What is an Insurance Underwriter?

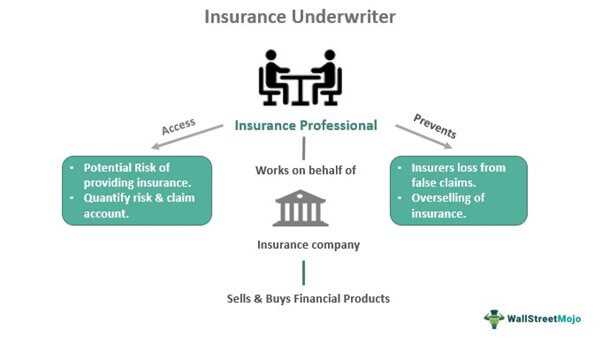

An insurance underwriter is a professional who assesses and evaluates the risks associated with insuring individuals or businesses. They play a crucial role in the insurance industry by determining the terms and conditions of insurance policies and deciding whether to accept or reject applications for coverage.

Responsibilities

Insurance underwriters have several key responsibilities:

- Reviewing insurance applications and supporting documents

- Analyzing data and information to assess risk

- Evaluating the financial status and creditworthiness of applicants

- Determining the appropriate coverage and premium rates

- Collaborating with other professionals, such as actuaries and claims adjusters

- Monitoring and reviewing existing policies to ensure they remain profitable

- Staying up to date with industry trends and regulatory changes

Overall, insurance underwriters play a critical role in the insurance industry by ensuring that policies are priced appropriately and that the risks associated with insuring individuals or businesses are properly managed.

Definition and Responsibilities

The responsibilities of an insurance underwriter include:

- Evaluating insurance applications and determining the level of risk involved

- Reviewing and analyzing applicant’s information, such as medical records, financial statements, and credit reports

- Assessing the potential for losses and determining the appropriate coverage and premium rates

- Collaborating with other professionals, such as actuaries and claims adjusters, to gather additional information and make informed decisions

- Keeping up-to-date with industry trends, regulations, and changes in underwriting guidelines

- Communicating with insurance agents and brokers to clarify information and address any concerns or questions

- Ensuring compliance with company policies, procedures, and underwriting guidelines

- Maintaining accurate records and documentation of underwriting decisions and related information

Overall, insurance underwriters play a crucial role in managing risk for insurance companies and ensuring that policies are priced appropriately based on the level of risk involved. They must have strong analytical and decision-making skills, as well as excellent attention to detail and the ability to effectively communicate complex information to various stakeholders.

Key Skills and Qualifications

2. Analytical Skills: Underwriters must be able to analyze complex data, assess risks, and make informed decisions. They should have strong analytical skills to evaluate the financial stability of individuals or businesses applying for insurance coverage.

3. Attention to Detail: Accuracy is crucial in the underwriting process. Underwriters need to pay close attention to details, such as policy terms, coverage limits, and exclusions, to ensure that insurance policies are accurately written and reflect the needs of the insured.

4. Communication Skills: Effective communication is essential for insurance underwriters. They need to communicate with insurance agents, brokers, and clients to gather information, explain underwriting decisions, and negotiate terms. Strong written and verbal communication skills are necessary to convey complex information clearly and concisely.

5. Risk Assessment: Underwriters must have the ability to assess risks accurately. They need to evaluate various factors, such as an individual’s health history, driving record, or a business’s financial statements, to determine the likelihood of a claim and set appropriate premium rates.

6. Decision-Making: Underwriters make critical decisions that impact the profitability and sustainability of insurance companies. They should have good judgment and the ability to weigh risks and rewards when making underwriting decisions.

7. Computer Skills: Insurance underwriters use various software applications and databases to analyze data, generate quotes, and manage policies. Proficiency in using computer programs and technology is essential for efficient underwriting processes.

8. Ethical Conduct: Underwriters must adhere to ethical standards and guidelines set by the insurance industry. They should prioritize the interests of the insured while ensuring the financial stability of the insurance company.

Requirements for the Role

Being an insurance underwriter requires a specific set of skills and qualifications. Here are some of the key requirements for the role:

Educational Background

Most insurance underwriter positions require a bachelor’s degree in finance, business, economics, or a related field. Some employers may also consider candidates with an associate’s degree or relevant work experience.

