Internal Revenue Code Definition

The Internal Revenue Code (IRC) is a comprehensive set of laws that governs the taxation of individuals, businesses, and other entities in the United States. It is the primary source of federal tax law and is enforced by the Internal Revenue Service (IRS).

What It Covers

The Internal Revenue Code covers a wide range of tax-related topics, including income taxes, estate taxes, gift taxes, excise taxes, and employment taxes. It provides rules and regulations for determining taxable income, calculating tax liabilities, and reporting and paying taxes.

Specifically, the IRC covers:

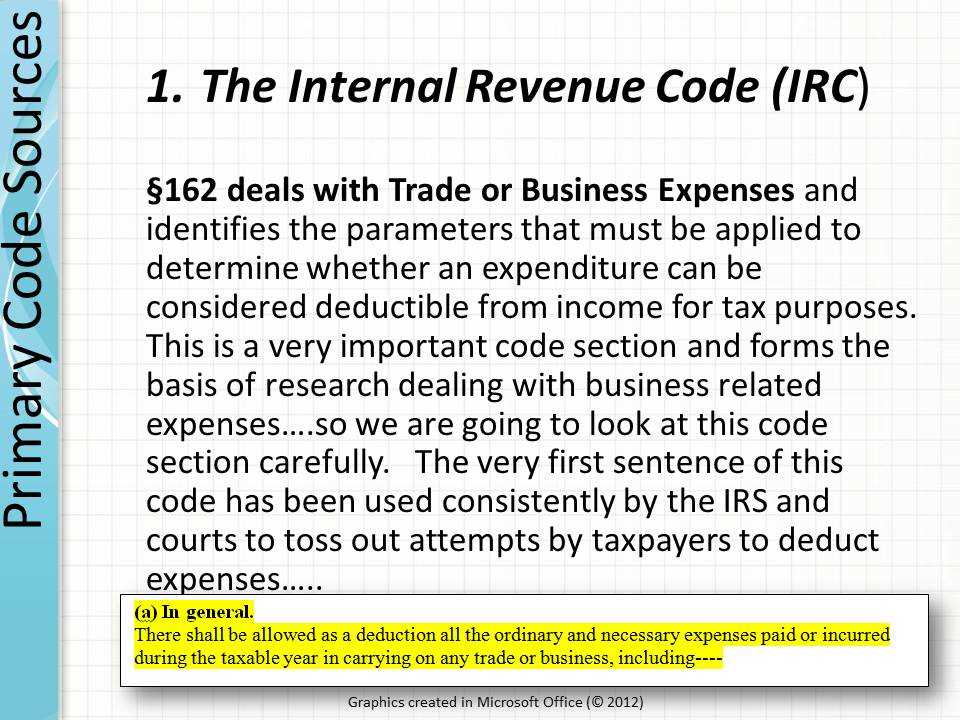

- Income Taxes: The IRC defines what constitutes taxable income and provides guidelines for determining deductions, exemptions, and credits.

- Estate and Gift Taxes: The IRC establishes rules for taxing the transfer of wealth through estates and gifts.

- Excise Taxes: The IRC imposes taxes on specific goods and services, such as alcohol, tobacco, and gasoline.

- Employment Taxes: The IRC governs the collection of taxes from employers and employees, including Social Security and Medicare taxes.

In addition to these major areas, the Internal Revenue Code also covers topics such as tax penalties, tax-exempt organizations, tax shelters, and international taxation.

History of the Internal Revenue Code

The Internal Revenue Code has a long and complex history. It traces its roots back to the Revenue Act of 1862, which was enacted to fund the Union’s efforts during the Civil War. Since then, the code has undergone numerous revisions and amendments to adapt to changing economic conditions and tax policies.

One of the most significant revisions occurred in 1986 with the Tax Reform Act, which simplified the tax code and lowered tax rates. Since then, there have been additional changes and updates to the code, including the Tax Cuts and Jobs Act of 2017.

Overall, the Internal Revenue Code is a constantly evolving body of law that plays a crucial role in the administration of the U.S. tax system.

What It Covers

The Internal Revenue Code (IRC) is a comprehensive set of tax laws and regulations that govern the administration and enforcement of federal taxes in the United States. It covers a wide range of tax-related topics, including income taxes, estate and gift taxes, excise taxes, payroll taxes, and more.

One of the main purposes of the Internal Revenue Code is to provide guidelines for determining taxable income and calculating the amount of tax owed. It outlines the rules for determining what types of income are subject to taxation and how deductions, credits, and exemptions can be applied to reduce the tax liability.

In addition, the Internal Revenue Code includes provisions for tax enforcement and penalties for non-compliance. It establishes the powers and responsibilities of the Internal Revenue Service (IRS), the federal agency responsible for administering and enforcing the tax laws. The IRC also outlines the procedures for audits, appeals, and collection activities.

Overall, the Internal Revenue Code is a complex and extensive body of law that plays a crucial role in the functioning of the U.S. tax system. It provides the framework for the collection of federal taxes and ensures that taxpayers comply with their tax obligations.

History of the Internal Revenue Code

The Internal Revenue Code (IRC) has a long and complex history that dates back to the founding of the United States. The roots of the IRC can be traced back to the Revenue Act of 1861, which was enacted to fund the Union’s efforts during the Civil War. This act introduced the concept of an income tax, although it was initially only applicable to individuals earning over $800 per year.

Over the years, the IRC has undergone numerous revisions and amendments to adapt to changing economic conditions and societal needs. One of the most significant changes occurred in 1913 with the ratification of the 16th Amendment to the Constitution, which granted Congress the power to levy an income tax without apportionment among the states.

Following the ratification of the 16th Amendment, the Revenue Act of 1913 was passed, establishing the modern income tax system. This act introduced the concept of progressive taxation, where individuals with higher incomes are subject to higher tax rates. It also expanded the scope of taxable income to include dividends, interest, and capital gains.

Since then, the IRC has continued to evolve through various acts and legislative changes. Some notable milestones include the introduction of withholding taxes during World War II, the creation of the Internal Revenue Service (IRS) in 1953, and the implementation of the Tax Reform Act of 1986, which simplified the tax code and lowered tax rates.

Today, the IRC is a comprehensive body of tax laws that covers a wide range of topics, including income taxes, estate and gift taxes, corporate taxes, and excise taxes. It is constantly updated and amended by Congress to address new tax issues and policy changes.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.