Gross Sales Calculation

Gross sales calculation is a vital aspect of any business, as it helps determine the total revenue generated from the sale of goods or services before deducting any expenses. It provides a clear picture of the financial performance of a company and is often used as a benchmark for evaluating business growth and profitability.

To calculate gross sales, you need to consider all the sales transactions that occurred within a specific period. This includes both cash and credit sales. Here is a step-by-step process to calculate gross sales:

- Identify the time frame for which you want to calculate gross sales. It could be a day, a week, a month, a quarter, or a year.

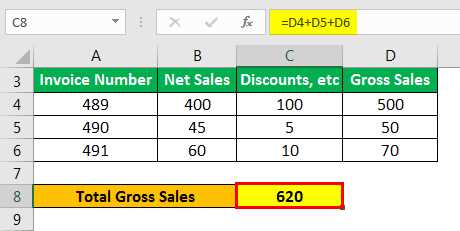

- Gather all the sales data for the selected time frame. This includes invoices, receipts, and any other relevant documents.

- Add up the total value of all the sales transactions. This should include the selling price of each item or service sold.

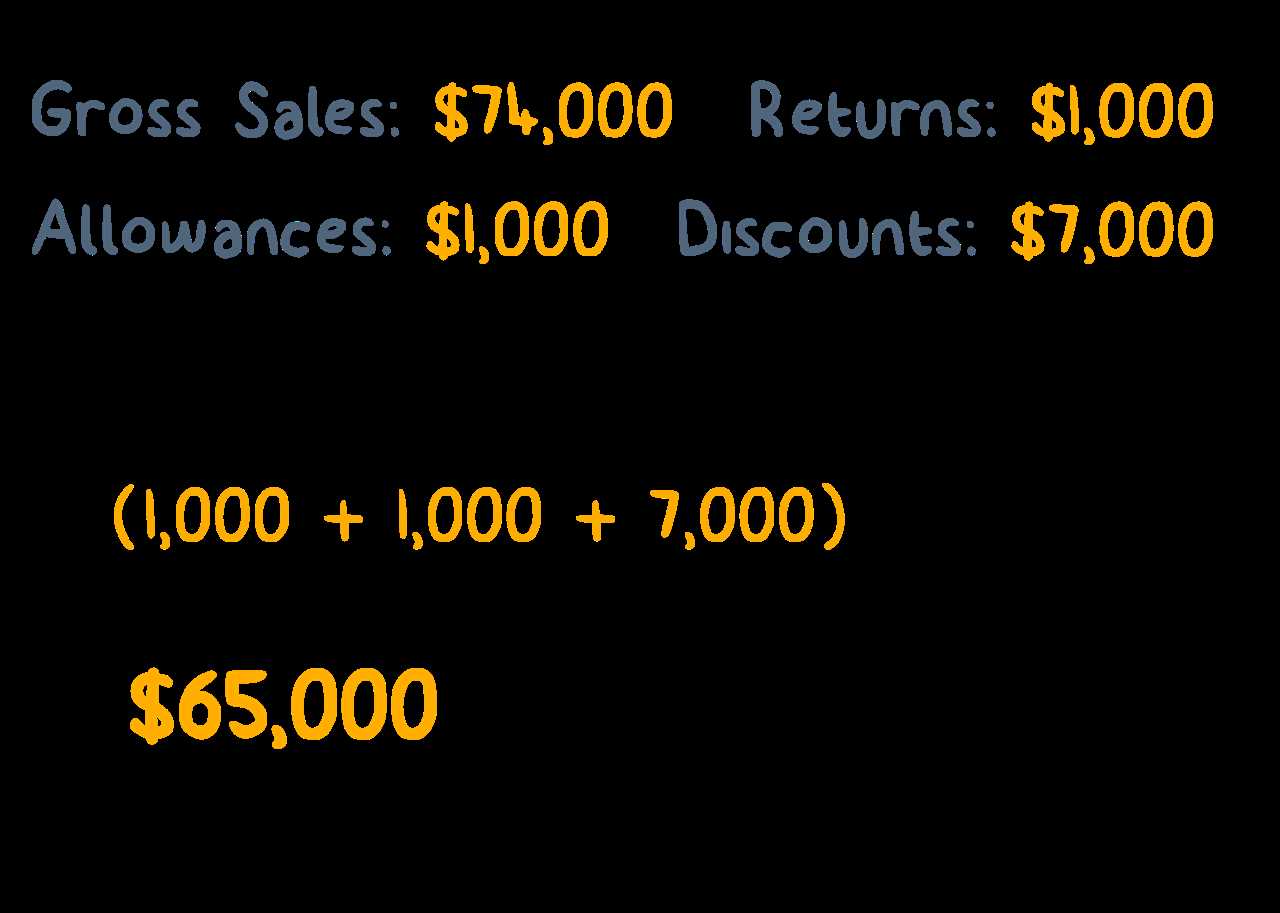

- If applicable, include any additional revenue sources such as discounts, returns, or allowances.

- The sum of all these values will give you the gross sales figure for the selected time frame.

Gross sales calculation is essential for various purposes, including financial reporting, tax calculations, and business planning. It helps businesses understand their revenue streams and make informed decisions regarding pricing, marketing strategies, and overall financial health.

Gross sales is a financial metric that represents the total revenue generated by a company from the sale of its goods or services. It is an important indicator of a company’s financial performance and is used to assess its overall sales effectiveness.

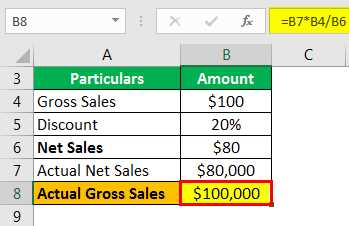

Gross sales include all sales made by a company, regardless of any discounts, returns, or allowances. It is calculated by multiplying the quantity of goods or services sold by their respective prices. For example, if a company sells 100 units of a product at $10 each, the gross sales would be $1,000.

Importance of Gross Sales

Moreover, gross sales are used to calculate other important financial ratios such as gross margin and sales growth rate. Gross margin is the percentage of gross profit to gross sales and measures the efficiency of a company’s production and pricing strategies. Sales growth rate, on the other hand, indicates the rate at which a company’s sales are increasing or decreasing over a specific period.

Factors Affecting Gross Sales

Several factors can influence a company’s gross sales. These include pricing strategies, market demand, competition, economic conditions, and customer preferences. By analyzing these factors, companies can make adjustments to their sales and marketing strategies to maximize their gross sales.

Examples of Gross Sales Calculation

Calculating gross sales is an essential task for businesses to determine their total revenue before any deductions or expenses are taken into account. Here are some examples of how to calculate gross sales:

| Example | Product | Quantity Sold | Price per Unit | Total Sales |

|---|---|---|---|---|

| 1 | Widget A | 100 | $10 | $1,000 |

| 2 | Widget B | 50 | $20 | $1,000 |

| 3 | Widget C | 75 | $15 | $1,125 |

In example 1, the business sold 100 units of Widget A at a price of $10 per unit, resulting in total sales of $1,000. Similarly, in example 2, the business sold 50 units of Widget B at a price of $20 per unit, also resulting in total sales of $1,000. Example 3 shows the sale of 75 units of Widget C at a price of $15 per unit, resulting in total sales of $1,125.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.