What is Free-Float Methodology?

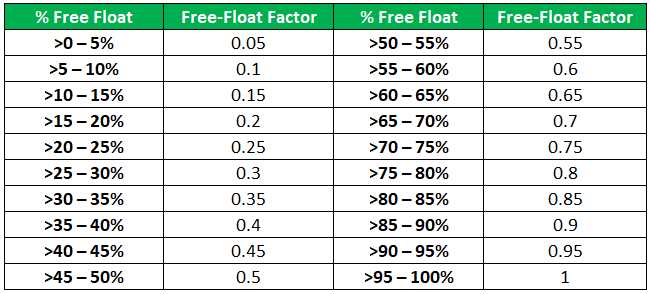

Free-float methodology is a way of calculating the market capitalization of a company by considering only the freely tradable shares in the market. It excludes shares that are held by promoters, governments, or other strategic investors who may not be actively trading their shares.

Market capitalization is a measure of the total value of a company’s outstanding shares in the market. It is calculated by multiplying the company’s share price by the total number of shares outstanding. However, using the total number of shares outstanding may not provide an accurate representation of the company’s market value if a significant portion of those shares are not freely tradable.

By using free-float methodology, only the shares that are available for trading in the open market are considered. This provides a more realistic and accurate measure of the company’s market capitalization, as it reflects the shares that are actually available for investors to buy and sell.

Free-float methodology is particularly important in determining the inclusion of a company in stock market indices, as many indices use market capitalization as a key criterion. By considering only the freely tradable shares, indices can more accurately represent the performance of the overall market and provide a benchmark for investors.

Importance of Free-Float Methodology

The free-float methodology is of great importance in the financial markets. It provides a more accurate representation of a company’s market capitalization and its true value. Here are some reasons why the free-float methodology is important:

- Reflects the true market value: By considering only the shares that are freely available for trading, the free-float methodology provides a more realistic picture of a company’s market capitalization. It excludes shares that are held by insiders, promoters, and strategic investors, which may not be readily available for trading. This ensures that the market capitalization reflects the true value of the company based on the shares that are actively traded in the market.

- Enhances comparability: The use of free-float market capitalization allows for better comparability between companies. Since it excludes shares that are not readily available for trading, it provides a standardized measure that can be used to compare companies across different sectors and markets. This is particularly useful for investors, analysts, and researchers who rely on market capitalization as a key metric for evaluating companies.

- Increases liquidity: The free-float methodology encourages companies to increase the liquidity of their shares. By increasing the number of shares available for trading in the market, companies can attract more investors and improve the liquidity of their stock. This can lead to a more efficient market and better price discovery.

- Avoids manipulation: The free-float methodology helps to prevent market manipulation. By excluding shares that are not freely available for trading, it reduces the possibility of insider trading and other forms of market manipulation. This enhances market integrity and investor confidence.

- Aligns with international standards: The free-float methodology is widely used and recognized by international financial institutions and stock exchanges. It aligns with global best practices and ensures consistency and comparability in the valuation of companies across different markets.

Calculating Market Capitalization

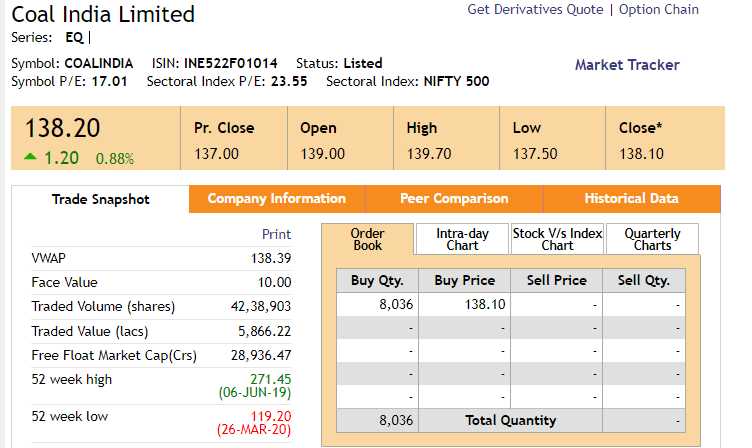

Market capitalization is a key metric used by investors to assess the size and value of a company. It is calculated by multiplying the current market price of a company’s shares by the total number of outstanding shares.

To calculate market capitalization, you need to follow these steps:

- Determine the current market price of the company’s shares. This information is readily available on stock market websites or financial news platforms.

- Find the total number of outstanding shares. This information can be obtained from the company’s financial statements or from reliable sources such as stock exchanges or financial data providers.

- Multiply the current market price per share by the total number of outstanding shares. The result is the market capitalization of the company.

For example, let’s say a company has a current market price of $50 per share and a total of 10 million outstanding shares. To calculate its market capitalization, you would multiply $50 by 10 million, resulting in a market capitalization of $500 million.

Market capitalization is an important metric because it provides investors with an indication of a company’s size and value relative to other companies. It is often used to categorize companies into different market segments, such as large-cap, mid-cap, and small-cap.

Investors use market capitalization to make investment decisions and assess the risk and potential return of investing in a particular company. Companies with larger market capitalizations are generally considered more stable and less risky, while companies with smaller market capitalizations may have higher growth potential but also higher risk.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.