What is Fund Flow?

Fund flow is a financial concept that refers to the movement of money into and out of a particular investment fund or portfolio. It provides insights into the buying and selling activities of investors, which can be used to analyze market trends and make informed investment decisions.

At its core, fund flow analysis involves tracking the inflows and outflows of money within a fund. Inflows represent the amount of money that investors are putting into the fund, while outflows represent the amount of money that investors are withdrawing from the fund.

One key aspect of fund flow analysis is the concept of net fund flow. Net fund flow is calculated by subtracting the outflows from the inflows. A positive net fund flow indicates that more money is flowing into the fund than flowing out, while a negative net fund flow indicates the opposite.

Net fund flow can be used as an indicator of investor sentiment towards a particular fund or market. A positive net fund flow suggests that investors have confidence in the fund and are willing to invest more money, which can be a sign of a bullish market. On the other hand, a negative net fund flow may indicate that investors are losing confidence and withdrawing their investments, which can be a sign of a bearish market.

Factors Affecting Fund Flow

There are several factors that can influence fund flow. One of the main factors is market performance. When the market is performing well and generating positive returns, investors are more likely to invest in funds, leading to a positive net fund flow. Conversely, when the market is experiencing a downturn, investors may withdraw their investments, resulting in a negative net fund flow.

Another factor that can impact fund flow is investor sentiment. Investor sentiment refers to the overall attitude and emotions of investors towards the market. Positive investor sentiment can lead to increased investments and a positive net fund flow, while negative investor sentiment can result in decreased investments and a negative net fund flow.

Additionally, changes in economic conditions, government policies, and global events can also affect fund flow. For example, during times of economic uncertainty, investors may choose to withdraw their investments and hold cash, leading to a negative net fund flow.

Conclusion

Fund Flow Example: A Step-by-Step Guide

Step 1: Select a Fund

First, you need to select a specific fund that you want to analyze. It can be a mutual fund, exchange-traded fund (ETF), or any other type of investment fund. For this example, let’s consider a large-cap equity mutual fund.

