What is the Income Approach in Real Estate Investing?

The income approach is a method used in real estate investing to determine the value of a property based on its income potential. It is one of the three main approaches, along with the market approach and the cost approach, used by appraisers and investors to estimate the value of a property.

Unlike the market approach, which relies on comparing the property to similar properties that have recently sold, and the cost approach, which focuses on the cost of replacing the property, the income approach looks at the property’s ability to generate income.

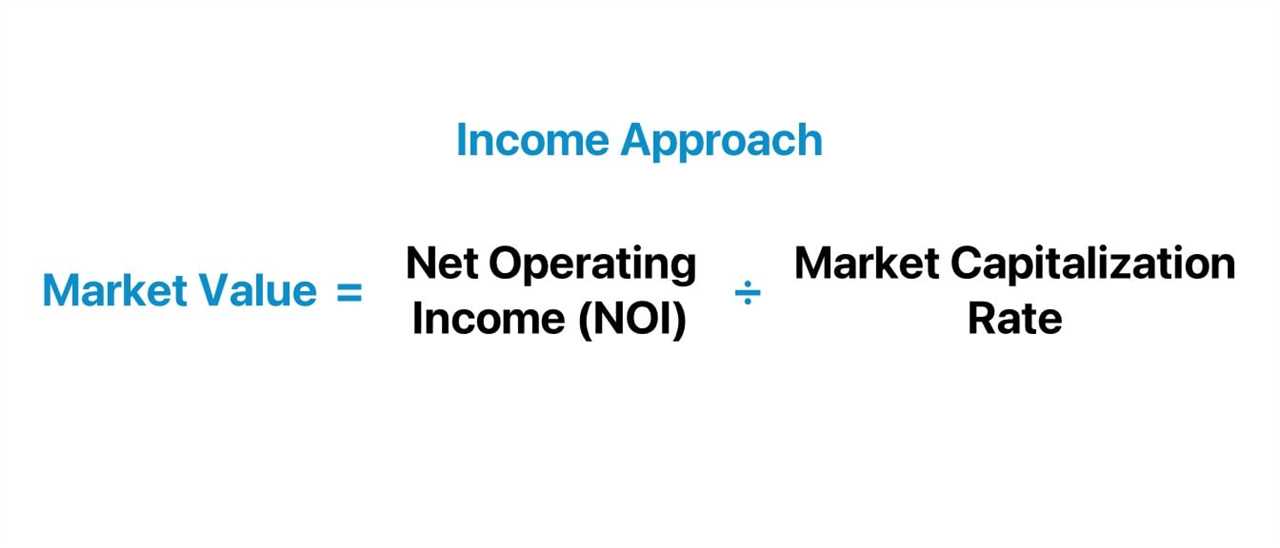

The income approach takes into account the net operating income (NOI) of the property, which is the income generated after deducting operating expenses. This includes expenses such as property taxes, insurance, maintenance, and management fees. The NOI is then divided by a capitalization rate, which is a rate of return that an investor expects to earn on their investment.

By using the income approach, investors can estimate the value of a property based on its income potential, rather than relying solely on comparable sales or replacement costs. This approach is particularly useful for income-producing properties, such as rental apartments, office buildings, and shopping centers.

However, it is important to note that the income approach is just one method of valuing a property and should be used in conjunction with other approaches to get a more accurate estimate of its value. Additionally, the income approach relies on assumptions about future income and expenses, which can be subject to change.

The income approach is a valuation method used in real estate investing to determine the value of a property based on its potential income. This method takes into account the income generated by the property and applies a capitalization rate to calculate its value.

The calculation method involves several steps:

1. Determine the Net Operating Income (NOI):

The first step in the calculation is to determine the Net Operating Income (NOI) of the property. This is the income generated by the property after deducting all operating expenses, such as property taxes, insurance, maintenance costs, and property management fees.

