What is a Grantor Retained Annuity Trust (GRAT)?

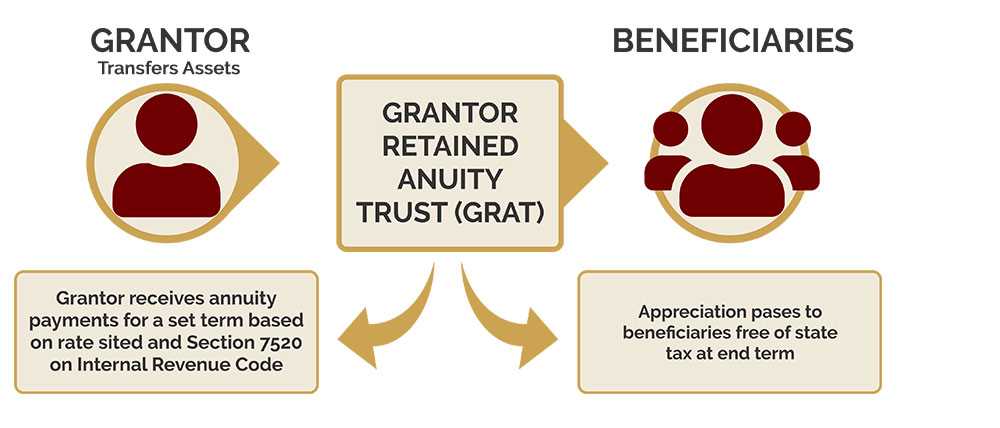

A Grantor Retained Annuity Trust (GRAT) is a type of irrevocable trust that allows the grantor to transfer assets to the trust while still receiving an annuity payment for a specified period of time. The annuity payment is determined at the creation of the trust and is based on the value of the assets transferred, the length of the annuity period, and an interest rate set by the IRS.

The main purpose of a GRAT is to transfer assets to beneficiaries at a reduced gift tax cost. By transferring assets to the trust, the grantor removes the value of the assets from their estate, potentially reducing estate taxes. Additionally, any appreciation of the assets during the annuity period passes to the beneficiaries free of gift and estate taxes.

During the annuity period, the grantor receives regular annuity payments, which can be structured to provide a steady income stream. These payments are typically made annually, but can also be made more frequently if desired. At the end of the annuity period, any remaining assets in the trust pass to the beneficiaries.

One of the key advantages of a GRAT is the ability to transfer assets with minimal or no gift tax consequences. This is because the value of the annuity payments is subtracted from the value of the assets transferred, reducing the taxable gift. If the value of the annuity payments is equal to or greater than the value of the assets transferred, there is no taxable gift.

GRATs can be an effective estate planning tool for individuals who have assets they expect to appreciate significantly in value. By transferring these assets to a GRAT, the grantor can potentially pass on a larger portion of their estate to beneficiaries while minimizing gift and estate taxes.

It is important to note that GRATs are subject to certain rules and regulations set by the IRS, and it is advisable to consult with a qualified estate planning attorney or financial advisor before creating a GRAT to ensure it is structured correctly and in compliance with tax laws.

Definition and Overview

A Grantor Retained Annuity Trust (GRAT) is a type of irrevocable trust that allows the grantor to transfer assets to beneficiaries while still retaining an income stream from those assets for a specified period of time. This estate planning tool is commonly used to minimize estate taxes and transfer wealth to future generations.

When setting up a GRAT, the grantor transfers assets, such as stocks, real estate, or business interests, into the trust. The grantor then receives an annuity payment from the trust for a predetermined number of years. At the end of the annuity period, any remaining assets in the trust are passed on to the beneficiaries, typically the grantor’s children or grandchildren.

The annuity payments made to the grantor are calculated based on the value of the assets transferred to the trust, the term of the annuity, and an interest rate determined by the IRS. The goal is to set the annuity payments in such a way that the present value of the retained interest is equal to the value of the assets initially transferred to the trust. This allows the grantor to transfer assets to beneficiaries without incurring gift tax.

One of the key benefits of a GRAT is its ability to leverage the gift tax exemption. By transferring assets to a GRAT, the grantor can remove the future appreciation of those assets from their taxable estate, effectively reducing the amount of estate tax that will be owed upon their death. If the assets in the GRAT outperform the IRS interest rate, the excess appreciation can pass to the beneficiaries free of gift tax.

Another advantage of a GRAT is its flexibility. The grantor can choose the length of the annuity period, typically between 2 and 10 years, and can also determine the size of the annuity payments. This allows the grantor to tailor the trust to their specific needs and goals.