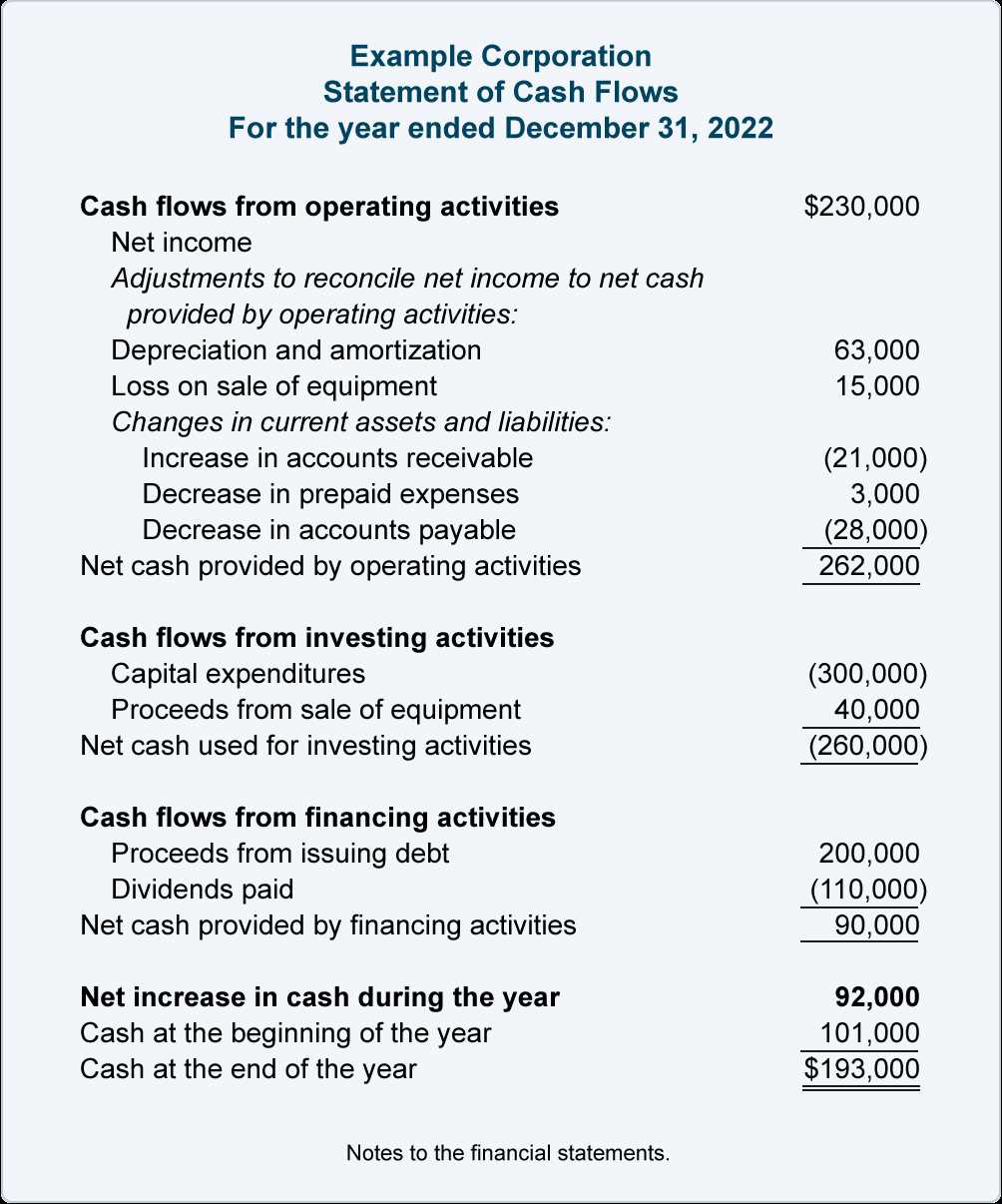

Step 2: Gather Fund Flow Data

Next, you need to gather the fund flow data for the selected fund. This data can be obtained from various sources, such as financial websites, fund fact sheets, or directly from the fund manager. The fund flow data will include information on the inflows (new investments) and outflows (redemptions) for a specific period.

Step 3: Calculate Net Fund Flow

Once you have the fund flow data, you can calculate the net fund flow by subtracting the outflows from the inflows. This will give you an idea of the overall flow of money into or out of the fund during the specified period.

Step 4: Analyze Fund Flow Trends

Now, it’s time to analyze the fund flow trends. Look for patterns and trends in the net fund flow over different time periods, such as monthly, quarterly, or annually. This will help you understand the investor sentiment towards the fund and identify any potential opportunities or risks.

Step 5: Compare Fund Flow with Performance

It’s also important to compare the fund flow data with the fund’s performance. Analyze whether there is any correlation between the net fund flow and the fund’s returns. A positive correlation may indicate that investors are attracted to the fund’s performance, while a negative correlation may suggest that investors are losing confidence in the fund.

Step 6: Consider Other Factors

Lastly, consider other factors that may impact the fund flow, such as market conditions, economic indicators, or changes in the fund’s investment strategy. These factors can provide additional insights into the fund’s flow dynamics and help you make more informed investment decisions.

| Step | Description |

|---|---|

| Step 1 | Select a Fund |

| Step 2 | Gather Fund Flow Data |

| Step 3 | Calculate Net Fund Flow |

| Step 4 | Analyze Fund Flow Trends |

| Step 5 | Compare Fund Flow with Performance |

| Step 6 | Consider Other Factors |

Interpreting Fund Flow: Key Metrics and Indicators

Interpreting fund flow is crucial for investors and fund managers as it provides valuable insights into the performance and health of a fund. By analyzing key metrics and indicators, investors can make informed decisions about their investments and identify potential risks and opportunities.

