What is the Equity Method of Accounting?

The equity method of accounting is a technique used by companies to account for their investments in other companies where they have significant influence, but not full control. It is commonly used when a company owns between 20% and 50% of the voting stock of another company.

Under the equity method, the investing company records its initial investment as an asset on its balance sheet. It then adjusts the value of this investment each reporting period to reflect its share of the investee company’s net income or loss. This adjustment is recorded as an increase or decrease in the investing company’s equity.

The purpose of using the equity method is to accurately reflect the economic substance of the investing company’s relationship with the investee company. It allows the investing company to recognize its share of the investee company’s financial performance and to reflect the impact of this investment on its own financial statements.

Key features and requirements of the equity method include:

- Significant influence: The investing company must have the ability to exercise significant influence over the operating and financial policies of the investee company.

- Ownership percentage: The investing company typically owns between 20% and 50% of the voting stock of the investee company.

- Reporting adjustments: The investing company must adjust the value of its investment each reporting period to reflect its share of the investee company’s net income or loss.

- Disclosure: The investing company must disclose its investments accounted for using the equity method in its financial statements.

Overall, the equity method of accounting is an important tool for companies to accurately account for their investments in other companies where they have significant influence. It helps provide a more complete picture of the investing company’s financial position and performance, and allows for better decision-making based on this information.

The equity method of accounting is a financial reporting technique used by companies to account for their investments in other companies. It is primarily used when a company has significant influence over the financial and operating decisions of another company, but does not have control over it.

The purpose of the equity method is to accurately reflect the economic reality of the investment and provide users of financial statements with relevant and reliable information. By using this method, companies can report their investments at their proportionate share of the investee’s net assets and income.

Key Features and Requirements

Under the equity method, the investor company initially records the investment at cost and subsequently adjusts it for its share of the investee’s earnings or losses. The investor’s share of the investee’s dividends is also recognized as a reduction in the investment account.

In order to apply the equity method, certain criteria must be met. The investor must have the ability to exercise significant influence over the investee, which is generally presumed when the investor owns between 20% and 50% of the voting stock of the investee. Additionally, the investor must have the ability to participate in the investee’s financial and operating policies.

The equity method requires the investor to account for its investment on an ongoing basis, recognizing its share of the investee’s earnings or losses in its income statement. This allows for a more accurate representation of the investor’s financial position and performance.

Benefits and Limitations

The equity method provides several benefits to companies. It allows for a more accurate valuation of investments and provides users of financial statements with relevant and reliable information. It also promotes transparency and comparability in financial reporting.

However, the equity method also has its limitations. It may not accurately reflect the fair value of the investment, especially if the investee’s financial performance fluctuates significantly. Additionally, the equity method can be complex and time-consuming to apply, requiring ongoing monitoring and adjustments.

Overall, the equity method of accounting is an important tool for companies to accurately report their investments in other companies. It provides a more accurate representation of the economic reality of the investment and enhances the transparency and reliability of financial statements.

Key Features and Requirements

The equity method of accounting has several key features and requirements that companies must adhere to:

1. Significant Influence

In order to use the equity method of accounting, a company must have significant influence over the investee. This generally means owning between 20% and 50% of the voting stock of the investee company. Significant influence is typically determined by the ability to participate in the financial and operating policy decisions of the investee.

2. Equity Investment

The equity method is used to account for investments in equity securities, such as common stock, preferred stock, or other forms of ownership in another company. It is not applicable to investments in debt securities or other financial instruments.

3. Fair Value

Under the equity method, the initial investment is recorded at cost and subsequently adjusted for the investor’s share of the investee’s earnings or losses. The investor’s share of the investee’s earnings or losses is determined based on the investor’s ownership percentage. The investment is reported on the balance sheet at fair value, which is the investor’s proportionate share of the investee’s net assets.

4. Ongoing Monitoring

Companies using the equity method are required to continuously monitor the financial performance and position of the investee. This includes reviewing the investee’s financial statements, attending board meetings, and staying informed about any significant events or changes in the investee’s business.

5. Reporting and Disclosure

The equity method requires companies to disclose their investments in equity securities in their financial statements. This includes providing information about the investee’s name, ownership percentage, and the investor’s share of the investee’s earnings or losses. The financial statements should also disclose any significant events or changes that may impact the value of the investment.

Overall, the equity method of accounting provides a way for companies to accurately reflect their ownership interests in other companies. By recognizing the investor’s share of the investee’s earnings or losses, the equity method allows for a more comprehensive and transparent representation of the investor’s financial position.

Benefits and Limitations of the Equity Method of Accounting

The equity method of accounting offers several benefits for companies that have significant influence over their investees. These benefits include:

1. Accurate Representation of Investment

By using the equity method, companies can accurately reflect their investment in the financial statements. This method allows for the recognition of the investor’s share of the investee’s profits or losses, which provides a more realistic picture of the investment’s performance.

2. Increased Transparency

3. Long-Term Investment Focus

The equity method encourages companies to take a long-term perspective when making investments. Since the method requires the investor to have significant influence over the investee, it promotes a closer relationship between the two entities, fostering collaboration and long-term strategic planning.

4. Improved Decision-Making

By using the equity method, companies can make more informed decisions regarding their investments. The method provides a comprehensive view of the investee’s financial performance, allowing the investor to assess the investee’s profitability, liquidity, and overall financial health.

