Deferred Tax Asset Calculation

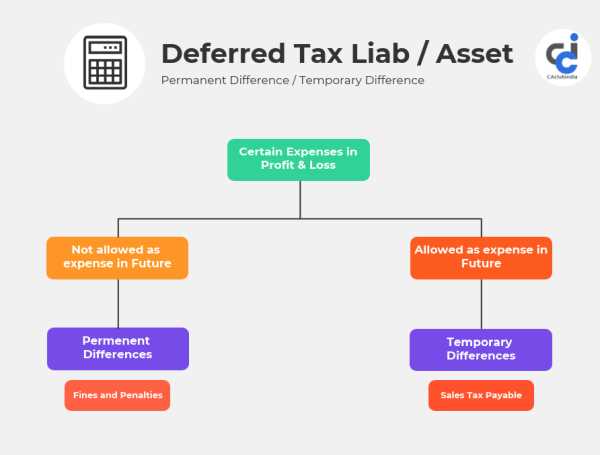

Deferred tax asset calculation is a process used by businesses to determine the amount of tax benefits that can be claimed in future periods. This calculation takes into account the difference between the accounting profit and taxable profit, which arises due to the differences in the recognition and measurement of items for accounting and tax purposes.

When a business incurs expenses or losses that are not deductible for tax purposes in the current period but can be carried forward to offset against future taxable income, a deferred tax asset is recognized. This asset represents the future tax benefits that the business will enjoy when it utilizes the carried forward expenses or losses to reduce its tax liability.

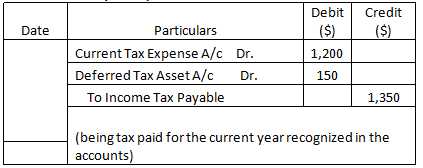

Once the temporary differences are identified, the deferred tax asset is calculated by multiplying the temporary difference by the applicable tax rate. The resulting amount represents the tax benefit that the business can expect to realize in future periods.

It is important for businesses to accurately calculate their deferred tax asset as it affects their financial statements and tax planning. A higher deferred tax asset can indicate that the business has significant tax benefits that can be utilized in the future, while a lower deferred tax asset may suggest limited tax benefits.

Deferred tax asset calculation is an important concept in accounting and finance. It is used to determine the amount of tax benefits that a company can expect to receive in the future. This calculation takes into account the difference between the accounting profit and the taxable profit, which arises due to the different treatment of certain items for accounting and tax purposes.

The main use of deferred tax asset calculation is to recognize the potential tax benefits that a company can carry forward to future periods. These tax benefits can arise from various sources, such as tax losses, tax credits, or deductible temporary differences. By calculating the deferred tax asset, a company can assess the value of these tax benefits and include them in its financial statements.

Another use of deferred tax asset calculation is to comply with accounting standards and regulations. Many accounting frameworks, such as International Financial Reporting Standards (IFRS) and Generally Accepted Accounting Principles (GAAP), require companies to recognize deferred tax assets and liabilities in their financial statements. By performing the calculation, companies can ensure compliance with these standards and provide transparent and accurate financial reporting.