Industry Knowledge

Analytical Skills

As an insurance underwriter, you will need strong analytical skills to evaluate risk and make informed decisions. You should be able to analyze data, assess potential risks, and determine the appropriate coverage and premiums for each policy.

Attention to Detail

Attention to detail is crucial in insurance underwriting. You will need to review and analyze complex documents, such as insurance applications and medical records, to accurately assess risk and determine policy terms.

Communication Skills

Effective communication is essential for insurance underwriters. You will need to communicate with insurance agents, clients, and other professionals to gather information, explain underwriting decisions, and negotiate policy terms.

Computer Skills

Insurance underwriters use various software and tools to analyze data, calculate premiums, and generate reports. Proficiency in computer skills, including spreadsheet and database software, is important for this role.

Job Outlook and Salary

As an insurance underwriter, you can expect a promising job outlook in the coming years. The demand for insurance underwriters is expected to grow steadily, driven by the need for insurance coverage in various sectors such as healthcare, finance, and real estate.

According to the Bureau of Labor Statistics, the employment of insurance underwriters is projected to decline by 5 percent from 2019 to 2029. This decline is mainly due to advancements in technology, which have automated many underwriting processes. However, there will still be a need for skilled underwriters to evaluate complex risks and make informed decisions.

Keep in mind that the salary can vary depending on factors such as experience, location, and the type of insurance being underwritten. For example, underwriters working in metropolitan areas or for large insurance companies may earn higher salaries compared to those in rural areas or smaller firms.

Overall, a career as an insurance underwriter offers stability, growth opportunities, and a competitive salary. If you have strong analytical skills, attention to detail, and the ability to assess risk, this profession may be a great fit for you.

Career Opportunities and Earnings

As an insurance underwriter, you will have various career opportunities in the insurance industry. You can work for insurance companies, brokerage firms, or consulting firms. Additionally, you may also find employment in government agencies or risk management departments of corporations.

Insurance underwriters are in high demand, and the job outlook for this profession is positive. With the increasing complexity of insurance policies and the need for accurate risk assessment, the demand for skilled underwriters is expected to grow.

Salary Range

The salary range for insurance underwriters can vary significantly. Entry-level underwriters can expect to earn around $40,000 to $50,000 per year. With experience and expertise, the salary can increase to $70,000 to $100,000 or more annually. Senior underwriters or those in managerial positions can earn even higher salaries, often exceeding $100,000 per year.

Additional Benefits

In addition to a competitive salary, insurance underwriters often receive benefits such as health insurance, retirement plans, and paid time off. Some companies may also offer bonuses or commission-based incentives based on performance. These benefits can further enhance the overall compensation package for insurance underwriters.

| Pros | Cons |

|---|---|

| High earning potential | Requires attention to detail |

| Opportunities for career advancement | Can be a high-stress job |

| Job stability and demand | May require long hours |

| Benefits and bonuses | Constant need for learning and staying updated |

Overall, a career as an insurance underwriter offers a promising future with opportunities for growth and a competitive salary. If you have strong analytical skills, attention to detail, and an interest in the insurance industry, becoming an insurance underwriter could be a rewarding career choice.

How to Become an Insurance Underwriter

If you are interested in pursuing a career as an insurance underwriter, there are several steps you can take to increase your chances of success.

Educational Requirements

Most insurance underwriter positions require a bachelor’s degree in finance, business, or a related field. Some employers may also prefer candidates who have a degree in risk management or insurance. It is important to choose a program that provides a strong foundation in insurance principles, risk assessment, and financial analysis.

Developing Key Skills

Insurance underwriters need to have strong analytical and decision-making skills. They must be able to evaluate risks, assess financial data, and make informed decisions about insurance policies. It is important to develop these skills through internships, part-time jobs, or volunteer work in the insurance industry.

Additionally, underwriters should have excellent communication and interpersonal skills. They need to be able to effectively communicate with clients, insurance agents, and other professionals in the industry. Developing these skills through coursework, public speaking, or joining professional organizations can be beneficial.

Job Experience

Continuing Education

Insurance underwriters should stay up-to-date with industry trends, regulations, and new technologies. Continuing education courses, workshops, and seminars can help you stay current in the field and demonstrate your commitment to professional growth.

By following these steps and continuously improving your skills and knowledge, you can increase your chances of becoming a successful insurance underwriter.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.