What is the Equivalent Annual Annuity Approach?

The Equivalent Annual Annuity (EAA) approach is a financial concept used to evaluate different investment opportunities or projects that provide cash flows over a certain period of time. It allows for the comparison of projects with different cash flow patterns by converting them into an equivalent annual cash flow.

When making investment decisions, it is important to consider the time value of money. The EAA approach takes into account the present value of cash flows, the duration of the investment, and the discount rate to calculate the equivalent annual cash flow.

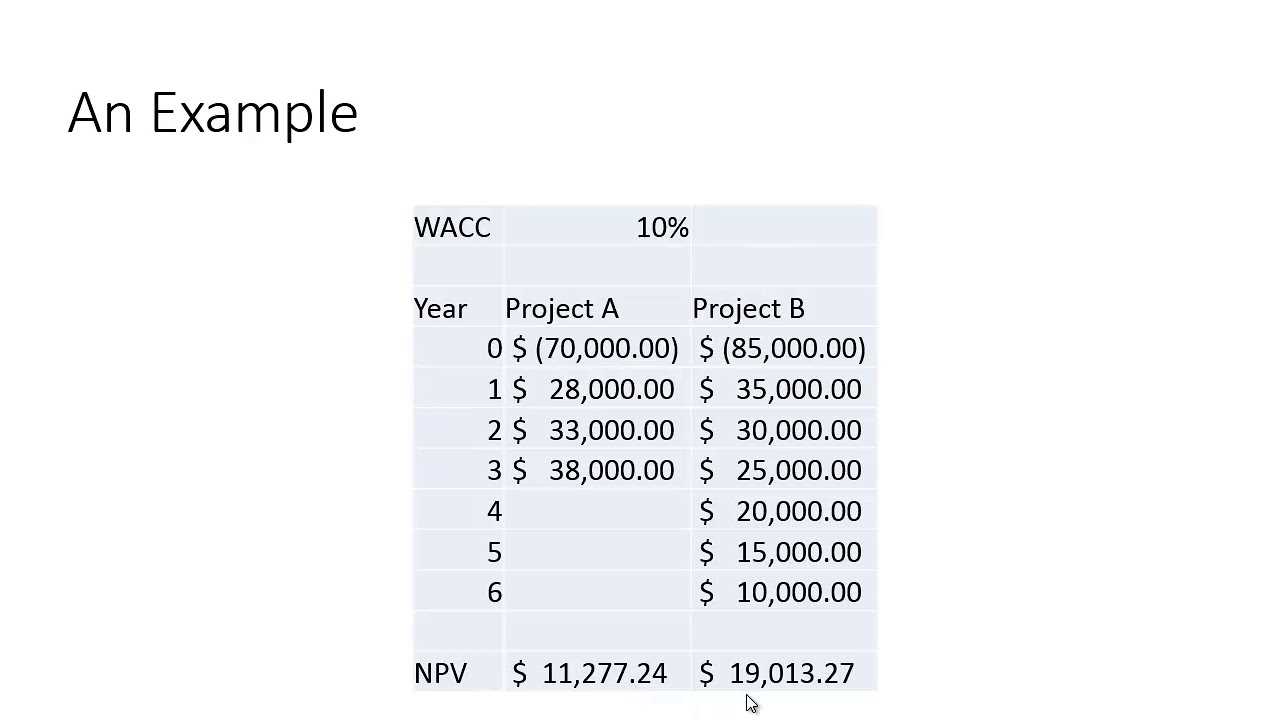

The EAA formula considers the initial investment, the expected cash flows, and the discount rate. By converting the cash flows into an equivalent annual amount, it becomes easier to compare different projects and determine which one provides the highest return on investment.

The EAA approach is particularly useful when evaluating annuities, which are a series of equal periodic payments received or made over a certain period of time. Annuities can be used for retirement planning, insurance, or other financial purposes.

By using the EAA approach, individuals or businesses can make informed decisions about which annuity option is the most beneficial. It allows for a clear comparison of different annuities and helps determine which one offers the highest annual return.

Annuities are financial products that provide a regular income stream for a specified period of time. The Equivalent Annual Annuity (EAA) approach is a method used to compare different annuity options and determine which one offers the best value.

The EAA formula takes into account the time value of money and allows for a fair comparison of annuities with different payment frequencies, durations, and interest rates. By converting the cash flows of each annuity into an equivalent annual amount, investors can easily compare the returns and make informed decisions.

The EAA formula for annuities can be expressed as follows:

Where:

- EAA is the equivalent annual annuity

- PMT is the payment amount per period

- r is the interest rate per period

- n is the total number of periods

Let’s break down the formula:

The denominator, r, represents the interest rate per period. It is used to convert the present value factor into an equivalent annual amount.

Using the EAA formula, investors can compare different annuity options and choose the one that offers the highest equivalent annual annuity. This allows them to make informed decisions based on the annuity’s overall value rather than just the raw payment amounts.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.