Definition of Capital Expenditure

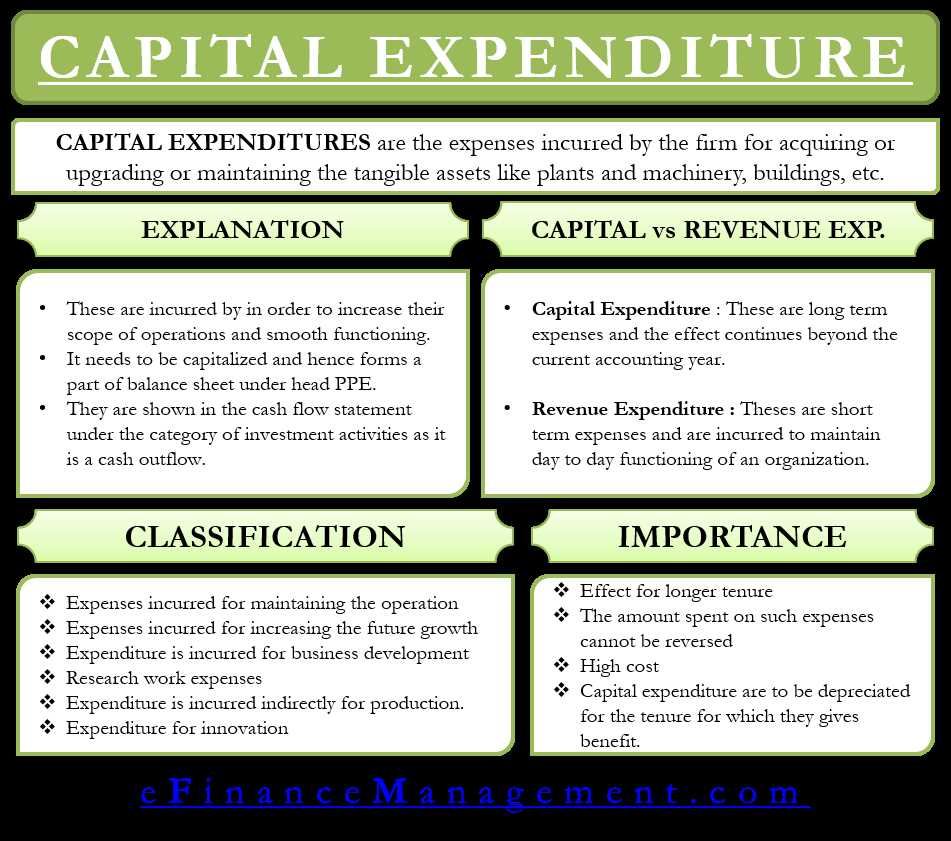

Capital expenditure refers to the funds that a company invests in acquiring, improving, or maintaining its long-term assets, such as property, plant, and equipment (PP&E). These expenditures are made with the expectation of generating future benefits for the company over a period of time exceeding one year.

Capital expenditures are different from operating expenses, which are the day-to-day costs of running a business. While operating expenses are deducted from revenue in the same accounting period, capital expenditures are capitalized and recorded as assets on the company’s balance sheet. The assets are then depreciated or amortized over their useful life, and the associated expenses are recognized over time.

Importance of Capital Expenditure

Capital expenditure plays a crucial role in the financial health and growth of a company. It involves the acquisition, improvement, or replacement of long-term assets that are essential for the company’s operations. Here are some key reasons why capital expenditure is important:

1. Long-Term Investment: Capital expenditure involves investing in assets that have a long useful life, such as buildings, machinery, or technology infrastructure. These investments are crucial for the company’s long-term growth and success.

2. Enhancing Productivity and Efficiency: Capital expenditure allows companies to upgrade their existing assets or acquire new ones that can improve productivity and efficiency. For example, investing in advanced machinery can increase production capacity and reduce production costs.

3. Competitive Advantage: By making strategic capital investments, companies can gain a competitive edge in the market. Upgrading technology, for instance, can help a company offer better products or services, attract more customers, and outperform competitors.

4. Meeting Regulatory Requirements: Some capital expenditures are necessary to comply with industry regulations or safety standards. Failing to make these investments can lead to penalties, legal issues, or reputational damage.

5. Future Growth Opportunities: Capital expenditure lays the foundation for future growth and expansion. By investing in assets that can support increased production or new business ventures, companies can position themselves for future opportunities and revenue growth.

