Current Assets: Definition and Calculation with Examples

Current assets are a key component of a company’s financial statements. They represent the resources that are expected to be converted into cash or used up within one year or the operating cycle of the business, whichever is longer. These assets are crucial for the day-to-day operations of a company and can provide insight into its liquidity and ability to meet short-term obligations.

What are Current Assets?

Current assets are assets that are expected to be converted into cash or used up within a year or the operating cycle of the business. They are listed on a company’s balance sheet and include cash, cash equivalents, accounts receivable, inventory, and prepaid expenses.

Types of Current Assets

There are several types of current assets that a company may have:

- Cash: This includes physical cash on hand and cash in bank accounts.

- Cash Equivalents: These are short-term investments that can be easily converted into cash, such as money market funds and Treasury bills.

- Accounts Receivable: This represents the amount of money owed to the company by its customers for goods or services provided on credit.

- Inventory: This includes the goods or products that a company has on hand and intends to sell to customers.

- Prepaid Expenses: These are expenses that have been paid in advance, such as insurance premiums or rent.

How to Calculate Current Assets

To calculate current assets, you need to add up all the individual current asset accounts listed on a company’s balance sheet. This can be done by reviewing the financial statements or using accounting software.

Examples of Current Assets

Here are a few examples of current assets:

- A company has $10,000 in cash and cash equivalents.

- The accounts receivable balance is $20,000.

- The inventory value is $30,000.

- Prepaid expenses amount to $5,000.

By adding up these individual amounts, the total current assets for this company would be $65,000.

What are Current Assets?

Current assets are a category of assets that a company expects to convert into cash or consume within one year or within the normal operating cycle of the business. These assets are considered to be highly liquid, meaning they can be easily converted into cash. Current assets are an important component of a company’s balance sheet and are used to assess its short-term financial health.

Examples of current assets include cash and cash equivalents, accounts receivable, inventory, and prepaid expenses. Cash and cash equivalents refer to the amount of money a company has on hand or in bank accounts that can be readily used for transactions. Accounts receivable represents the money owed to a company by its customers for goods or services provided on credit. Inventory includes the goods a company has on hand that are intended for sale. Prepaid expenses are payments made in advance for goods or services that will be consumed within the next year.

Current assets are important for several reasons. First, they provide a company with the necessary funds to cover its short-term obligations, such as paying suppliers and employees. Second, they can be used as collateral for obtaining loans or credit from financial institutions. Third, they can be used to generate revenue through their conversion into cash or through their consumption in the normal course of business.

In summary, current assets are a vital component of a company’s financial position and are used to assess its short-term liquidity. They provide the necessary funds to cover short-term obligations and can be used as collateral for obtaining loans. Analyzing a company’s current assets is important for investors and creditors to evaluate its financial health and ability to meet its short-term obligations.

Types of Current Assets

Current assets are a crucial component of a company’s financial statements. They represent the resources that are expected to be converted into cash or used up within one year or the operating cycle of a business. These assets are important for the day-to-day operations of a company and can be easily converted into cash.

There are several types of current assets that a company may have:

| Asset | Description |

|---|---|

| Cash and Cash Equivalents | This includes physical cash, as well as highly liquid assets that can be easily converted into cash, such as bank accounts, money market funds, and short-term investments. |

| Accounts Receivable | These are amounts owed to the company by its customers for goods or services provided on credit. They represent the company’s right to receive payment in the future. |

| Inventory | This includes the goods that a company has on hand and intends to sell to customers. It can include raw materials, work-in-progress, and finished goods. |

| Prepaid Expenses | These are expenses that have been paid in advance but have not yet been used or consumed. They represent future benefits that the company will receive. |

| Short-term Investments | These are investments that are expected to be converted into cash within one year. They can include marketable securities, certificates of deposit, and treasury bills. |

| Other Current Assets | This category includes any other current assets that do not fit into the above categories. It can include prepaid taxes, advances to suppliers, and other short-term assets. |

These types of current assets are important for a company’s liquidity and financial health. They provide the necessary resources for a company to meet its short-term obligations and fund its day-to-day operations. By analyzing the composition and value of a company’s current assets, investors and analysts can gain insights into its financial strength and ability to generate cash.

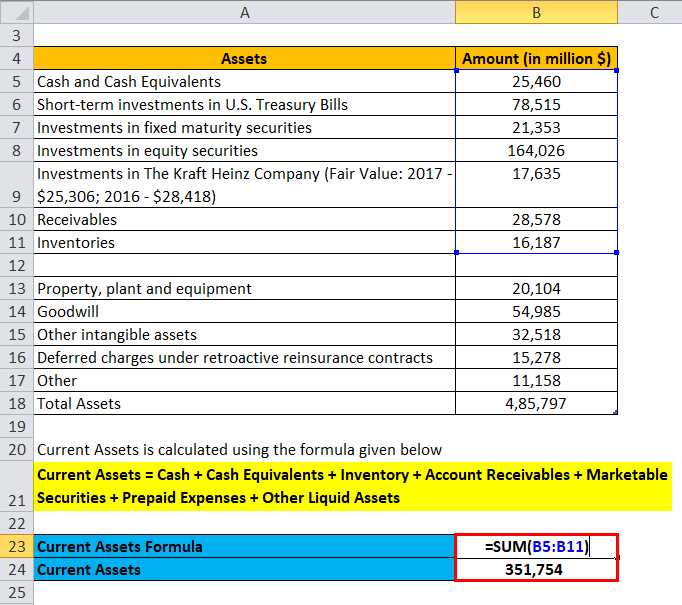

How to Calculate Current Assets

Step 1: Identify the Current Assets

The first step is to identify the different types of current assets that a company has. These may include cash and cash equivalents, accounts receivable, inventory, prepaid expenses, and short-term investments.

Step 2: Gather the Necessary Information

Next, gather the necessary information from the company’s financial statements. This includes the balance sheet, which provides the values of each current asset category.

Step 3: Determine the Value of Each Current Asset

For each current asset category, determine its value as reported in the balance sheet. This can be found under the corresponding line item. For example, the value of cash and cash equivalents will be listed under the “Cash” or “Cash and Cash Equivalents” line item.

Step 4: Add Up the Values

Add up the values of all the current assets to calculate the total current assets. This will provide an overview of the company’s short-term liquidity and its ability to meet its short-term obligations.

Step 5: Analyze the Results

Once the total current assets have been calculated, it is important to analyze the results. Compare the current assets to the company’s current liabilities to calculate the current ratio. This ratio indicates the company’s ability to pay off its short-term debts using its current assets. A higher current ratio is generally considered favorable as it suggests a greater ability to meet short-term obligations.

By following these steps, you can accurately calculate the current assets of a company and gain insight into its financial position. This information is crucial for investors, creditors, and other stakeholders in evaluating the company’s liquidity and overall financial health.

Examples of Current Assets

Here are some examples of current assets:

Cash: This includes physical cash as well as cash equivalents, such as money market funds and short-term investments that can be easily converted into cash.

Accounts Receivable: These are amounts owed to the company by its customers for goods or services that have been delivered but not yet paid for. Accounts receivable represent the company’s right to receive payment in the future.

Inventory: This includes the goods that a company holds for sale or for use in the production process. Inventory can include raw materials, work-in-progress, and finished goods.

Prepaid Expenses: These are expenses that have been paid in advance but have not yet been used or consumed. Examples of prepaid expenses include prepaid rent, prepaid insurance, and prepaid subscriptions.

Other examples of current assets can include short-term investments, marketable securities, and notes receivable. These assets are typically listed on a company’s balance sheet under the current assets section.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.