Examples of Deferred Tax Asset Calculation

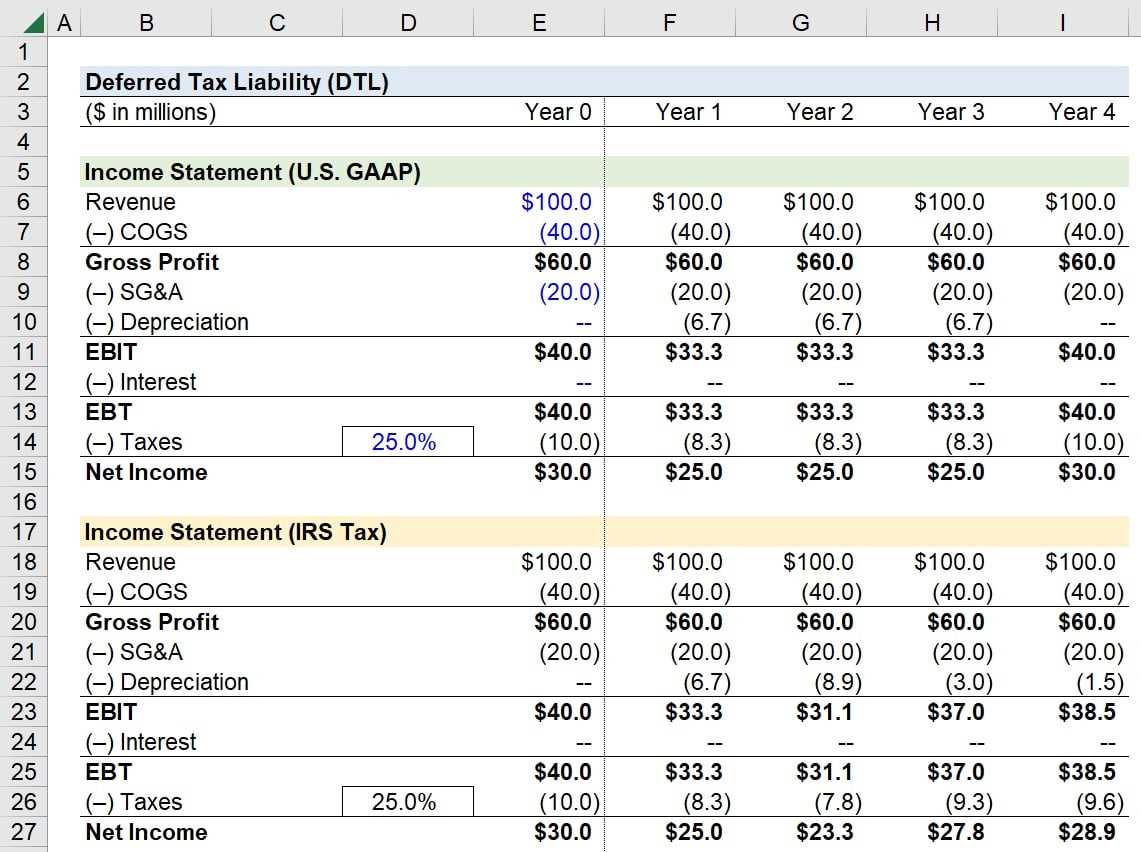

Example 1: Depreciation

Let’s say a company purchases a piece of machinery for $100,000. According to tax laws, the company can depreciate the machinery over a period of 5 years. However, for accounting purposes, the company depreciates the machinery over a period of 3 years.

Example 2: Bad Debt Expense

Another example of a deferred tax asset calculation is related to bad debt expense. Let’s say a company estimates that it will have $10,000 in bad debts for the year. According to tax laws, the company can only deduct bad debts once they are actually written off.

However, for accounting purposes, the company recognizes the estimated bad debt expense in the current year. This creates a temporary difference between the tax deduction and the expense recognized for financial reporting purposes.

As a result, the company will have a deferred tax asset representing the tax savings it will realize in the future when the bad debts are actually written off for tax purposes.

These examples highlight how deferred tax assets can arise from differences between tax laws and accounting rules. By recognizing these temporary differences, companies can account for the future tax benefits they will receive, which can have a significant impact on their financial statements and tax planning strategies.

It is important for companies to carefully calculate and monitor their deferred tax assets to ensure compliance with tax laws and regulations. Failure to accurately account for deferred tax assets can result in penalties and potential legal issues.

Tax Laws & Regulations

There are various uses of deferred tax assets. For businesses, they can be used to reduce future tax liabilities and improve cash flow. For individuals, they can be used to offset tax liabilities in future years. However, it is important to note that deferred tax assets can only be recognized if it is more likely than not that they will be realized.

Here are some examples of how deferred tax assets are calculated:

1. Carryforward of tax losses: If a company incurs a tax loss in a particular year, it can carry forward that loss to offset future taxable income. The amount of the tax loss carryforward represents a deferred tax asset.

2. Tax credits: Certain tax credits, such as research and development credits, can be carried forward to offset future tax liabilities. The amount of the tax credit represents a deferred tax asset.

3. Depreciation: When a company depreciates its assets for tax purposes, it can deduct a portion of the asset’s cost each year. The difference between the depreciation expense for tax purposes and the depreciation expense for financial reporting purposes represents a deferred tax asset.

4. Unrealized losses: If a company has investments that have declined in value but has not sold them, it can recognize a deferred tax asset for the tax benefit that will be realized when the investments are sold.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.