6. Financial Stability: Capital expenditure decisions are often based on careful financial analysis and planning. By maintaining a balance between capital investments and available resources, companies can ensure their financial stability and avoid excessive debt or liquidity issues.

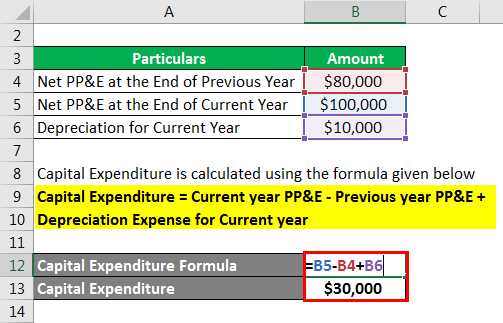

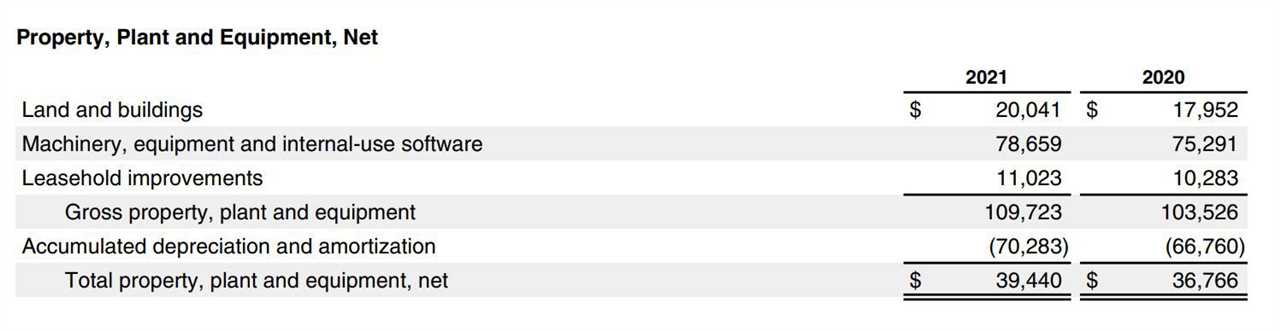

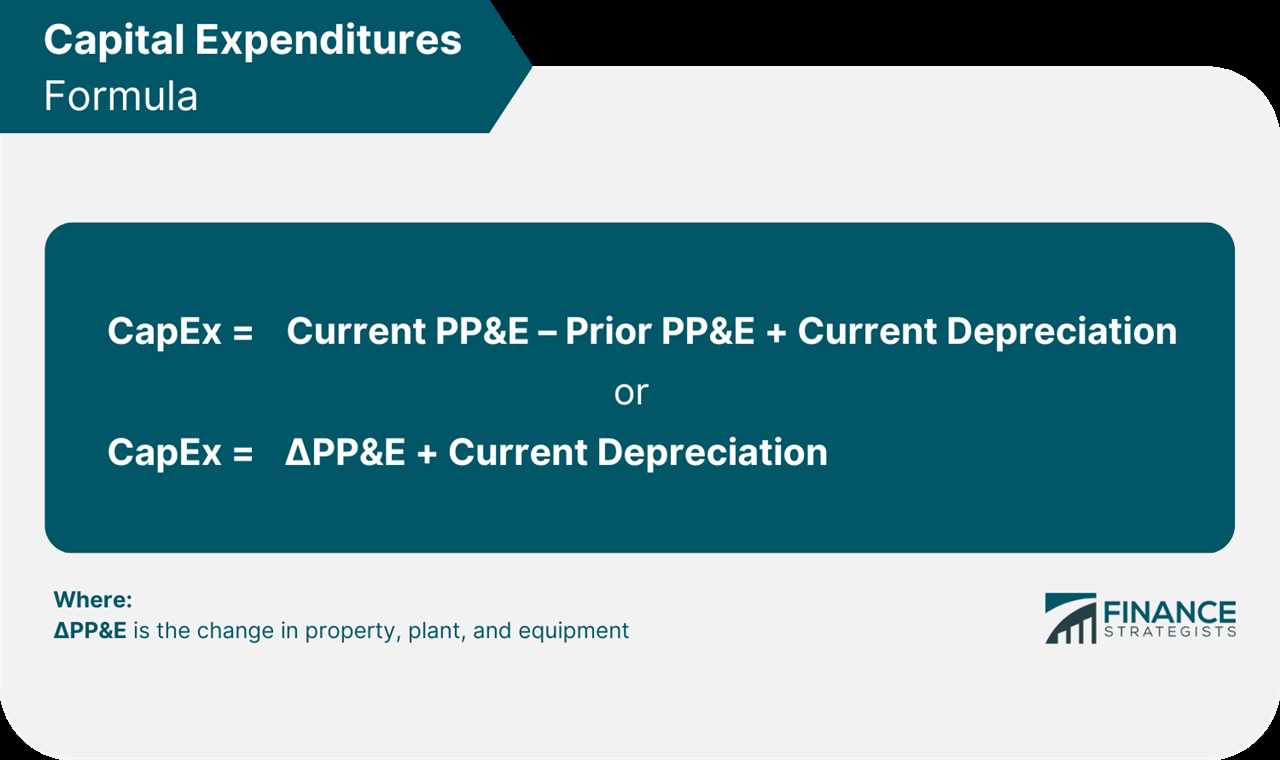

Formula for Calculating Capital Expenditure

Calculating capital expenditure is important for businesses to understand their investment in long-term assets. The formula for calculating capital expenditure is:

- Start with the total cost of the asset, including any additional costs such as installation or transportation.

- Subtract the salvage value, which is the estimated value of the asset at the end of its useful life.

- Divide the result by the useful life of the asset, which is the estimated number of years the asset will be in use.

The formula can be represented as:

For example, let’s say a company purchases a piece of machinery for $100,000. The estimated salvage value of the machinery is $10,000, and its useful life is estimated to be 10 years. Using the formula, we can calculate the capital expenditure as:

So, the capital expenditure for this machinery would be $9,000.

By calculating capital expenditure, businesses can make informed decisions about their investments in long-term assets and plan their financial strategies accordingly.

Examples of Capital Expenditure

Capital expenditure refers to the funds that a company invests in acquiring, upgrading, or maintaining long-term assets, such as property, plant, and equipment. Here are some examples of capital expenditure:

- Purchase of new manufacturing equipment: When a company buys new machinery or equipment to improve its production process, it is considered a capital expenditure. For example, a manufacturing company may invest in new automated machinery to increase efficiency and reduce labor costs.

- Construction of a new building: When a company constructs a new building or facility to expand its operations, it is a capital expenditure. This could include building a new office space, warehouse, or manufacturing facility.

- Upgrade of computer systems: When a company invests in upgrading its computer systems, such as purchasing new servers or software, it is considered a capital expenditure. Upgrading computer systems can improve efficiency, enhance data security, and support business growth.

