What are Excess Reserves?

Excess reserves refer to bank deposits that exceed the required reserve ratio set by the central bank. In simple terms, it is the amount of money that banks hold in their reserve accounts beyond what they are legally obligated to hold.

These excess reserves can be in the form of cash or deposits with the central bank. Banks hold excess reserves as a precautionary measure to ensure they have enough liquidity to meet unexpected demands for withdrawals or to cover any potential losses.

By holding excess reserves, banks can effectively manage their liquidity and minimize the risk of becoming illiquid. This allows them to maintain stability and continue their normal operations even during challenging economic conditions.

Overall, excess reserves serve as a safety net for banks, ensuring their ability to meet their financial obligations and maintain the stability of the banking system.

Definition and Purpose

Excess reserves refer to the amount of money that banks hold in their accounts beyond what is required by regulatory authorities. These reserves are held in addition to the required reserves, which are the minimum amount of funds that banks must keep on hand to meet customer withdrawal demands and other obligations.

The purpose of excess reserves is to provide banks with a buffer against unexpected events or fluctuations in the economy. By holding excess reserves, banks can ensure that they have enough liquidity to meet their financial obligations and maintain stability in the banking system.

Excess reserves can be seen as a form of insurance for banks. They act as a safeguard against potential risks such as a sudden increase in customer withdrawals, a decline in the value of assets held by the bank, or a financial crisis. By having a cushion of excess reserves, banks can better withstand economic shocks and maintain confidence in the financial system.

In addition to providing a safety net, excess reserves also play a role in monetary policy. Central banks use the level of excess reserves in the banking system as a tool to manage interest rates and control the money supply. By adjusting the amount of excess reserves held by banks, central banks can influence lending activity and stimulate or slow down economic growth.

Overall, excess reserves serve as a vital component of the banking system, providing stability, liquidity, and flexibility to banks. They help ensure the smooth functioning of financial markets and contribute to the overall health of the economy.

Why Do Banks Hold Excess Reserves?

Banks hold excess reserves for a variety of reasons, including risk management and regulatory requirements.

One of the main reasons banks hold excess reserves is for risk management purposes. By holding excess reserves, banks can protect themselves against unexpected events, such as a sudden increase in loan defaults or a liquidity crisis. These reserves act as a buffer, providing a safety net for the bank in case of unforeseen circumstances.

Another reason banks hold excess reserves is to comply with regulatory requirements. Central banks often set reserve requirements, which mandate that banks hold a certain percentage of their deposits as reserves. By holding excess reserves, banks ensure that they meet these requirements and avoid potential penalties or sanctions.

In addition to risk management and regulatory compliance, holding excess reserves can also provide certain benefits for banks. For example, banks can earn interest on their excess reserves, which can contribute to their overall profitability. Excess reserves can also provide banks with the flexibility to lend to other banks or invest in other financial instruments, further enhancing their financial position.

Risk Management

One of the main reasons why banks hold excess reserves is for risk management purposes. By keeping a portion of their deposits as excess reserves, banks can protect themselves against unexpected events or financial shocks.

Having excess reserves provides a buffer for banks in case of a sudden increase in withdrawals or a decrease in deposits. This can happen during times of economic uncertainty or financial instability. By having a cushion of excess reserves, banks can ensure that they have enough liquidity to meet their obligations and continue operating smoothly.

Excess reserves also act as a safeguard against potential losses. Banks face various risks, including credit risk, market risk, and operational risk. By holding excess reserves, banks can mitigate these risks and protect themselves from potential losses.

In addition, excess reserves can help banks manage their cash flow. They provide a source of funds that banks can tap into if needed, without having to rely on external sources of liquidity. This can be particularly useful during periods of tight credit conditions or when access to funding is limited.

Overall, holding excess reserves is an important risk management strategy for banks. It allows them to maintain financial stability, protect against unexpected events, and ensure that they can meet their financial obligations. By having a cushion of excess reserves, banks can weather economic downturns and other challenges more effectively.

