Accrued Interest: What is it and How it Works

Accrued interest is a concept that is commonly used in the world of finance, particularly in fixed income investments. It refers to the interest that has been earned but not yet paid or received by the investor.

When an investor purchases a fixed income security, such as a bond, they are essentially lending money to the issuer of the bond. In return for this loan, the issuer agrees to pay the investor interest at regular intervals, typically semi-annually or annually.

To understand how accrued interest works, let’s consider an example. Suppose an investor purchases a bond with a face value of $1,000 and a coupon rate of 5% per annum. The bond pays interest semi-annually on January 1st and July 1st. The investor buys the bond on April 1st. The last interest payment date was January 1st, and there are 90 days between January 1st and April 1st.

| Last Interest Payment Date | Days Since Last Interest Payment | Accrued Interest |

|---|---|---|

| January 1st | 90 days | $45 |

Accrued interest is an important concept to understand when investing in fixed income securities. It refers to the interest that has been earned but not yet paid to the investor. This can occur when an investor purchases a bond or other fixed income security between interest payment dates.

When an investor buys a bond, they are essentially lending money to the issuer of the bond. In return for this loan, the issuer agrees to pay the investor periodic interest payments, usually semi-annually or annually, until the bond matures. However, these interest payments are typically made on specific dates, such as January 1st and July 1st.

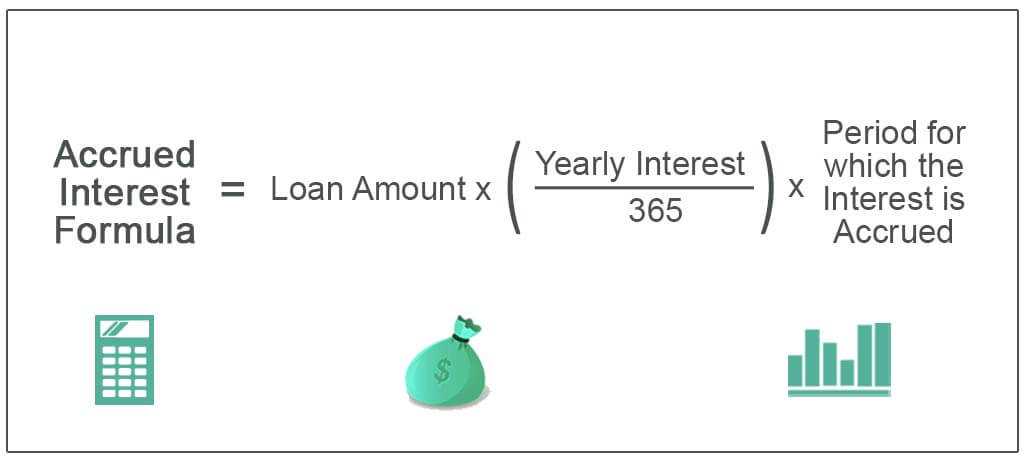

To calculate accrued interest, you need to know the bond’s coupon rate, which is the annual interest rate stated on the bond, and the number of days between interest payment dates. The formula for calculating accrued interest is:

Accrued Interest = (Coupon Rate / Number of Days in a Year) x Number of Days Since Last Interest Payment

For example, let’s say you purchase a bond with a coupon rate of 5% on March 1st, and the last interest payment date was January 1st. There are 59 days between January 1st and March 1st. Using the formula above, the accrued interest would be:

Accrued Interest = (0.05 / 365) x 59 = 0.008082

So, the accrued interest on the bond would be approximately 0.008082, or 0.8082% of the bond’s face value.

Accrued interest is an important consideration for investors when buying or selling fixed income securities. When buying a bond, investors need to be aware of the accrued interest they will have to pay in addition to the purchase price. When selling a bond, investors need to factor in the accrued interest they will receive in addition to the sale price.

Accrued Interest Calculation and Example

Accrued interest is calculated based on the interest rate and the time period for which the interest has been earned but not yet paid. It is an important concept in fixed income investments, as it affects the overall return on investment for bondholders.

To calculate accrued interest, you need to know the face value of the bond, the interest rate, and the number of days for which the interest has accrued. The formula for calculating accrued interest is:

Accrued Interest = (Face Value x Interest Rate x Number of Days) / (Number of Days in a Year)

Let’s take an example to understand this calculation better. Suppose you have a bond with a face value of $10,000, an annual interest rate of 5%, and the interest has accrued for 60 days. The number of days in a year is typically considered as 365.

Using the formula mentioned above, the accrued interest would be:

Accrued Interest = ($10,000 x 0.05 x 60) / 365 = $82.19

This means that the bondholder is entitled to receive an additional $82.19 as interest for the 60-day period. This amount will be added to the regular interest payment when it is due.

It is important to note that accrued interest is typically calculated up to the settlement date of a bond transaction. After the settlement date, the buyer of the bond is responsible for paying the accrued interest to the seller.

Accrued interest calculations can vary depending on the specific terms and conditions of a bond. Some bonds may have different interest payment frequencies or use a different day count convention for calculating accrued interest. It is important for investors to carefully review the bond’s prospectus or offering memorandum to understand the specific rules for calculating accrued interest.

Emily Bibb simplifies finance through bestselling books and articles, bridging complex concepts for everyday understanding. Engaging audiences via social media, she shares insights for financial success. Active in seminars and philanthropy, Bibb aims to create a more financially informed society, driven by her passion for empowering others.