Forward Dividend Yield Definition Formula

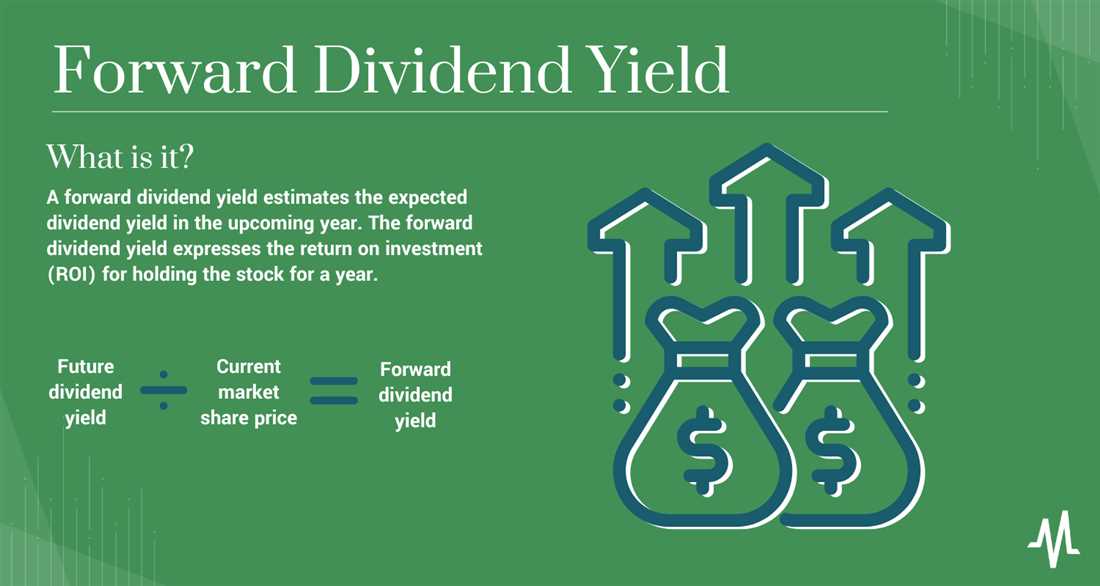

Forward Dividend Yield is a financial ratio that indicates the annual dividend payment as a percentage of the stock’s current market price. It is calculated by dividing the expected annual dividend per share by the current market price per share and multiplying the result by 100.

Formula:

The formula to calculate the Forward Dividend Yield is:

Forward Dividend Yield = (Expected Annual Dividend Per Share / Current Market Price Per Share) * 100

The expected annual dividend per share can be obtained from the company’s financial statements or analyst estimates. The current market price per share is the price at which the stock is currently trading in the market.

The Forward Dividend Yield is an important metric for investors as it helps them assess the income potential of a stock. A higher yield indicates a higher return on investment through dividends.

Investors often compare the Forward Dividend Yield of different stocks to identify attractive investment opportunities. However, it is important to note that a high yield may not always be sustainable and could be a result of a declining stock price.

It is also worth mentioning that the Forward Dividend Yield is different from the Trailing Yield. The Trailing Yield is calculated using the dividends paid in the past 12 months, while the Forward Dividend Yield uses the expected dividends for the next 12 months.

Overall, the Forward Dividend Yield is a useful tool for investors to evaluate the income potential of a stock and make informed investment decisions.

Forward Dividend Yield is a financial metric used to assess the potential return on investment from owning a particular stock. It is calculated by dividing the annual dividend per share by the stock’s current market price. The result is expressed as a percentage.

Forward Dividend Yield differs from Trailing Yield in that it takes into account the expected future dividend payments, rather than the historical dividend payments. This makes it a more forward-looking measure of a stock’s potential return.

Forward Dividend Yield can also be compared to the yields of other stocks or to the average yield of a particular market or sector. This can help investors identify stocks that offer relatively higher or lower returns compared to their peers.

It is worth noting that Forward Dividend Yield is just one of many factors to consider when evaluating a stock for investment. It should be used in conjunction with other financial metrics and analysis methods to make informed investment decisions.

Calculating Forward Dividend Yield

Calculating the forward dividend yield is a crucial step in determining the potential return on investment for dividend stocks. The forward dividend yield is a financial ratio that indicates the percentage of a company’s current stock price that is expected to be paid out as dividends over the next year.

To calculate the forward dividend yield, you need to know the annual dividend per share and the current stock price. The formula for calculating the forward dividend yield is as follows:

| Forward Dividend Yield = | (Annual Dividend per Share / Current Stock Price) x 100% |

|---|

The forward dividend yield is an important metric for investors as it helps them assess the income potential of a dividend stock. A higher forward dividend yield indicates a higher potential return on investment, while a lower forward dividend yield suggests a lower potential return.

It is important to note that the forward dividend yield is based on future expectations and may not always be accurate. It is influenced by various factors such as changes in the company’s dividend policy, earnings, and market conditions. Therefore, investors should consider other factors and conduct thorough research before making investment decisions based solely on the forward dividend yield.

Trailing Yield

The trailing yield is a financial metric used to calculate the dividend yield of a stock based on the dividends paid in the past. It provides investors with an indication of the income they can expect to receive from owning a particular stock.

Definition

The trailing yield is calculated by dividing the total dividends paid by a company over the past year by its current stock price. It is expressed as a percentage and represents the annual return on investment through dividends.

Formula

The formula to calculate the trailing yield is as follows:

Trailing Yield = (Total Dividends Paid / Current Stock Price) * 100

The trailing yield is an important metric for income-focused investors who rely on dividends for regular cash flow. By analyzing the trailing yield, investors can compare the dividend-paying capabilities of different stocks and make informed investment decisions.

Calculating Trailing Yield

To calculate the trailing yield, you need to gather the historical dividend payments made by a company over the past year. This information can be found in the company’s financial statements or through financial data providers. Once you have the total dividends paid, divide it by the current stock price and multiply by 100 to get the trailing yield percentage.

For example, if a company paid $2 in dividends over the past year and its current stock price is $50, the trailing yield would be (2 / 50) * 100 = 4%.

Investors can use the trailing yield as a benchmark to compare the dividend-paying capabilities of different stocks within the same industry or sector. It can help identify stocks that offer attractive dividend yields and potential income opportunities.

What is Trailing Yield?

Trailing yield is a financial metric that measures the dividend yield of a stock based on the dividends paid over the past year. It provides investors with an indication of the income they can expect to receive from owning a particular stock.

To calculate the trailing yield, you need to know the annual dividends paid by the company and the current stock price. The formula for calculating the trailing yield is as follows:

| Trailing Yield Formula |

|---|

| Trailing Yield = (Annual Dividends / Stock Price) * 100 |

For example, if a company pays annual dividends of $2 per share and the current stock price is $50, the trailing yield would be calculated as follows:

| Example Calculation |

|---|

| Trailing Yield = ($2 / $50) * 100 = 4% |

The trailing yield is expressed as a percentage and represents the annual dividend income as a proportion of the stock price. A higher trailing yield indicates a higher dividend income relative to the stock price, making the stock potentially more attractive to income-focused investors.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.