What is an Employee Stock Ownership Plan (ESOP)?

An Employee Stock Ownership Plan (ESOP) is a type of retirement plan that allows employees to become owners of the company they work for. It is a unique and powerful tool that provides employees with a stake in the company’s success and helps to align their interests with those of the company’s shareholders.

Under an ESOP, employees are given the opportunity to acquire shares of company stock, either through direct purchase or as part of their compensation package. These shares are held in a trust on behalf of the employees, and the value of the shares is determined by the performance of the company.

ESOPs are typically established by privately held companies, but they can also be found in some publicly traded companies. They are governed by specific rules and regulations set forth by the Internal Revenue Service (IRS) and the Department of Labor (DOL).

In addition to providing a retirement savings vehicle, ESOPs also offer tax advantages for both the company and the employees. Contributions made to the ESOP are tax-deductible for the company, and employees can defer taxes on the value of the shares until they are distributed.

Overall, an ESOP is a powerful tool that can help companies attract and retain top talent, while also providing employees with a valuable retirement savings option. It is a win-win situation that can benefit both the company and its employees in the long run.

An Employee Stock Ownership Plan (ESOP) is a type of retirement plan that allows employees to become owners of the company they work for. It is a unique way for employees to share in the company’s success and build wealth for their future.

Here are some key points to understand about ESOPs:

- Retirement Savings: ESOPs are designed to help employees save for retirement. Contributions to the ESOP are made by the company on behalf of the employees, and these contributions are tax-deductible for the company.

- Employee Benefits: ESOPs offer a range of benefits to employees, including potential tax advantages, diversification of retirement savings, and the opportunity to share in the company’s success.

- Employee Engagement: ESOPs can help increase employee engagement and loyalty. When employees have a stake in the company, they are more likely to be motivated and committed to its success.

The Benefits of an ESOP

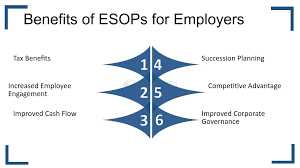

An Employee Stock Ownership Plan (ESOP) offers numerous benefits for both employees and employers. Here are some of the key advantages:

- Ownership Stake: With an ESOP, employees have the opportunity to become owners of the company they work for. This sense of ownership can lead to increased motivation, loyalty, and commitment.

- Employee Engagement: ESOPs can foster a culture of employee engagement and participation. When employees have a stake in the company’s success, they are more likely to be actively involved in decision-making processes and contribute their ideas and expertise.

- Succession Planning: ESOPs can be an effective tool for business owners who are looking to transition out of their role and pass on the company to the next generation of leaders. By selling their shares to the ESOP, owners can ensure the long-term stability and continuity of the business.

- Competitive Advantage: Offering an ESOP can give companies a competitive edge in attracting and retaining top talent. Many employees value the opportunity to become owners and participate in the company’s success, which can help companies attract and retain skilled and motivated employees.

In summary, an ESOP provides a range of benefits, including ownership stake, retirement savings, tax advantages, employee engagement, succession planning, and a competitive advantage. Implementing an ESOP can be a strategic decision that benefits both employees and employers in the long run.

The Benefits of an ESOP for Retirement Planning

An Employee Stock Ownership Plan (ESOP) can be a valuable tool for retirement planning. It offers several benefits that can help employees secure their financial future.

| 1. Tax Advantages: | Contributions made to an ESOP are tax-deductible for the company, and employees can defer taxes on the contributions until they withdraw the funds. |

| 2. Retirement Income: | |

| 3. Company Growth: | |

| 4. Employee Engagement: | When employees have a stake in the company through an ESOP, they are more likely to be engaged and motivated. This can lead to increased productivity and a stronger company culture. |

| 5. Diversification: |

Overall, an ESOP offers employees the opportunity to build wealth, secure a reliable retirement income, and have a vested interest in the success of their company. It is an attractive option for retirement planning and can provide long-term financial security.

The Mechanics of an ESOP

An Employee Stock Ownership Plan (ESOP) is a retirement benefit plan that allows employees to become owners of the company they work for. This unique plan is designed to provide employees with a stake in the company’s success and incentivize them to work towards its growth and profitability.

Here is a breakdown of how an ESOP works:

1. Contribution

The company contributes shares of its stock to the ESOP on behalf of the employees. These shares are allocated to individual employee accounts based on their compensation or length of service.

2. Vesting

Employees become vested in their ESOP accounts over a period of time, typically through a vesting schedule. Vesting means that the employee has earned the right to the shares in their account and can take ownership of them even if they leave the company before retirement.

3. Valuation

The value of the shares in the ESOP is determined by an independent appraiser who assesses the fair market value of the company. This valuation is important for determining the worth of the employee’s ESOP account.

4. Dividends

If the company pays dividends to its shareholders, those dividends are passed through to the ESOP participants. This allows employees to benefit from the company’s profitability and receive additional shares or cash in their accounts.

5. Distribution

When an employee reaches retirement age or leaves the company, they can begin to receive distributions from their ESOP account. The distribution can be in the form of cash or company stock, depending on the rules of the plan.

6. Tax Benefits

One of the advantages of an ESOP is the potential for tax benefits. Contributions made by the company to the ESOP are tax-deductible, and employees can defer taxes on their ESOP distributions until they actually receive them.

Overall, an ESOP provides employees with a unique opportunity to share in the success of the company they work for and build wealth for their retirement. It aligns the interests of employees and shareholders, creating a win-win situation for everyone involved.

| Benefits of an ESOP | Mechanics of an ESOP |

|---|---|

| Ownership stake in the company | Contribution of company stock |

| Retirement savings and wealth accumulation | Vesting and distribution of shares |

| Tax benefits for both the company and employees | Valuation and dividends |

The Mechanics of an ESOP

An Employee Stock Ownership Plan (ESOP) is a retirement plan that allows employees to become owners of the company they work for. The mechanics of an ESOP involve several steps and processes that ensure the smooth operation of the plan.

1. Establishment of the ESOP

The first step in the mechanics of an ESOP is the establishment of the plan. This involves creating a trust that will hold the company’s stock on behalf of the employees. The company then contributes shares of its stock to the trust, which are allocated to individual employee accounts based on their compensation or length of service.

2. Vesting of Employee Accounts

Once the shares are allocated to employee accounts, they are subject to a vesting schedule. Vesting determines the ownership rights of the employees over the shares. Typically, employees become fully vested in their accounts over a period of time, such as five years. This means that if an employee leaves the company before becoming fully vested, they may forfeit a portion of their shares.

3. Valuation of Company Stock

Another important aspect of the mechanics of an ESOP is the valuation of the company’s stock. The stock must be valued periodically to determine its fair market value. This valuation is important for various purposes, such as determining the value of employee accounts, making distributions, and complying with regulatory requirements.

4. Distributions to Employees

When employees reach retirement age or become eligible for distributions, they can receive their share of the company stock. These distributions can be made in the form of cash or stock, depending on the rules of the ESOP. Employees can choose to sell their shares back to the company or hold onto them as a long-term investment.

5. Tax Benefits

One of the key benefits of an ESOP is the tax advantages it offers to both the company and the employees. Contributions made by the company to the ESOP are tax-deductible, and employees can defer taxes on the stock they receive until they sell it. Additionally, if employees hold onto the stock for at least five years, they may be eligible for certain tax benefits, such as capital gains tax deferral or exemption.

| Step | Description |

|---|---|

| 1 | Establishment of the ESOP |

| 2 | Vesting of Employee Accounts |

| 3 | Valuation of Company Stock |

| 4 | Distributions to Employees |

| 5 | Tax Benefits |

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.