How Does a GRAT Work?

A Grantor Retained Annuity Trust (GRAT) is a legal tool used in estate planning to transfer assets to beneficiaries while minimizing estate and gift taxes. It allows the grantor to transfer assets to the trust while retaining an annuity payment for a specified period of time. At the end of the trust term, the remaining assets are passed on to the beneficiaries.

Setting Up a GRAT

To set up a GRAT, the grantor transfers assets, such as stocks, real estate, or a business, into the trust. The grantor then determines the annuity payment amount and the term of the trust. The annuity payment is typically a fixed percentage of the initial value of the assets transferred.

During the trust term, the grantor receives annual annuity payments from the trust. These payments are calculated based on the value of the assets at the time of transfer and the specified annuity rate. The annuity payments are subject to income tax, but the grantor can use the annuity payments to cover the tax liability.

Tax Advantages of a GRAT

One of the main advantages of a GRAT is its potential to minimize estate and gift taxes. When the assets are transferred to the trust, their value is frozen for tax purposes. Any appreciation in the value of the assets during the trust term is not subject to estate or gift taxes.

If the grantor survives the trust term, the remaining assets in the trust pass on to the beneficiaries free of estate and gift taxes. This allows the grantor to transfer a significant amount of wealth to beneficiaries without incurring substantial tax liabilities.

Risks and Considerations

While a GRAT can be an effective estate planning tool, there are some risks and considerations to keep in mind. If the grantor does not survive the trust term, the assets in the trust are included in their estate for estate tax purposes.

Benefits and Advantages of a GRAT

A Grantor Retained Annuity Trust (GRAT) offers several benefits and advantages for individuals engaged in trust and estate planning. Some of the key advantages of a GRAT include:

1. Estate Tax Reduction:

One of the primary benefits of a GRAT is its ability to reduce estate taxes. By transferring assets into a GRAT, the grantor effectively removes the asset’s future appreciation from their taxable estate. This can result in significant tax savings, especially for individuals with substantial assets.

2. Wealth Transfer:

A GRAT allows the grantor to transfer wealth to their beneficiaries while still retaining an income stream from the trust. This can be particularly useful for individuals who want to provide for their loved ones while also ensuring a steady income for themselves during their lifetime.

3. Asset Protection:

Assets placed in a GRAT are protected from creditors and potential legal claims. This can be especially valuable for individuals in professions or industries where lawsuits are common, as it provides an additional layer of protection for their assets.

4. Flexibility:

GRATs offer flexibility in terms of the annuity payments received by the grantor. The annuity payments can be structured in a way that maximizes tax benefits or meets the grantor’s specific financial needs. This flexibility allows individuals to customize their GRAT to suit their unique circumstances.

5. Potential for Growth:

If the assets in the GRAT appreciate at a rate higher than the IRS’s assumed rate, the excess growth passes to the beneficiaries free of gift or estate taxes. This potential for growth can result in significant wealth transfer to the beneficiaries.

6. Gift Tax Efficiency:

When creating a GRAT, the grantor makes a taxable gift to the beneficiaries equal to the present value of the remainder interest in the trust. However, the gift tax is minimized or even eliminated due to the structure of the GRAT, resulting in more efficient wealth transfer.

Example of a GRAT in Trust & Estate Planning

To better understand how a Grantor Retained Annuity Trust (GRAT) works in the context of trust and estate planning, let’s consider an example:

Scenario:

John, a successful business owner, wants to transfer a significant portion of his wealth to his children while minimizing gift and estate taxes. He decides to establish a GRAT to achieve this goal.

Process:

- John creates a GRAT and transfers assets, such as stocks or real estate, into the trust.

- He retains the right to receive an annuity payment from the trust for a specific period, typically 2-10 years.

- During the annuity period, John receives annual payments from the trust, which can be a fixed amount or a percentage of the initial value of the trust assets.

- At the end of the annuity period, any remaining assets in the trust pass to John’s children or other designated beneficiaries.

Benefits:

The GRAT offers several benefits and advantages:

- Transfer of wealth: By establishing a GRAT, John can transfer assets to his children or beneficiaries without incurring substantial gift or estate taxes.

- Tax efficiency: The taxable gift is calculated based on the present value of the annuity payments, which reduces the overall tax burden.

- Appreciation potential: If the assets in the GRAT appreciate at a rate higher than the Section 7520 rate, the excess growth passes to the beneficiaries free of gift and estate taxes.

- Retained income stream: John can still receive regular annuity payments from the trust during the annuity period, ensuring a steady income stream.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.