One of the key metrics used to interpret fund flow is the net inflow or outflow of funds. This metric indicates whether more money is coming into the fund (net inflow) or going out of the fund (net outflow). A positive net inflow suggests that investors are buying more shares of the fund, indicating confidence in its performance. On the other hand, a negative net outflow may indicate that investors are selling their shares, signaling potential concerns or dissatisfaction.

Another important indicator is the fund’s asset allocation. This refers to how the fund’s assets are distributed among different investment categories, such as stocks, bonds, or cash. By analyzing the asset allocation, investors can assess the fund’s risk profile and determine if it aligns with their investment objectives. For example, a fund with a higher allocation to stocks may be more volatile but potentially offer higher returns, while a fund with a higher allocation to bonds may be more conservative but provide lower returns.

Furthermore, analyzing the fund’s performance relative to its benchmark is crucial. The benchmark is a standard index or measure that represents the overall market or a specific sector. By comparing the fund’s performance to its benchmark, investors can evaluate how well the fund is performing in relation to its peers. If a fund consistently outperforms its benchmark, it may indicate skilled fund management and attract more investors. Conversely, underperformance may raise concerns and lead to investor redemptions.

Additionally, tracking the fund’s expense ratio is essential. The expense ratio represents the percentage of a fund’s assets that are used to cover operating expenses, such as management fees and administrative costs. A high expense ratio can eat into the fund’s returns, making it less attractive to investors. Therefore, investors should compare the expense ratio of a fund with its peers to ensure they are getting good value for their investment.

Lastly, monitoring the fund’s turnover ratio is important. The turnover ratio measures the frequency with which the fund buys and sells its holdings. A high turnover ratio may indicate active trading and potentially higher transaction costs, which can impact the fund’s performance. Investors should consider the fund’s investment strategy and their own investment goals when evaluating the turnover ratio.

Fund Trading: Strategies for Maximizing Returns

1. Diversification: One of the key strategies in fund trading is diversification. By investing in a variety of different funds across different asset classes, sectors, and regions, investors can spread their risk and potentially increase their returns. Diversification helps to mitigate the impact of any single investment’s poor performance on the overall portfolio.

2. Timing: Timing is crucial in fund trading. Investors need to carefully monitor market trends and economic indicators to identify the best time to buy or sell funds. This requires staying informed about global events, economic news, and market sentiment. Timing the market correctly can significantly impact the returns on fund investments.

3. Active Management: Active management involves actively monitoring and adjusting the fund portfolio to take advantage of market opportunities and mitigate risks. This strategy requires regular analysis of fund performance, asset allocation, and market conditions. Active managers aim to outperform the market by making strategic investment decisions based on their expertise and research.

4. Risk Management: Effective risk management is essential in fund trading. Investors should carefully assess the risk profile of each fund and ensure that it aligns with their investment objectives and risk tolerance. This involves analyzing factors such as volatility, beta, and standard deviation. Implementing risk management strategies, such as stop-loss orders or hedging techniques, can help protect investments from significant losses.

5. Fundamental Analysis: Fundamental analysis involves evaluating the financial health and performance of the underlying assets in a fund. Investors analyze factors such as earnings, revenue, debt levels, and management quality to determine the intrinsic value of the fund. By conducting thorough fundamental analysis, investors can identify undervalued funds and potentially generate higher returns.

6. Long-Term Investing: Long-term investing is a strategy that focuses on holding funds for an extended period, typically several years or more. This strategy aims to benefit from the power of compounding and minimize the impact of short-term market fluctuations. Long-term investors often have a buy-and-hold approach and are less concerned with short-term market volatility.

It is important to note that fund trading involves risks, and past performance is not indicative of future results. Investors should carefully consider their investment objectives, risk tolerance, and consult with a financial advisor before engaging in fund trading.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.