be committed and loyal. This can result in higher employee morale and lower turnover rates.

6. Succession Planning

LESOP can be an effective tool for succession planning. By gradually transferring ownership to employees, business owners can ensure a smooth transition of leadership and maintain the continuity of the company’s operations.

Overall, implementing a LESOP can have a positive impact on both employees and employers, fostering a culture of ownership, loyalty, and long-term financial security.

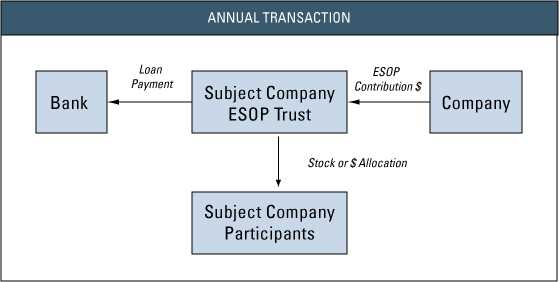

How LESOP Works

The Leveraged Employee Stock Ownership Plan (LESOP) is a unique retirement benefit program that allows employees to become owners of the company they work for. It is a long-term investment strategy that provides employees with the opportunity to accumulate wealth and share in the success of the company.

1. Contribution

Under the LESOP, employees can contribute a portion of their salary towards purchasing company stock. These contributions are made on a pre-tax basis, which means that employees can reduce their taxable income by participating in the plan.

2. Company Contribution

In addition to employee contributions, the company also contributes to the LESOP. This contribution can be in the form of cash or company stock. The company’s contribution helps to leverage the employee’s investment and increase the overall value of the plan.

3. Stock Purchase

Once the contributions are made, the LESOP uses the funds to purchase company stock on behalf of the employees. The stock is held in a trust, and the employees become beneficial owners of the shares. The value of the stock can increase over time, providing employees with potential capital gains.

4. Vesting

Vesting refers to the process by which employees become entitled to the company’s contributions to their LESOP accounts. The vesting schedule determines how long employees must work for the company before they are fully vested in the plan. Once fully vested, employees have complete ownership of the company stock in their LESOP accounts.

5. Distribution

Employees can begin to receive distributions from their LESOP accounts once they reach the age of retirement or meet certain other eligibility criteria. The distributions can be taken as cash or as company stock, providing employees with flexibility in how they access their retirement savings.

| Advantages of LESOP |

|---|

| 1. Tax advantages: Employee contributions are made on a pre-tax basis, reducing taxable income. |

| 2. Ownership stake: Employees have the opportunity to become owners of the company they work for. |

| 3. Long-term investment: LESOP is a retirement benefit program that helps employees accumulate wealth over time. |

| 4. Potential for capital gains: The value of the company stock held in the LESOP can increase, providing employees with potential capital gains. |

| 5. Flexibility in distributions: Employees can choose to receive distributions in cash or as company stock. |

Eligibility and Participation

Participating in the Leveraged Employee Stock Ownership Plan (LESOP) is a valuable opportunity for employees to become owners of the company they work for. However, not all employees may be eligible to participate in the LESOP. Here are the key factors that determine eligibility:

1. Length of Employment

Employees must have completed a minimum period of employment, typically one year, to be eligible for participation in the LESOP. This requirement ensures that employees have a vested interest in the long-term success of the company.

2. Full-Time Employment Status

Only full-time employees are eligible to participate in the LESOP. Part-time or temporary employees may not meet the eligibility criteria. This ensures that employees who are fully committed to the company’s success can benefit from the plan.

Once an employee meets the eligibility criteria, they can actively participate in the LESOP. Participation involves several steps:

1. Enrollment

Employees who meet the eligibility criteria will be provided with enrollment forms to officially join the LESOP. These forms will require personal information, such as name, address, and social security number, to ensure accurate record-keeping.

2. Contribution Elections

After enrolling in the LESOP, employees will need to make contribution elections. This involves deciding how much of their salary they want to contribute to the plan. The employer may also offer a matching contribution, further increasing the employee’s ownership stake in the company.

3. Vesting Schedule

The LESOP typically has a vesting schedule, which determines when employees become fully vested in their shares. Vesting refers to the employee’s ownership rights and the ability to sell or transfer their shares. The vesting schedule may be based on years of service or a graded schedule, gradually increasing ownership over time.

By meeting the eligibility criteria and actively participating in the LESOP, employees can enjoy the benefits of employee ownership, including potential long-term financial growth and a sense of pride in being a part-owner of the company.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.