Bear Put Spread Strategy Explained

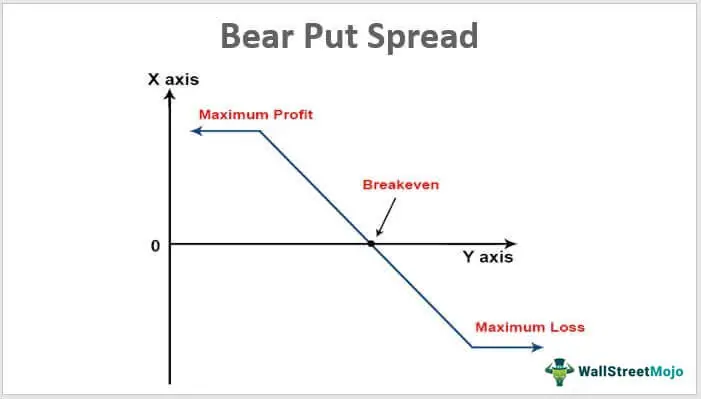

The bear put spread strategy is a popular options trading strategy used by investors who anticipate a decline in the price of an underlying asset. It involves the purchase of put options with a higher strike price and the simultaneous sale of put options with a lower strike price. This strategy allows investors to profit from a downward movement in the price of the underlying asset while limiting their potential losses.

Definition and Explanation

The long put option provides the investor with the right to sell the underlying asset at the strike price. If the price of the underlying asset decreases below the strike price, the investor can exercise the option and sell the asset at a higher price, thereby making a profit. The maximum profit potential is limited to the difference between the strike prices minus the cost of the options.

The short put option, on the other hand, obligates the investor to buy the underlying asset at the strike price if the option is exercised. By selling the short put, the investor receives a premium, which helps offset the cost of the long put. However, if the price of the underlying asset decreases below the strike price of the short put, the investor may be required to buy the asset at a higher price, resulting in a loss.

Example, Usage, and Risks

Let’s say an investor believes that the price of a particular stock, currently trading at $50, will decline in the near future. The investor decides to implement a bear put spread strategy by buying a put option with a strike price of $55 for $2 and selling a put option with a strike price of $45 for $1. The net cost of the strategy is $1.

The bear put spread strategy is commonly used by investors who have a moderately bearish outlook on an underlying asset. It allows them to profit from a decline in price while limiting their potential losses. However, it is important to note that options trading involves risks and may not be suitable for all investors. It is advisable to consult with a financial advisor before implementing any options trading strategy.

Definition and Explanation

The bear put spread strategy is a type of options trading strategy that is used by investors who believe that the price of a particular stock or asset is going to decrease in the near future. This strategy involves buying put options at a certain strike price and selling put options at a lower strike price. The goal of the strategy is to profit from the decline in the price of the underlying asset.

The bear put spread strategy involves buying a higher strike put option and selling a lower strike put option. This creates a spread between the two strike prices, which limits the potential profit and loss of the strategy. The investor’s maximum profit is limited to the difference between the strike prices, minus the cost of the options, while the maximum loss is limited to the cost of the options.

This strategy is often used when an investor expects a moderate decline in the price of the underlying asset. By selling a put option at a lower strike price, the investor is able to offset some of the cost of buying the higher strike put option. This reduces the overall cost of the strategy and increases the potential profit if the price of the underlying asset falls below the lower strike price.

However, it is important to note that the bear put spread strategy also comes with risks. If the price of the underlying asset does not decrease as expected, the investor may incur a loss. Additionally, if the price of the underlying asset falls below the lower strike price, the investor’s potential profit is limited to the difference between the strike prices, minus the cost of the options.

Example, Usage, and Risks

Let’s consider an example to understand how the bear put spread strategy works. Suppose you are bearish on a particular stock, let’s say XYZ, and you expect its price to decline in the near future. You decide to implement a bear put spread strategy to profit from this downward movement.

First, you buy a put option with a strike price of $50, which gives you the right to sell the stock at $50. This is your long put option. To offset the cost of the long put option, you also sell a put option with a lower strike price of $45. This is your short put option.

Now, let’s analyze the potential outcomes:

If the stock price is above $50 at expiration:

If the stock price is below $45 at expiration:

If the stock price is between $45 and $50 at expiration:

The bear put spread strategy is commonly used by traders who have a moderately bearish outlook on a stock. It allows them to limit their downside risk while still benefiting from a potential decline in the stock price.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.