- Acquisition of another company: When a company acquires another company or its assets, it is a capital expenditure. This could involve purchasing the entire company or specific assets, such as intellectual property or customer contracts.

- Investment in research and development: When a company invests in research and development activities to develop new products or improve existing ones, it is a capital expenditure. This could include expenses related to hiring scientists, conducting experiments, and acquiring patents.

These are just a few examples of capital expenditure. It is important for companies to carefully evaluate and prioritize their capital expenditure projects to ensure they align with their strategic goals and provide a positive return on investment.

Financial Ratios Related to Capital Expenditure

When analyzing a company’s capital expenditure, there are several financial ratios that can provide valuable insights into its financial health and investment efficiency. These ratios help investors and analysts evaluate the company’s ability to generate returns on its capital investments and manage its capital expenditure effectively.

1. Return on Capital Expenditure (ROCE)

ROCE is a profitability ratio that measures the return generated from the company’s capital expenditure. It is calculated by dividing the operating profit by the capital expenditure. A higher ROCE indicates that the company is generating more profit from its capital investments.

Formula: ROCE = Operating Profit / Capital Expenditure

2. Capital Expenditure Ratio

The capital expenditure ratio measures the proportion of a company’s cash flow that is used for capital expenditure. It is calculated by dividing the capital expenditure by the operating cash flow. This ratio helps assess the company’s investment strategy and its ability to fund future growth.

Formula: Capital Expenditure Ratio = Capital Expenditure / Operating Cash Flow

3. Return on Investment (ROI)

ROI is a widely used ratio to evaluate the profitability of an investment. It measures the return generated from an investment relative to its cost. When analyzing capital expenditure, ROI can help assess the effectiveness of the company’s investment decisions.

These financial ratios provide valuable insights into a company’s capital expenditure and its ability to generate returns on its investments. By analyzing these ratios, investors and analysts can make informed decisions about the company’s financial health and investment potential.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.