What is Loss Carryforward?

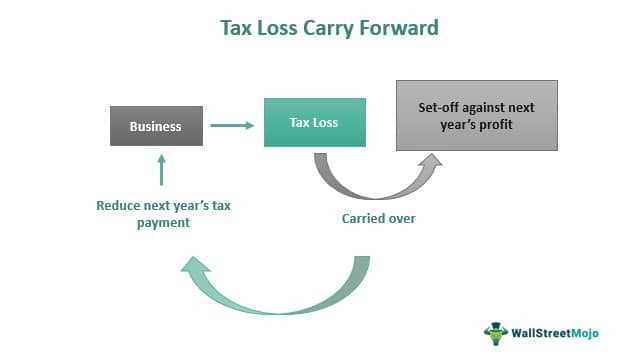

Loss carryforward is a tax strategy that allows businesses to offset their current or future taxable income with losses incurred in previous years. When a business operates at a loss, it can carry forward those losses and use them to reduce its tax liability in future profitable years.

This strategy is particularly useful for businesses that experience fluctuations in their income from year to year. By carrying forward losses, they can smooth out their tax obligations and potentially save money in the long run.

Loss carryforward works by applying the losses from previous years against the taxable income of future years. For example, if a business incurs a loss of $50,000 in Year 1 and generates a profit of $100,000 in Year 2, it can offset the Year 2 profit with the Year 1 loss, resulting in a taxable income of only $50,000.

There are certain rules and limitations that govern the use of loss carryforward. In most cases, losses can be carried forward for a specified number of years, typically up to 20 years. Additionally, there may be restrictions on the amount of losses that can be offset against future income in any given year.

Definition and Explanation

Loss carryforward is a tax provision that allows businesses to offset their current year’s taxable income with losses incurred in previous years. This provision helps businesses reduce their tax liability and provides them with financial relief during periods of economic downturn or unexpected losses.

When a business incurs a loss in a particular year, it can carry forward that loss to future years and deduct it from its taxable income. This means that the business can reduce its tax liability in the future by offsetting the loss against its future profits. Loss carryforward is a valuable tool for businesses as it allows them to recover from financial setbacks and regain profitability.

The concept of loss carryforward is based on the principle of fairness in taxation. It recognizes that businesses may experience fluctuations in their income due to various factors such as market conditions, industry changes, or unexpected events. By allowing businesses to carry forward their losses, the tax system ensures that they are not unfairly penalized for temporary setbacks and are given the opportunity to recover and contribute to the economy.

In addition to the loss carryforward period, there may also be restrictions on the amount of losses that can be carried forward in a given year. Some jurisdictions impose a limit on the percentage of taxable income that can be offset by loss carryforwards, while others may have a dollar limit. These limitations are in place to prevent abuse of the provision and ensure that businesses are not able to indefinitely avoid paying taxes.

Overall, loss carryforward is an important tax provision that provides businesses with the flexibility to recover from financial setbacks and manage their tax liability effectively. It allows businesses to smooth out their tax payments over time and encourages entrepreneurship and investment by reducing the risk associated with business losses.

Example of Loss Carryforward

Let’s consider a hypothetical scenario to understand how loss carryforward works. Imagine a small business that operates in the manufacturing industry. In the first year of operation, the business incurs a net loss of $50,000 due to various factors such as high production costs and low sales.

According to the tax rules, the business can carry forward this loss to future years to offset against any future profits. In the second year, the business manages to turn things around and generates a net profit of $30,000. Instead of paying taxes on this profit, the business can utilize the loss carryforward from the previous year.

By applying the loss carryforward, the business can deduct the $50,000 loss from the previous year’s net profit of $30,000, resulting in a taxable income of -$20,000. Since the taxable income is negative, the business does not owe any taxes for the second year. However, the remaining loss of $20,000 can be carried forward to future years and used to offset against any future profits.

This example illustrates the benefit of loss carryforward for businesses. It allows them to mitigate the impact of losses in one year by offsetting them against future profits, thereby reducing their tax liability. Loss carryforward provides businesses with flexibility and helps them recover from financial setbacks.

How Loss Carryforward Works in Practice

Loss carryforward is a tax strategy that allows businesses to offset their current year’s taxable income with losses incurred in previous years. This can help reduce the amount of taxes owed and provide financial relief to struggling businesses.

When a business incurs a loss in a particular year, it can carry forward that loss to future years and deduct it from any taxable income generated in those years. This allows the business to effectively “carry forward” the loss and use it to offset future profits.

Example

Let’s say a business incurs a loss of $100,000 in Year 1. In Year 2, the business generates a taxable income of $50,000. Without the ability to carry forward the loss, the business would owe taxes on the full $50,000. However, if the business has a loss carryforward provision, it can deduct the $100,000 loss from Year 1, reducing its taxable income to $0. As a result, the business would not owe any taxes in Year 2.