However, the equity method of accounting also has its limitations, including:

1. Limited Applicability

The equity method is only applicable when the investor has significant influence over the investee. This means that it may not be suitable for all types of investments, such as passive investments where the investor has little to no influence over the investee’s operations.

2. Subjectivity in Determining Significant Influence

Determining whether an investor has significant influence over an investee can be subjective and open to interpretation. This subjectivity can lead to inconsistencies in the application of the equity method and potential disagreements among different stakeholders.

3. Lack of Timeliness

The equity method relies on the investee’s financial statements, which may not be available in a timely manner. This can result in delays in recognizing the investor’s share of the investee’s profits or losses and may impact the accuracy of the investor’s financial statements.

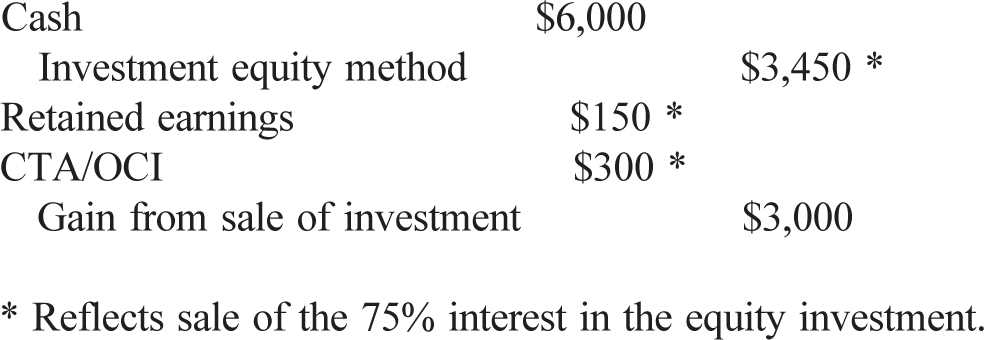

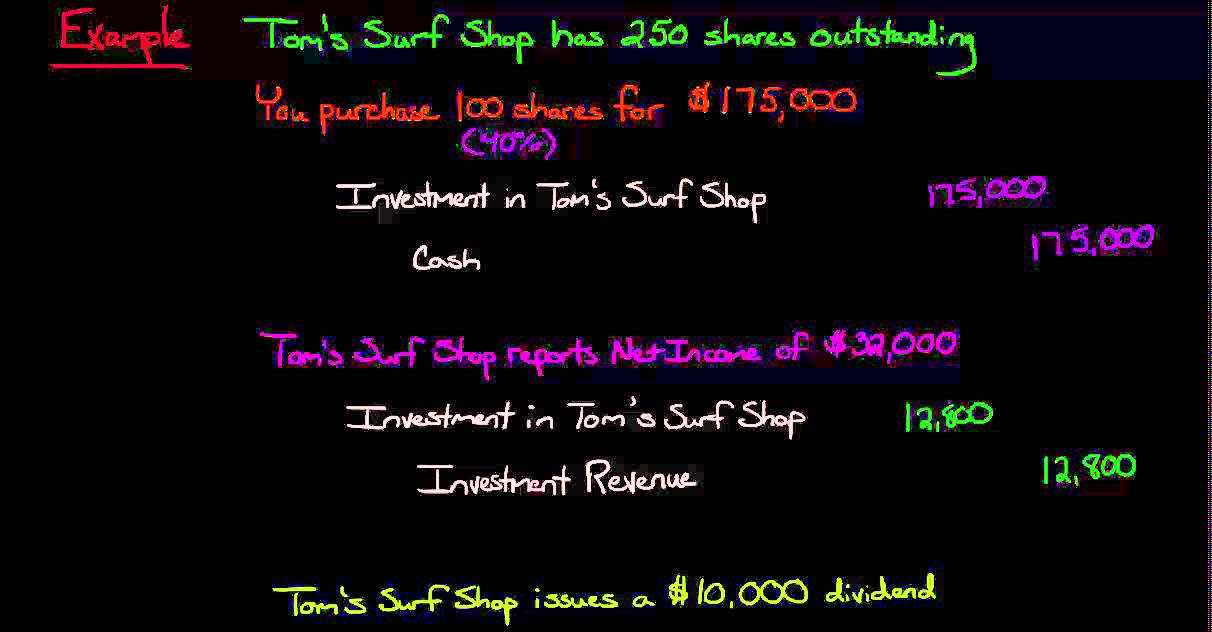

Example of the Equity Method in Practice

Let’s consider a hypothetical example to better understand how the equity method of accounting works in practice.

Company A owns a 30% stake in Company B. Company B generates annual revenue of $1 million and has total assets of $5 million. According to the equity method, Company A would record its share of Company B’s earnings and assets on its own financial statements.

At the end of the year, Company B reports a net income of $200,000. Since Company A owns a 30% stake, it would recognize 30% of the net income, which is $60,000, as its share of the earnings. This amount would be recorded as an increase in Company A’s investment in Company B on its balance sheet.

As time goes on, Company A’s investment in Company B may increase or decrease based on changes in Company B’s earnings and assets. Company A would continue to adjust its investment account accordingly to reflect its share of the changes.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.