2. Determine the Capitalization Rate:

3. Calculate the Property Value:

Once the cap rate is determined, the property value can be calculated by dividing the NOI by the cap rate. This formula is expressed as:

Property Value = NOI / Cap Rate

The result of this calculation represents the estimated value of the property based on its income potential. It is important to note that the income approach is just one of several valuation methods used in real estate investing, and it may not always provide an accurate estimate of a property’s value.

However, the income approach can be particularly useful for income-producing properties, such as rental properties or commercial buildings, where the income generated by the property is a key factor in determining its value. It allows investors to evaluate the potential return on investment and make informed decisions about whether to purchase or sell a property.

Overall, the income approach provides a systematic and objective method for valuing real estate based on its income potential. By considering the property’s income and applying a cap rate, investors can estimate its value and make informed decisions in the real estate market.

Key Factors to Consider

When using the income approach in real estate investing, there are several key factors that need to be considered. These factors play a crucial role in determining the value of a property and can greatly impact the overall investment decision.

1. Rental Income

The rental income generated by the property is one of the most important factors to consider. This includes both the current rental income and the potential future rental income. Investors need to analyze the rental market in the area and determine the rental rates that can be achieved for similar properties. The rental income should be stable and predictable to ensure a steady cash flow.

2. Operating Expenses

Operating expenses are another important factor to consider. These expenses include property taxes, insurance, maintenance costs, utilities, and management fees. It is crucial to accurately estimate these expenses to determine the net operating income (NOI) of the property. The lower the operating expenses, the higher the potential return on investment.

3. Vacancy Rate

4. Market Conditions

The current market conditions play a crucial role in determining the value of a property. Factors such as supply and demand, interest rates, and economic trends can greatly impact the rental rates and property values. Investors need to stay informed about the local market conditions and make adjustments to their investment strategy accordingly.

5. Capitalization Rate

By carefully considering these key factors, investors can make informed decisions when using the income approach in real estate investing. It is important to conduct thorough research and analysis to ensure a successful and profitable investment.

Example of Income Approach in Action

Let’s take a closer look at how the income approach can be applied in real estate investing. Imagine you are considering purchasing a rental property as an investment. To determine its value using the income approach, you need to gather some key information.

First, you need to determine the property’s net operating income (NOI). This is the income generated by the property after deducting all operating expenses, such as property taxes, insurance, maintenance costs, and property management fees.

Next, you need to determine the capitalization rate (cap rate) for similar properties in the area. The cap rate is the rate of return an investor expects to earn on their investment. It is calculated by dividing the NOI by the property’s purchase price.

Once you have the NOI and the cap rate, you can calculate the value of the property using the formula: Value = NOI / Cap Rate. For example, if the property has an NOI of $50,000 and the cap rate is 8%, the value of the property would be $625,000 ($50,000 / 0.08).

By using the income approach, you can determine whether the property is a good investment opportunity. If the calculated value is higher than the purchase price, it may indicate that the property is undervalued and could generate a positive cash flow. On the other hand, if the calculated value is lower than the purchase price, it may indicate that the property is overvalued and may not be a profitable investment.

Overall, the income approach provides real estate investors with a systematic way to assess the potential income and value of a property. By considering the property’s income-generating potential, investors can make informed decisions and maximize their returns.

Benefits and Limitations of the Income Approach

The income approach is a widely used method in real estate investing due to its numerous benefits. One of the main advantages of using the income approach is that it focuses on the potential income that a property can generate, making it particularly useful for income-producing properties such as rental properties or commercial buildings.

By considering the income potential of a property, investors can make more informed decisions about its value and potential return on investment. This approach takes into account factors such as rental rates, occupancy rates, and operating expenses, providing a comprehensive analysis of the property’s income-generating capabilities.

Additionally, the income approach allows investors to compare different properties based on their income potential. This can be particularly useful when evaluating investment opportunities and determining which property offers the best return on investment.

However, it is important to note that the income approach also has its limitations. One of the main limitations is that it relies on accurate and reliable data regarding rental rates, expenses, and occupancy rates. If the data used in the calculation is inaccurate or outdated, it can lead to inaccurate valuations and investment decisions.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.