This example illustrates how loss carryforward can help businesses offset their losses and reduce their tax liability. It provides businesses with the opportunity to recover from financial setbacks and regain profitability.

Tax Rules for Loss Carryforward

While loss carryforward can be a valuable tax strategy, there are certain rules and limitations that businesses must adhere to. The most common rule is that losses can typically be carried forward for a certain number of years, usually up to 20 years. Additionally, there may be restrictions on the amount of losses that can be deducted in a given year.

Important Considerations

When utilizing loss carryforward, businesses should keep the following considerations in mind:

- Loss carryforward can only be used to offset future taxable income, not past or current income.

- Loss carryforward can be a valuable tool for businesses facing financial difficulties or experiencing temporary losses, but it should not be relied upon as a long-term solution.

Benefits of Loss Carryforward

Loss carryforward offers several benefits to businesses, including:

- Reduced tax liability: By offsetting current year’s taxable income with previous year’s losses, businesses can significantly reduce their tax liability.

- Financial relief: Loss carryforward provides financial relief to businesses by allowing them to recover from losses and regain profitability.

- Encourages investment and risk-taking: Loss carryforward incentivizes businesses to take risks and invest in growth, knowing that any losses incurred can be offset in the future.

Tax Rules for Loss Carryforward

Loss carryforward is subject to certain tax rules that determine how and when a company can use its accumulated losses to offset future taxable income. These rules vary by jurisdiction, but there are some common principles that apply in many countries.

Firstly, loss carryforward typically has a time limit within which the losses can be utilized. This time limit is usually set by the tax authorities and can range from a few years to indefinitely. If the losses are not used within the specified time frame, they may expire and become unusable.

Secondly, there may be restrictions on the types of income that can be offset by the loss carryforward. For example, some jurisdictions may only allow the losses to offset future taxable income from the same business or activity that generated the losses. This prevents companies from using losses from one business to offset profits from another.

Furthermore, there may be limitations on the amount of losses that can be used in a given year. This is often expressed as a percentage of the taxable income in that year. For example, a jurisdiction may allow companies to offset only 80% of their taxable income with loss carryforwards, with the remaining 20% being subject to tax.

In addition to these general rules, there may be specific provisions for certain industries or types of losses. For instance, some jurisdictions may have special rules for losses incurred in the financial sector or for losses related to specific events such as natural disasters.

It is important for companies to understand and comply with the tax rules for loss carryforward in their jurisdiction to ensure they maximize the benefits of this tax strategy. Failure to do so can result in penalties or missed opportunities to reduce tax liabilities.

Important Considerations

When considering the use of loss carryforward, there are several important factors to keep in mind:

1. Time Limit

Loss carryforwards typically have a time limit within which they must be utilized. This time limit varies by jurisdiction but is commonly around 5 to 10 years. It is important to monitor the expiration dates of loss carryforwards to ensure they are used before they expire.

2. Change in Ownership

In some cases, a change in ownership of a company may limit or restrict the use of loss carryforwards. This is often done to prevent the acquisition of a company solely for the purpose of utilizing its tax losses. It is important to understand the rules and regulations regarding change in ownership and how they may impact the utilization of loss carryforwards.

3. Tax Planning

Loss carryforwards can be a valuable tool for tax planning purposes. By strategically utilizing loss carryforwards, companies can minimize their tax liabilities and potentially increase their cash flow. It is important to work with a tax professional or accountant to develop a tax planning strategy that maximizes the benefits of loss carryforwards.

4. Documentation and Record Keeping

Benefits of Loss Carryforward

Loss carryforward is a valuable tool for businesses and individuals to offset their taxable income and reduce their tax liability. There are several benefits associated with utilizing loss carryforward:

1. Tax Savings

2. Increased Cash Flow

Utilizing loss carryforward can also help improve cash flow for businesses. By reducing their tax liability, businesses can retain more of their earnings and allocate them towards other operational expenses or investments.

3. Flexibility

Loss carryforward provides businesses and individuals with flexibility in managing their tax liability. They can choose to utilize the losses in the most advantageous way, such as carrying them forward for multiple years or using them to offset specific types of income.

4. Business Growth

For businesses, loss carryforward can be particularly beneficial during periods of growth or expansion. It allows them to offset any losses incurred during the early stages of business development against future profits, enabling them to reinvest in the company and fuel further growth.

5. Risk Mitigation

Loss carryforward can also help mitigate the risks associated with business operations. By carrying forward losses, businesses can offset any potential future losses, providing a buffer against unforeseen financial challenges or economic downturns.

6. Incentive for Entrepreneurship

Loss carryforward can serve as an incentive for entrepreneurship and innovation. It encourages individuals to take risks and start new businesses by providing them with a mechanism to offset any initial losses against future profits.

| Benefits of Loss Carryforward |

|---|

| Tax Savings |

| Increased Cash Flow |

| Flexibility |

| Business Growth |

| Risk Mitigation |

| Incentive for Entrepreneurship |

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.