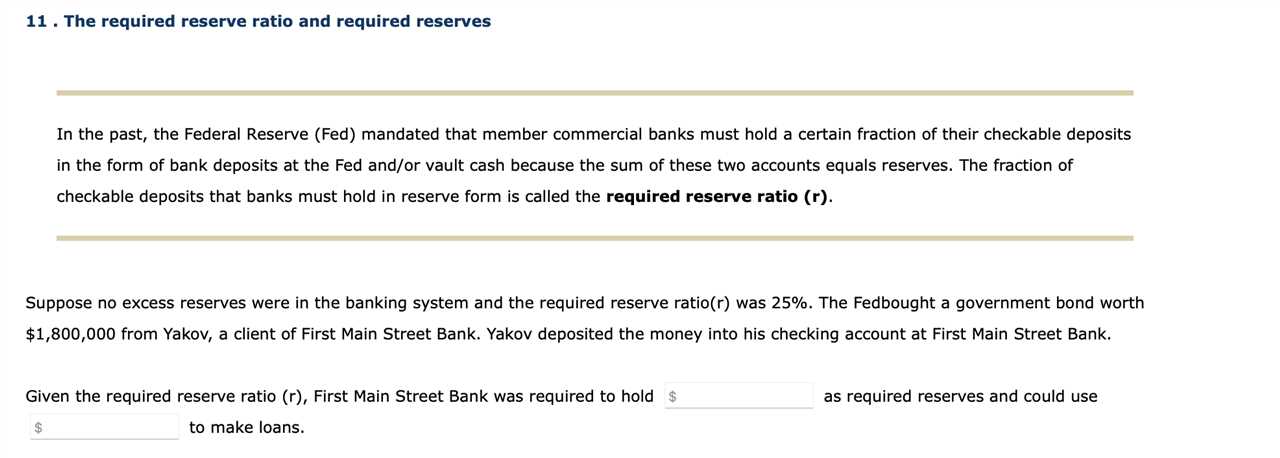

Regulatory Requirements

By holding excess reserves, banks ensure that they meet the regulatory requirements and avoid penalties or sanctions. The excess reserves act as a buffer, providing a cushion for banks to comply with the regulations even during times of increased customer withdrawals or economic downturns.

In addition to reserve requirements, banks may also be subject to other regulatory measures, such as stress tests or liquidity requirements. These measures aim to ensure the stability and soundness of the banking system and protect against potential financial crises.

By holding excess reserves, banks demonstrate their compliance with these regulatory requirements and show their commitment to maintaining a strong financial position. This can enhance their reputation and credibility among customers, investors, and regulators.

Furthermore, holding excess reserves can also provide banks with flexibility in managing their liquidity. In times of unexpected cash outflows or market disruptions, banks can rely on their excess reserves to meet their obligations and maintain smooth operations.

Overall, regulatory requirements are a key driver behind banks holding excess reserves. By complying with these requirements and maintaining a sufficient level of reserves, banks can ensure their stability, protect against risks, and contribute to the overall stability of the financial system.

Benefits of Excess Reserves

Excess reserves play a crucial role in the stability and functioning of the banking system. Here are some key benefits:

1. Liquidity Management

By holding excess reserves, banks can effectively manage their liquidity needs. These reserves act as a buffer, ensuring that banks have enough funds to meet unexpected withdrawals or sudden increases in demand for loans. This helps to maintain the stability of the banking system and prevents liquidity crises.

2. Increased Confidence

Having excess reserves gives banks a sense of security and confidence. It reassures depositors and investors that the bank is financially stable and capable of fulfilling its obligations. This can help attract more deposits and investments, which in turn strengthens the bank’s financial position.

3. Flexibility in Lending

Excess reserves provide banks with the flexibility to extend loans and credit to businesses and individuals. With these reserves, banks can meet the borrowing needs of their customers more easily, promoting economic growth and development. This flexibility also allows banks to respond to changes in market conditions and adjust their lending activities accordingly.

4. Interest Income

By holding excess reserves, banks can earn interest income. These reserves are typically invested in low-risk assets such as government securities, which generate interest for the bank. This additional income contributes to the bank’s profitability and strengthens its financial position.

5. Compliance with Regulatory Requirements

Excess reserves help banks comply with regulatory requirements imposed by central banks and financial authorities. These requirements often mandate a minimum level of reserves that banks must hold to ensure financial stability and mitigate systemic risks. By maintaining excess reserves, banks can easily meet these regulatory obligations.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.