Exploring the Concept of Face Value

Face value is important because it determines the amount that will be repaid to the investor at maturity. For example, if a bond has a face value of $1,000, the issuer of the bond is obligated to repay the investor $1,000 when the bond reaches its maturity date.

However, it is important to note that face value does not necessarily reflect the actual market value of a financial instrument. The market value of a security is determined by various factors such as supply and demand, interest rates, and the creditworthiness of the issuer.

Face value is particularly relevant in fixed-income securities such as bonds. When a bond is issued, it is typically sold at face value, and the investor receives regular interest payments based on the face value. At maturity, the investor receives the face value of the bond.

Face value is also used to calculate the coupon payments on a bond. The coupon rate is expressed as a percentage of the face value, and it represents the annual interest payment that the investor will receive.

Overall, face value is an important concept in finance as it represents the nominal value of a financial instrument and determines the amount that will be repaid to the investor at maturity.

| Key Points |

|---|

| Face value refers to the nominal value or the stated value of a financial instrument. |

| It is the value that is printed on the face of a bond, stock, or other types of securities. |

| Face value determines the amount that will be repaid to the investor at maturity. |

| Market value is the actual value of a financial instrument, which can be different from the face value. |

| Face value is particularly relevant in fixed-income securities such as bonds. |

Factors Affecting Market Value

There are several factors that can influence the market value of an asset:

| Factor | Description |

|---|---|

| Supply and Demand | The balance between the number of buyers and sellers in the market can impact the price of an asset. If there is high demand and limited supply, the market value is likely to increase. |

| Investor Sentiment | The overall perception and confidence of investors can greatly influence the market value. Positive sentiment can drive up prices, while negative sentiment can lead to a decrease in value. |

| Economic Conditions | The state of the economy, including factors such as inflation, interest rates, and employment levels, can impact the market value of assets. A strong economy often leads to higher market values. |

| Company Performance | The financial performance and prospects of a company can have a significant impact on the market value of its stocks or bonds. Positive earnings reports and growth potential can drive up market values. |

Importance of Market Value

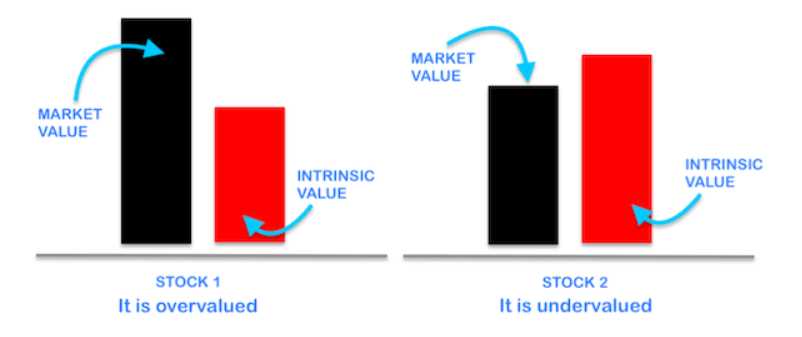

- Valuation: Market value provides an estimate of the worth of an asset in the current market conditions. It helps investors determine whether an asset is overvalued or undervalued.

- Portfolio Management: Market value is used to assess the performance of an investment portfolio. It allows investors to track the changes in the value of their holdings over time.

- Buying and Selling: Market value is crucial for buying and selling assets. Investors can use market value to determine the selling price of an asset or to negotiate a fair purchase price.

- Risk Assessment: Market value is an important factor in assessing the risk associated with an investment. Assets with volatile market values may carry higher risks.

Overall, market value plays a significant role in the world of finance. It provides investors with valuable information for making informed investment decisions and managing their portfolios effectively.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.